Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

XRP is surpassing bitcoin and ether as investors flock to it following the recent market downturn.

XRP is surpassing bitcoin and ether as investors show signs of dip buying during the recent downturn.

XRP rises faster than bitcoin and ether after dip buying by investors. (Kanchanara / Unsplash modified by CoinDesk)

XRP rises faster than bitcoin and ether after dip buying by investors. (Kanchanara / Unsplash modified by CoinDesk)

What to know:

- XRP’s value has increased by 38% since the lows experienced during the February 6 crash.

- The rally that outperformed BTC coincides with a withdrawal of coins from Binance, indicating accumulation after the price decline.

Payments-centric cryptocurrency XRP is advancing more quickly than bitcoin and ether as investors seek opportunities after the early-month decline.

XRP’s price has surged 38% to $1.55 from a low of $1.12 on February 6, based on CoinDesk data. The price has increased by over 5% in the last 24 hours alone.

STORY CONTINUES BELOWDon’t miss another story.Subscribe to the Crypto Daybook Americas Newsletter today. See all newslettersSign me up

This strong performance positions XRP significantly ahead of both bitcoin and ether, which have seen a recovery of approximately 15% since February 6. At the time of writing, bitcoin and ether were trading at $69,420 and $2,020, respectively.

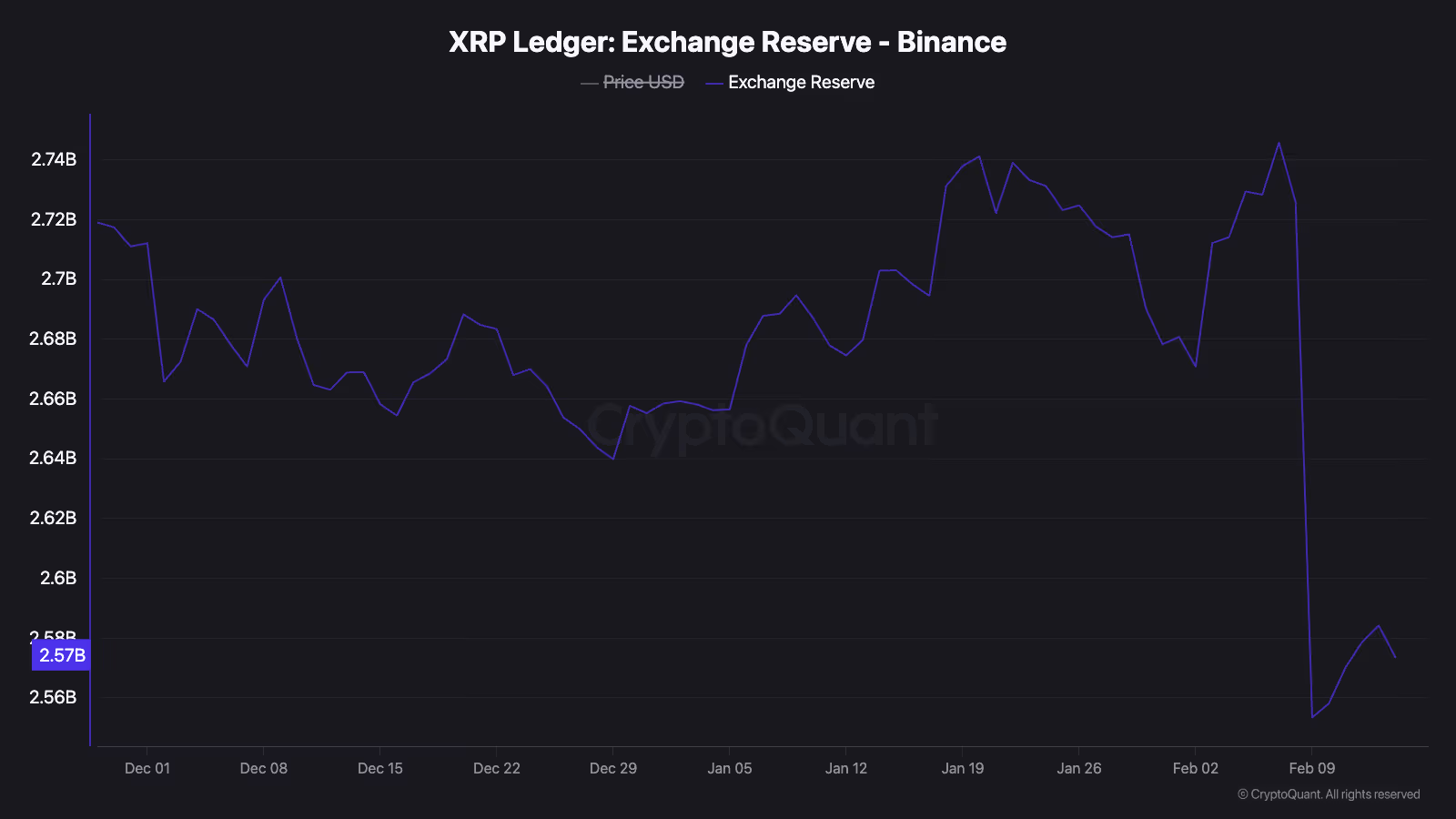

XRP’s rally exceeding bitcoin aligns with indications of dip-buying on Binance following the February 6 crash. Data from CryptoQuant shows that Binance’s XRP reserves fell significantly by 192.37 million XRP to 2.553 billion between February 7 and 9. This 7% decline marked the lowest level since January 2024, and the reserves have remained stable since then.

XRP: exchange reserve on Binance. (CryptoQuant)

XRP: exchange reserve on Binance. (CryptoQuant)

Analysts generally link a decrease in exchange reserves with investor accumulation. The rationale is that investors tend to prefer taking direct possession of coins rather than leaving them on exchanges when planning to hold them for a longer duration.

Rapid, significant withdrawals can diminish the available supply, potentially paving the way for a price increase. Historical patterns support this perspective. XRP experienced a substantial rise from $0.60 to over $2.40 during the last two months of 2024 as the balance held on exchanges declined more rapidly.