Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

WisdomTree, a company managing $150 billion in assets, declares that cryptocurrency has become an essential part of its operations.

Jonathan Steinberg of WisdomTree states that the company’s initiative in tokenization is approaching profitability, with $750 million in digital assets and plans to innovate financial infrastructure in the long run.

Key points:

- WisdomTree’s CEO Jonathan Steinberg mentioned that the company’s cryptocurrency division has evolved from a trial phase to a fundamental strategic priority and is close to achieving profitability.

- The asset management firm has swiftly expanded its digital asset offerings, increasing from approximately $30 million to nearly $750 million in tokenized assets while venturing into new blockchains like Solana.

- Steinberg positioned cryptocurrency as the cornerstone of a contemporary financial ecosystem, referencing initiatives like tokenized funds, the WisdomTree Connect platform, and a strategic focus on compliance-oriented tokenization technology as essential to the firm’s future growth.

New York — According to CEO Jonathan Steinberg during a fireside chat at the Ondo Summit in New York on Tuesday, WisdomTree’s cryptocurrency business is no longer just an experiment but a fundamental aspect of the company’s strategy and is on the brink of becoming profitable.

“We aim to keep scaling our operations,” Steinberg stated. “Last year, we grew from about $30 million in assets to around $750 million in assets,” adding that the firm is not yet generating profit from its digital asset initiatives but is “on the verge of transforming this into a profitable enterprise.”

STORY CONTINUES BELOWDon't miss another story.Subscribe to the Crypto Daybook Americas Newsletter today. See all newslettersSign me up

With $150 billion in assets under management, the firm has been making significant investments in blockchain infrastructure, launching tokenized funds, and expanding into new chains such as Solana . Steinberg emphasized that this initiative is driven by a long-term belief. “It’s still in the early stages, but it’s no longer a trial. We have conviction. Therefore, we believe that ultimately everything will be conducted on-chain.”

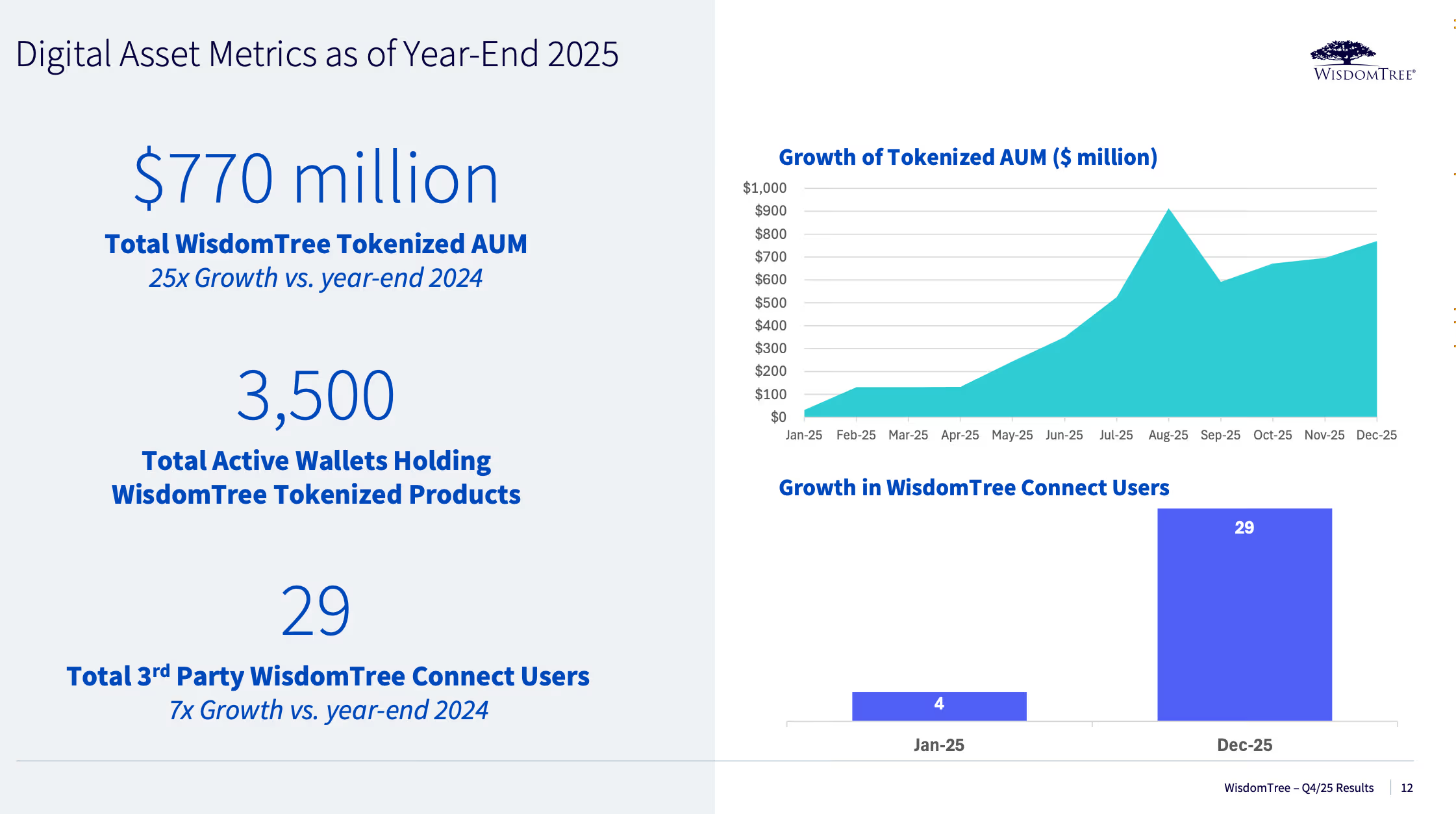

It’s evident why WisdomTree has been intensifying its efforts in digital assets. Recently, during its earnings call, it reported that its total tokenized assets under management rose to $770 million, a 25-fold increase from 2024.

WisdomTree digital assets snapshot as of end of last year (WisdomTree)

WisdomTree digital assets snapshot as of end of last year (WisdomTree)

WisdomTree has established a strong early presence among traditional asset managers in the realm of digital assets, introducing a range of tokenized funds and recently enhancing distribution through WisdomTree Connect, which allows those assets to transfer across self-custodied wallets and institutional platforms.

The company also made a strategic investment in blockchain infrastructure by acquiring Securrency, a compliance-oriented tokenization firm, which it subsequently sold to the DTCC. Steinberg remarked that this action was a crucial step in facilitating “compliance-aware tokens” and programmable finance, aiding WisdomTree in establishing a long-term, interoperable digital asset framework.

For Steinberg, cryptocurrency signifies more than just a product opportunity — it embodies a new financial framework. “This is truly larger than asset management. It pertains to financial services,” he explained. “Financial services — many of these banks have histories spanning centuries. Hence, they have built upon legacy upon legacy. Modernization is essential.”

Regarding WisdomTree’s aspirations? “We simply want to keep expanding our current initiatives,” Steinberg concluded.