Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Widespread bitcoin acquisition arises following significant sell-off.

Glassnode data indicates an increase in buying activity among all segments of bitcoin holders.

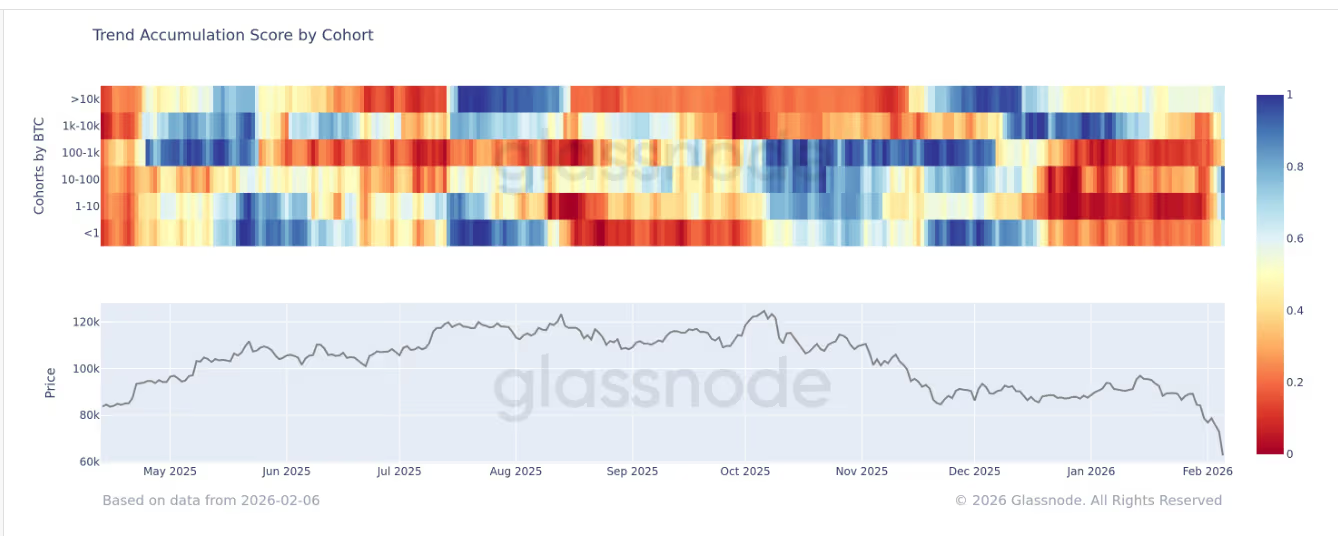

Accumulation Trend Score by cohort (Glassnode)

Accumulation Trend Score by cohort (Glassnode)

Key points:

- Bitcoin accumulation has expanded across different cohorts for the first time since late November.

- Wallets with 10 to 100 BTC have shown the strongest activity as dip buyers during the recent price decline, stepping in as values approached $60,000.

As February commenced, bitcoin was valued at approximately $80,000, with large holders cautiously entering the market while retail investors were exiting. Just a week later, on February 5, bitcoin experienced a drop to $60,000, and the market now reflects a widespread trend toward accumulation across nearly all groups as participants begin to recognize value.

This development follows one of the most significant capitulation events in bitcoin’s history, which now seems to be transitioning into a more coordinated accumulation phase.

STORY CONTINUES BELOWDon’t miss another story.Subscribe to the Crypto Daybook Americas Newsletter today. See all newslettersSign me up

Glassnode’s Accumulation Trend Score by cohort illustrates this behavioral change. The metric assesses the relative strength of accumulation among various wallet sizes by considering both entity size and the quantity of BTC accumulated over the prior 15 days. A score nearing 1 indicates accumulation, whereas a score approaching 0 signifies distribution.

On an aggregate scale, the Accumulation Trend Score by cohort has risen to 0.68, surpassing the 0.5 mark. This represents the first instance since late November where broad-based accumulation has been noted, coinciding with bitcoin forming a local bottom near $80,000.

The cohort demonstrating the most vigorous dip buying activity comprises wallets holding between 10 and 100 BTC, especially as prices dipped toward $60,000.

While it remains unclear if the ultimate bottom has been reached, it is apparent that investors are rediscovering value in bitcoin following a decline exceeding 50% from its all-time high in October.