Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

While certain major investors exit the cryptocurrency market, others increase their investments.

Your day-ahead look for Feb. 18, 2026

What to know:

You are reading Crypto Daybook Americas, your morning summary of the previous night’s events in the cryptocurrency markets and what to anticipate for the upcoming day. Crypto Daybook Americas will provide you with in-depth insights to start your morning. If you haven’t subscribed to the email yet, click here. You won’t want to begin your day without it.

By Jacob Joseph (All times ET unless stated otherwise)

Bitcoin is still fluctuating within the narrow $66,000-$70,000 range observed in recent days. As of this writing, the BTC price had increased by approximately 1.04% over the last 24 hours. Ether was trading at $2,020, reflecting a 1.43% rise for the day.

STORY CONTINUES BELOWDon’t miss another story.Subscribe to the Crypto Daybook Americas Newsletter today. See all newslettersSign me up

Institutional positioning continues to be a significant focus.

Digital asset treasury firms and public institutions were notable sources of demand in mid-2025, aiding in driving prices to all-time highs. However, with bitcoin having fallen over 50% from its peak in October, the scenario has changed. Many treasury-oriented companies are now experiencing pressure. Metaplanet revealed a net loss of $619 million earlier this week, while Harvard Management Company reduced its investment in bitcoin ETFs.

Ether treasury companies are also reassessing their positions. ETHZilla announced last evening that tech entrepreneur Peter Thiel and associated Founders Fund entities have sold their complete 7.5% stake in the firm. The company has also decreased its ether holdings through various sales since October.

Nevertheless, not all participants are retreating.

Michael Saylor’s Strategy has continued to expand its bitcoin holdings, acquiring 2,486 BTC earlier this week, raising its total to 717,131 BTC. Additionally, two funds based in Abu Dhabi — Mubadala Investment Company and Al Warda Investments — announced yesterday that they collectively possessed over $1 billion in BlackRock’s Bitcoin ETF at the conclusion of last year.

BitMine Immersion Technologies revealed yesterday that it has kept increasing its position, adding 45,759 ETH in the past week and raising its total holdings to 4.4 million ETH. Approximately 3 million of that is currently staked, generating additional yield on top of its core position.

In another development announced yesterday, BlackRock has progressed its plans for a U.S.-listed yield-generating ether product. An amended S-1 filing indicated further advancement toward the iShares Staked Ethereum Trust ETF, with a BlackRock affiliate purchasing 4,000 seed shares at $25 each, providing $100,000 in initial capital for the trust.

While these developments signal positive long-term trends, it may still be too early to declare an end to the recent downturn, even with bitcoin and ether trading approximately 50% and 60% below their respective all-time highs.

Simultaneously, traditional finance indexes are beginning to exhibit signs of exhaustion, as increasing AI-related capital costs surpass previous projections and exert more pressure on corporate cash flows. Stay vigilant!

Read more: For analysis of today’s activity in altcoins and derivatives, see Crypto Markets Today

What to Watch

For a more detailed list of events this week, see CoinDesk’s "Crypto Week Ahead".

- Crypto

- Feb. 18, 1 p.m.: Hedera to implement a mainnet upgrade estimated to take around 40 minutes to complete.

- Macro

- Feb. 18, 8:30 a.m.: U.S. durable goods orders MoM for December (Prev. 5.3%)

- Feb. 18, 9:15 a.m.: U.S. industrial production MoM for January estimated at 0.3% (Prev. 0.4%)

- Feb. 18, 2:00 p.m.: U.S. FOMC Minutes

- Earnings (Estimates based on FactSet data)

- Feb. 18: Figma (FIG), post-market, $0.45

Token Events

For a more detailed list of events this week, see CoinDesk’s "Crypto Week Ahead".

- Governance votes & calls

- Feb. 18: VeChain to host its monthly VeChain Builders Space.

- Unlocks

- No significant unlocks.

- Token Launches

- No major launches.

Conferences

For a more detailed list of events this week, see CoinDesk’s "Crypto Week Ahead".

- Day 2 of 4: ETHDenver

Market Movements

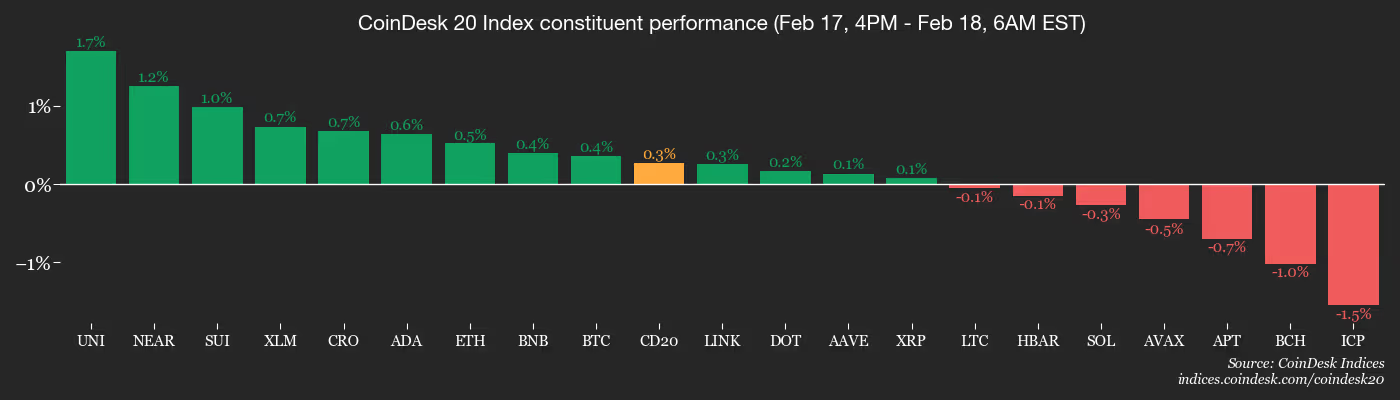

- BTC is up 0.86% from 4 p.m. ET Tuesday at $68,227.58 (24hrs: -0.09%)

- ETH is up 1.03% at $2,019.54 (+2.24%)

- CoinDesk 20 is up 0.55% at 1,994.39 (+0.54%)

- Ether CESR Composite Staking Rate is down 3 bps at 2.81%

- BTC funding rate is at 0.0018% (1.9425% annualized) on Binance

- DXY is up 0.13% at 97.28

- Gold futures are up 0.58% at $4,934.20

- Silver futures are up 2.92% at $75.68

- Nikkei 225 closed up 1.02% at 57,143.84

- Hang Seng closed up 0.52% at 26,705.94

- FTSE is up 1.03% at 10,664.40

- Euro Stoxx 50 is up 0.93% at 6,077.76

- DJIA closed on Tuesday unchanged at 49,533.19

- S&P 500 closed up 0.1% at 6,843.22

- Nasdaq Composite closed up 0.14% at 22,578.38

- S&P/TSX Composite closed down 0.54% at 32,896.55

- S&P 40 Latin America closed down 0.62% at 3,694.06

- U.S. 10-Year Treasury rate is up 1.9 bps at 4.073%

- E-mini S&P 500 futures are up 0.52% at 6,896.50

- E-mini Nasdaq-100 futures are up 0.59% at 24,914.00

- E-mini Dow Jones Industrial Average Index futures are up 0.47% at 49,844.00

Bitcoin Stats

- BTC Dominance: 58.56%