Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

What lies ahead for XRP as price fluctuations reach their lowest levels for 2024?

Technical traders identify a compression setup, with $1.39 acting as crucial support and $1.44 serving as immediate resistance that could lead to a movement towards $1.50 to $1.62 if it is reclaimed.

What to know:

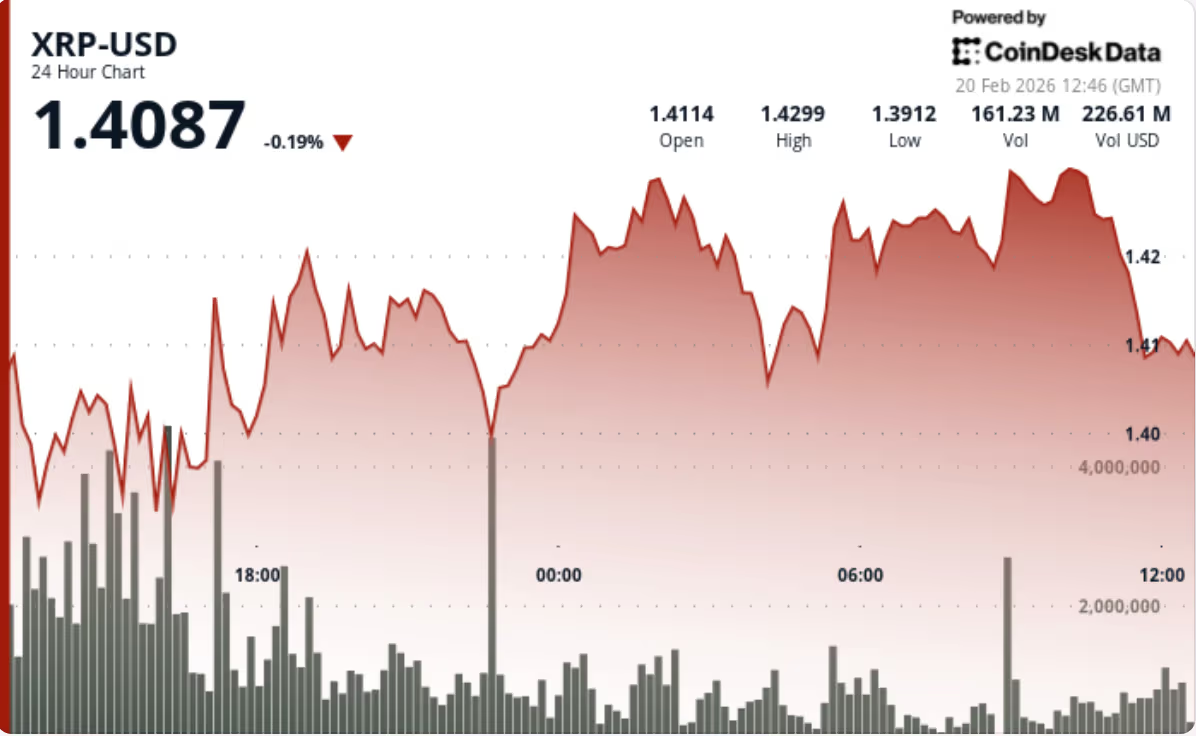

- XRP is stabilizing around $1.42 as volatility decreases to levels not seen since prior to a significant rally in 2024, leading to speculation that the ongoing downtrend might be nearing its end.

- Technical traders identify a compression setup, with $1.39 as critical support and $1.44 as immediate resistance that could facilitate a movement towards $1.50 to $1.62 if reclaimed.

- With volatility approaching previous cycle lows, analysts suggest that the timing and direction of the upcoming breakout will likely depend on the duration of this low-volatility base-building phase.

XRP remained stable close to $1.42 as volatility fell to levels last observed before a significant rally in 2024, raising considerations about whether the downtrend is reaching exhaustion.

News Background

- XRP has decreased approximately 61% from its all-time peak during the current phase of market instability, but recent price movements indicate that the selloff might be slowing. Losses have transitioned into consolidation, with modest gains on shorter timeframes replacing abrupt directional shifts.

- Importantly, XRP’s historical volatility has declined to 96, matching figures last noted in June 2024 — a timeframe that marked the bottom of a previous downtrend prior to a rally into November.

- This compression has sparked speculation that XRP could be entering a similar base-building phase.

- Certain analysts draw parallels with earlier cycle patterns, including the prolonged consolidation that preceded the 2017 breakout.

Price Action Summary

- XRP dipped 0.14% to $1.42

- The price tested and maintained support around $1.39

- Volume surged nearly 94% above average during the breakdown

- Recovery stalled near $1.428–$1.431 resistance

Technical Analysis

- The session’s pivotal moment occurred when XRP tested $1.3915 on high volume before stabilizing. While the bounce completed a 38.2% retracement, momentum diminished as the price approached $1.44, which serves as the daily pivot and near-term ceiling.

- The structure remains cautious below $1.44–$1.45, but the successful defense of $1.39 indicates that sellers are losing urgency. Declining volume during consolidation suggests compression rather than fresh distribution.

What traders say is next?

- Traders perceive this as a compression setup.

- If XRP reclaims $1.44, it opens up potential movement towards $1.50 and possibly $1.62.

If $1.39 is breached, downside risk shifts to $1.35. - With volatility near previous cycle lows, the next significant move may be less about direction at this moment — and more about how long this compression can sustain before expansion resumes.