Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Trader indicates Bitcoin price needs to reach $26K following ‘textbook short squeeze’

On September 12, Bitcoin (BTC) bounced back from three-month lows as traders expressed skepticism regarding BTC price movements.

BTC/USD 1-hour chart. Source: TradingView

BTC/USD 1-hour chart. Source: TradingView

Bitcoin shorts face pressure as BTC price rises by $1,000

Data from Cointelegraph Markets Pro and TradingView tracked a swift return to levels observed following the weekly close on BTC/USD.

Bitcoin experienced immediate weakness during the previous day’s Wall Street opening, momentarily falling below $25,000, marking its worst performance since mid-June.

The subsequent recovery lifted the largest cryptocurrency by $1,000; however, at the time of writing, $26,000 continued to serve as a resistance level.

Prior to this, on-chain analytics platform Material Indicators cautioned that BTC price was likely to encounter a “support test” due to the removal of bid liquidity further down the order book.

#FireCharts indicates that two significant #BTC Buy Walls have been removed. A support test is imminent. pic.twitter.com/QnKIEoAnEc

— Material Indicators (@MI_Algos) September 11, 2023

In additional preemptive analysis, Material Indicators and others observed that prior instances of support “rug pulls” had ultimately led to upward movements in the Bitcoin market, as large-volume traders cleared liquidity from around the spot price.

Continuing, co-founder Keith Alan anticipated that $24,750 would serve as support during the downward movement, a prediction that remained valid at the time of writing.

Following the recovery, which he described as a “textbook short squeeze,” well-known trader Skew was among those urging bulls to surpass the $26,000 resistance.

$BTC CVDs & Price

A clear perp CVD divergence with sellers unable to break below $25K

Setup criteria

> high short float in OI & negative funding

> Price reclaiming price level / failing to maintain LTF trend lower (appears to be SFP below initial low)

> Perp CVD divergence… pic.twitter.com/rsRLzAUbkE— Skew Δ (@52kskew) September 12, 2023

“$25.6K – $25.3K remains significant for structure & confirmation of buyers,” Skew noted.

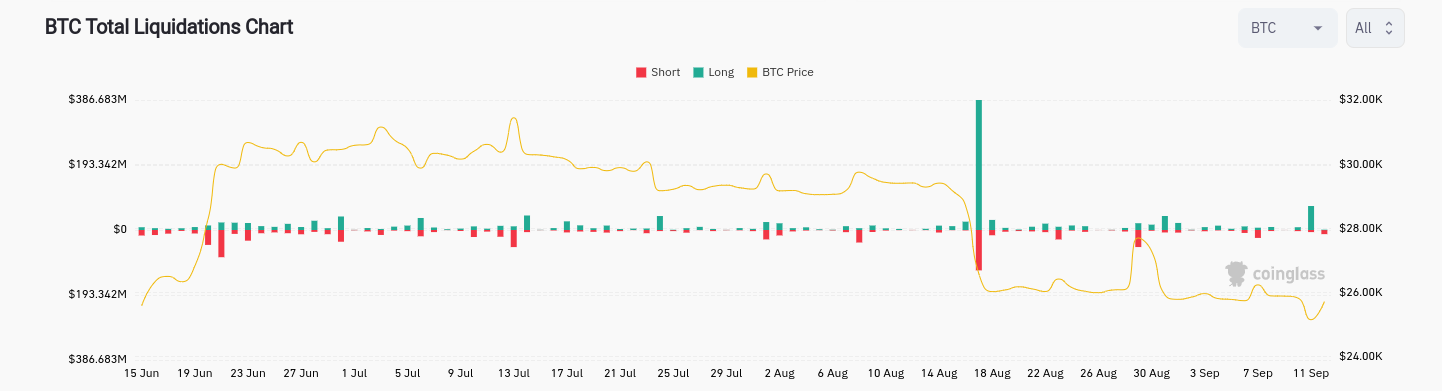

Data from the monitoring platform CoinGlass revealed total BTC short liquidations exceeding $12 million for September 12 thus far, while $71 million in BTC longs faced liquidation the previous day.

BTC liquidations chart (screenshot). Source: CoinGlass

BTC liquidations chart (screenshot). Source: CoinGlass

Bitcoin price: “Next impulse” on the horizon?

Remaining optimistic, fellow prominent trader Credible Crypto observed a potential breakout in Bitcoin market cap dominance as a possible precursor to the next bullish BTC price movement.

Related: Double top ‘likely’ confirmed — 5 things to know in Bitcoin this week

In a recent analysis on X dated September 12, he highlighted a local dominance downtrend being tested — a situation last seen in mid-June, which led to over $7,000 in gains over a two-week period.

“Five days after BTC dominance broke its local downtrend, price followed suit with the next impulsive leg which was a $7,000 move,” part of his accompanying comments stated.

“With bullish market structure intact on BTC, 24.8k held, and BTC dominance breaking out, I believe there is a strong argument to suggest that our next impulse is just around the corner.”

Bitcoin dominance vs. BTC/USD annotated chart. Source: Credible Crypto/X

Bitcoin dominance vs. BTC/USD annotated chart. Source: Credible Crypto/X

This article does not provide investment advice or recommendations. Every investment and trading decision carries risk, and readers should perform their own research before making any decisions.