Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

The United States might acquire a substantial bitcoin reserve if the speculation regarding Venezuela’s $60 billion assets is accurate.

Your day-ahead look for Jan. 5, 2026

Nicolas Maduro’s capture sparked speculation regarding a concealed Venezuelan bitcoin stash. (Matt Cardy/Getty Images modified by CoinDesk)

Nicolas Maduro’s capture sparked speculation regarding a concealed Venezuelan bitcoin stash. (Matt Cardy/Getty Images modified by CoinDesk)

What to know:

You are reading Crypto Daybook Americas, your morning update on the overnight developments in the crypto markets and what to anticipate for the day ahead. Crypto Daybook Americas will set the tone for your morning with detailed insights. If you’re not yet subscribed to the email, click here. You won’t want to begin your day without it.

By Omkar Godbole (All times ET unless stated otherwise)

Happy New Year, readers! Crypto is starting 2026 on a positive note: Bitcoin is vibrant around $92,700, up 1.3% in the last 24 hours and 5% during the first five days of the year.

STORY CONTINUES BELOWDon’t miss another story.Subscribe to the Crypto Daybook Americas Newsletter today. See all newslettersSign me up

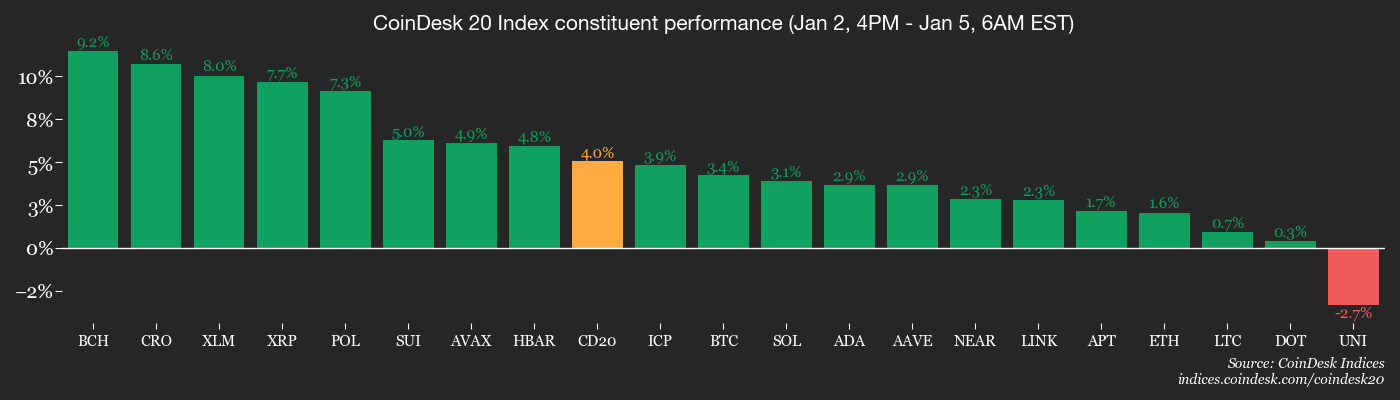

Leading altcoins such as XRP, SOL, BNB, and ETH have increased by 1%-3% in the past 24 hours, with XRP rising by 2.49%, SOL by 1.27%, BNB by 0.54%, and ETH by 0.99%. The CoinDesk 20 Index (CD20) increased by 1.25%, indicating strength among the largest and most actively traded assets, while the CoinDesk 80 Index (CD80) lost early gains, suggesting relative weakness in the broader altcoin market.

Analysts pointed to safe-haven demand following the U.S. intervention in Venezuela and a slowdown in tax-related selling as significant drivers for bitcoin’s price increase.

Data from Deribit highlights renewed interest among traders for bullish option positions, particularly the $100,000 strike call.

"We observed ETF inflows on January 2nd after a series of outflows during December and substantial volumes of January-end BTC calls being processed on the last day of December," Laser Digital informed CoinDesk via email.

This past weekend, the U.S. launched an operation against Venezuela and apprehended President Nicolás Maduro. Following this event, crypto social media has been buzzing with speculation that Venezuela may possess a hidden bitcoin reserve exceeding $60 billion, potentially rivaling that of bitcoin treasury company Strategy (MSTR), which holds BTC valued at over $62 billion. These assertions have yet to be substantiated.

If this is indeed accurate, the U.S. could potentially confiscate those coins and incorporate them into its strategic BTC reserve.

"The possibility of the U.S. adding any confiscated BTC to its strategic reserve lowers the chances of forced selling and highlights BTC’s increasing strategic significance as countries compete to accumulate it," QCP Capital noted in a market update on Monday.

Another prominent narrative is that President Donald Trump may soon exploit Venezuela’s 300 billion barrels of oil reserves, increasing supply. This could lead to a drop in oil prices, enabling the Federal Reserve to implement interest rate cuts more swiftly.

However, possessing reserves and the ability to produce them are two separate matters. Numerous analysts have indicated that Venezuelan crude from the Orinoco Belt is heavy, impure sour crude, complicating extraction and refining, which requires significant investments.

This situation implies that the reserves may not be tapped into anytime soon, restricting their influence on oil prices. In other words, the disinflationary effect anticipated by BTC supporters may not materialize in the near future.

In other notable news, Ethereum co-founder Vitalik Buterin stated that the network has effectively addressed the blockchain scalability trilemma, achieving a balance between decentralization, security, and high transaction speed, aided by significant upgrades such as zkEVMs and PeerDAS.

In traditional markets, the dollar index has increased for the fourth consecutive trading day, surpassing 98.50. Futures linked to the S&P 500 and Nasdaq 100 have shown upward movement. In the macroeconomic landscape, a series of crucial U.S. data releases is scheduled for this week, beginning with the ISM Manufacturing PMI later today, followed by the non-manufacturing PMI, the ADP Employment report, and nonfarm payrolls data in the upcoming days. Stay vigilant!

Read more: For insights into today’s movements in altcoins and derivatives, see Crypto Markets Today

What to Watch

- Crypto

- No events scheduled.

- Macro

- Jan. 5, 10 a.m.: U.S. Dec. ISM Manufacturing PMI Est. 48.3.

- Earnings (Estimates based on FactSet data)

- No events scheduled.

Token Events

- Governance votes & calls

- BIM Protocol is voting on integrating a bridge to Bitcoin and Monero via Quickex to enhance cross-chain interoperability. Voting concludes on Jan. 5.

- Unlocks

- Jan. 5: will unlock 3.61% of its circulating supply valued at $329.6 million.

- Token Launches

- Jan. 5: Lighter (LIT) to be listed on BTSE.

- Jan. 5: Renzo will carry out its third monthly REZ token burn of tokens acquired through protocol revenue.

Conferences

- No events scheduled.

Market Movements

- BTC has risen by 3.26% since 4 p.m. ET on Friday, currently at $92,963.75 (24hrs: +1.87%)

- ETH is up 1.28% at $3,168.94 (24hrs: +0.99%)

- CoinDesk 20 is up 3.67% at 2,947.34 (24hrs: +1.27%)

- Ether CESR Composite Staking Rate has decreased by 2 bps to 3.05%

- BTC funding rate stands at 0.0041% (4.4435% annualized) on Binance

- DXY has increased by 0.18% to 98.61

- Gold futures have risen by 3.06% to $4,446.50/oz

- Silver futures are up 7.53% to $75.87/oz

- Nikkei 225 closed +2.97% at 51,832.80

- Hang Seng remained unchanged at 26,347.24

- FTSE is up 0.32% at 9,983.44

- Euro Stoxx 50 has increased by 1.79% to 5,900.01

- DJIA closed on Friday +0.66% at 48,382.39

- S&P 500 finished up 0.19% at 6,858.47

- Nasdaq Composite closed unchanged at 23,235.63

- S&P/TSX Composite Index closed -0.37% at 31,883.40

- S&P 40 Latin America finished +0.76% at 3,157.25

- U.S. 10-year Treasury rate has decreased by 2 bps to 4.17%

- E-mini S&P 500 futures are up 0.21% at 6,914.75

- E-mini Nasdaq-100 futures are up 0.49% at 25,510.50

- E-mini Dow Jones Industrial Average Index futures are unchanged at 48,643.00

Bitcoin Stats

- BTC Dominance: 59.37% (+0.35%)

- Ether-bitcoin ratio: 0.03418 (-0.52%)

- Hashrate (seven-day moving average): 1,053 EH/s

- Hashprice (spot): $39.46

- Total fees: 2.4 BTC / $218,657

- CME Futures Open Interest: 104,905 BTC

- BTC priced in gold: 20.8 oz.

- BTC vs gold market cap: 6.21%