Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

The strength and volatility of the U.S. dollar increase as markets anxiously anticipate the opening of the U.S. market.

As speculation surrounding the Fed chair creates volatility in equities, rates, and cryptocurrencies.

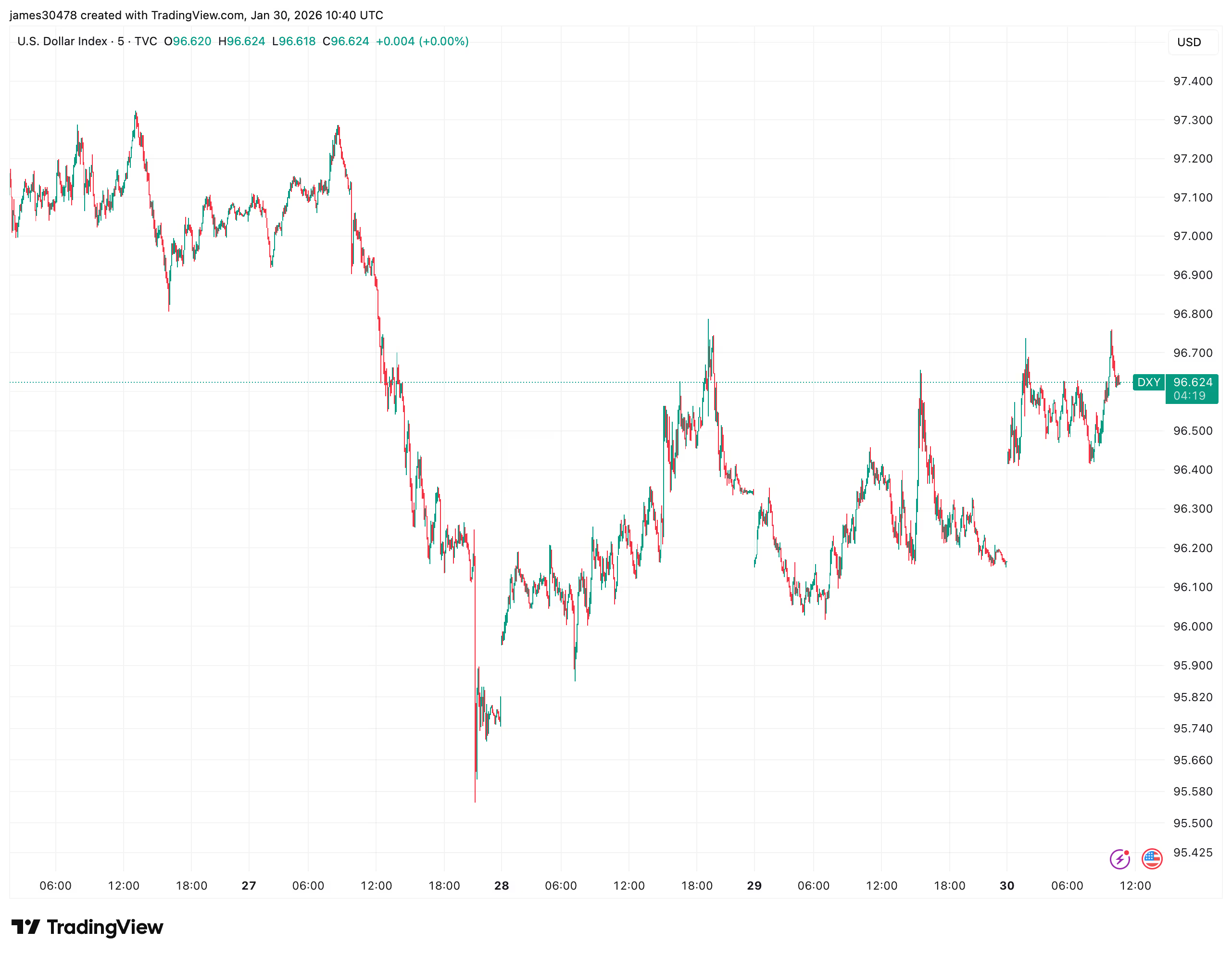

DXY Index (TradingView)

DXY Index (TradingView)

Key points:

- Sources indicate that the Trump administration might designate Kevin Warsh as the upcoming Federal Reserve chair, replacing Jerome Powell.

- The VIX has risen by 13%, and the MOVE Index has increased by 6%, underscoring heightened uncertainty in both equity and Treasury markets.

- The DXY index is moving upwards, supporting a risk-averse sentiment as U.S. equities decline before the market opening.

The Trump administration is reportedly getting ready to announce Kevin Warsh as the next Federal Reserve chair this Friday, succeeding Jerome Powell, a change that has disturbed the markets and incited a widespread selloff across various asset classes.

Consequently, risk appetite has diminished as investors anticipate possible changes in the direction of monetary policy.

STORY CONTINUES BELOWDon’t miss another story.Subscribe to the Crypto Daybook Americas Newsletter today. See all newslettersSign me up

In the meantime, the DXY index, which measures the U.S. dollar’s strength against a group of major currencies, has risen to 96.6.

U.S. Treasury yields have slightly increased, with the 10-year benchmark yield around 4.25%.

Volatility has surged, with the Volatility Index (VIX) up by 13%, and the MOVE Index, which measures volatility in the U.S. Treasury market, rising by 6%.

In pre-market trading on Friday, the Invesco QQQ (QQQ) has dropped more than 1%, trading at approximately $622 per share.

Bitcoin has seen a substantial decline, dropping to $82,000. This decrease has caused bitcoin to fall out of the top ten global assets by market capitalization, now sitting at eleventh place with a market cap of $1.6 trillion.

Assets associated with bitcoin have mirrored this trend. Strategy (MSTR), the largest publicly traded holder of bitcoin, is down 4% in pre-market trading after experiencing a roughly 10% drop on Thursday, currently trading near $138. In the bitcoin mining and AI sectors, IREN (IREN) has seen a 5% decline to $57, while Cipher Mining (CIFR) has dropped by 4%. Both Galaxy Digital (GLXY) and Coinbase (COIN) are down 3% as well.

Metals have absorbed a significant portion of the downturn in the last 24 hours. Gold has retreated toward $5,000 per ounce, while silver has decreased to about $100 per ounce. Other commodities have also weakened, with both copper and oil trading lower.