Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Strategy’s STRC rebounds to $100, set to facilitate increased bitcoin acquisition

The perpetual preferred STRC reaches $100 par during bitcoin decline, allowing for potential additional BTC acquisitions for the firm.

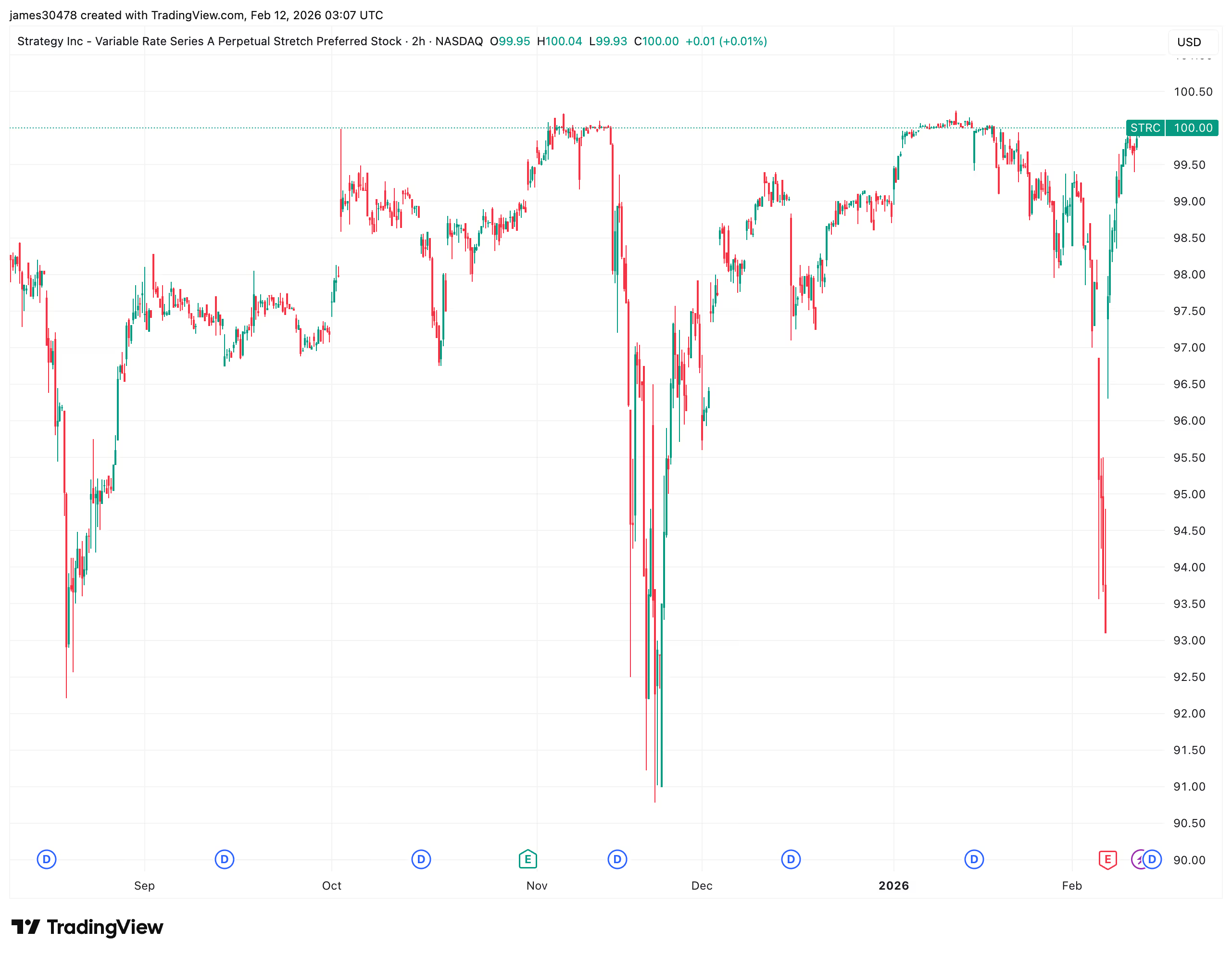

STRC (TradingView)

STRC (TradingView)

Key points:

- Stretch (STRC) regained its $100 par value for the first time since mid-January, allowing Strategy (MSTR) to restart at-the-market offerings for further bitcoin acquisitions.

- The preferred equity remained stable near par despite the recent fluctuations in bitcoin, bolstered by a monthly dividend rate that Strategy recently raised to 11.25%.

Stretch (STRC), the perpetual preferred equity issued by Strategy (MSTR), the largest corporate bitcoin holder globally, recovered its $100 par value during Wednesday’s U.S. trading session, marking the first such occurrence since mid-January.

STRC trading at or above par permits the company to recommence at-the-market (ATM) offerings to finance additional bitcoin acquisitions. STRC last reached the $100 mark on January 16 when bitcoin was trading around $97,000; however, as the leading cryptocurrency by market capitalization declined to as low as $60,000 by February 5, STRC fell to a low of $93 before its recent upswing.

STORY CONTINUES BELOWDon’t miss another story.Subscribe to the Crypto Daybook Americas Newsletter today. See all newslettersSign me up

Designed as a short-duration, high-yield credit instrument, STRC currently provides an 11.25% annual dividend, distributed monthly. To reduce volatility and encourage trading near par, Strategy adjusts this rate monthly, having recently increased it to the current 11.25% yield.

MSTR common stock encountered pressure, dropping 5% on Wednesday to finish at $126, while bitcoin remains around $67,500.