Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

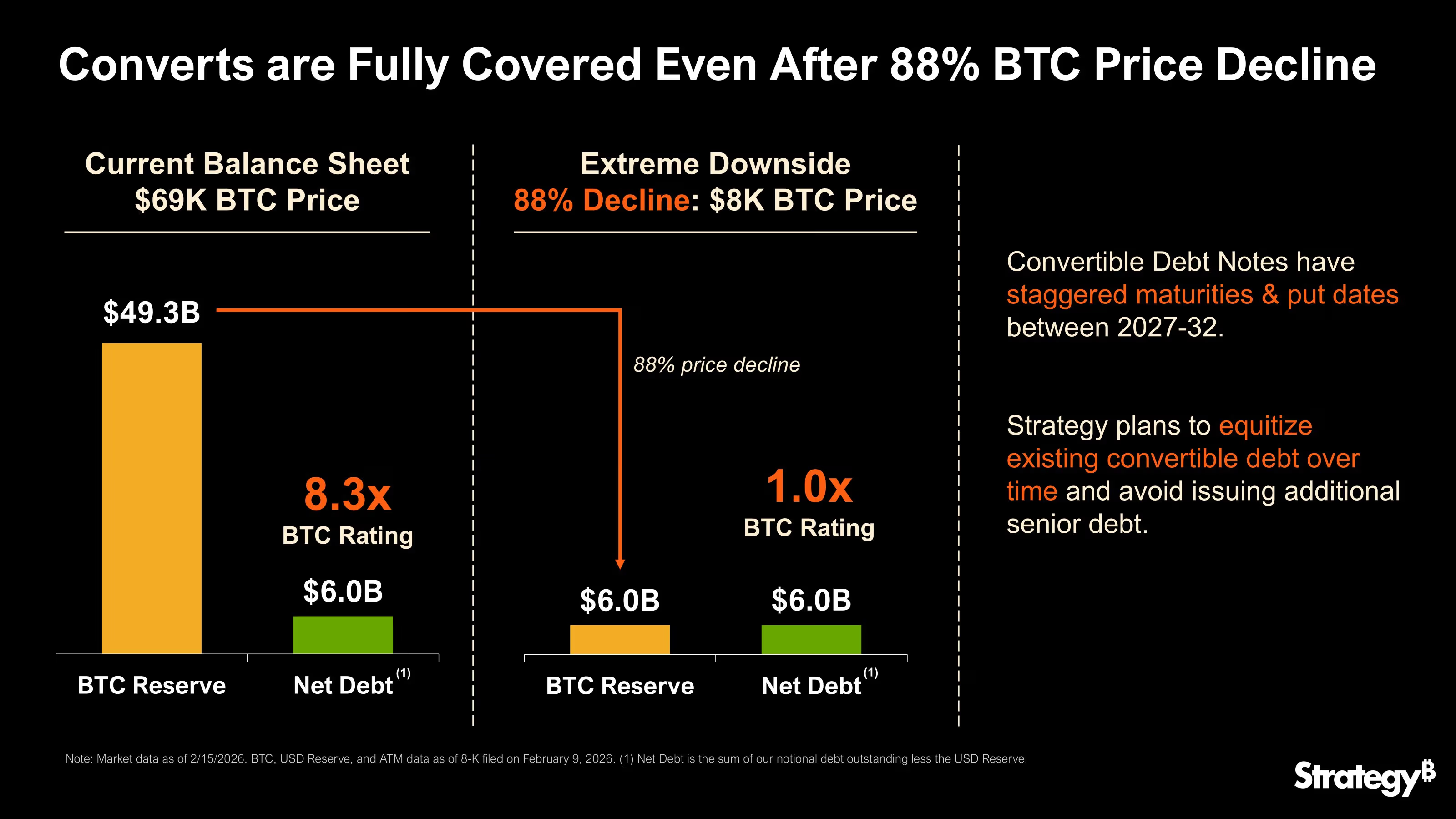

Strategy claims it can endure a decline in bitcoin to $8,000 and plans to convert debt into equity.

Strategy claims it can endure a bitcoin price decline to $8,000 while still managing to address its approximately $6 billion in net debt.

Strategy Executive Chairman Michael Saylor (Nikhilesh De modified by CoinDesk)

Strategy Executive Chairman Michael Saylor (Nikhilesh De modified by CoinDesk)

What to know:

- Strategy, under the leadership of Michael Saylor, asserts it can endure a bitcoin price decrease to $8,000 while still managing its approximately $6 billion in debt through its 714,644-bitcoin treasury.

- The firm intends to gradually convert its convertible debt into equity and refrain from issuing additional senior debt, a plan that critics warn could significantly dilute existing shareholders.

- Doubters suggest that a substantial bitcoin decline would leave Strategy with billions in unrealized losses, complicate refinancing efforts, and necessitate share issuance that they argue would effectively transfer risk to retail investors.

Bitcoin treasury firm Strategy (MSTR) announced it can survive a potential drop in the price of the leading cryptocurrency to $8,000 while still fulfilling its debt obligations.

"Strategy can endure a price drop in $BTC to $8K and still possess adequate assets to completely cover our debt," the company led by Michael Saylor stated on X.

STORY CONTINUES BELOWDon’t miss another story.Subscribe to the Crypto Daybook Americas Newsletter today. See all newslettersSign me up

The firm, which possesses more bitcoin than any other publicly traded entity, has amassed 714,644 BTC, valued at approximately $49.3 billion at current market rates, since it adopted bitcoin as a treasury asset in 2020.

Throughout the years, it has accumulated bitcoin through borrowing, a strategy mirrored by other companies like Tokyo-listed Metaplanet (3350). It has around $6 billion in debt—equivalent to 86,956 BTC—against bitcoin holdings that are over eight times greater.

While these debt-fueled bitcoin purchases were widely praised during the crypto market‘s bullish phase, they have turned into a liability following the cryptocurrency’s fall from nearly $60,000 after peaking above $126,000 in October.

If Strategy is compelled to liquidate its bitcoin reserves to settle its debt, it could inundate the market and further depress prices.

In a post on Sunday, Strategy reassured investors that its bitcoin assets would still hold a value of $6 billion even at an $8,000 BTC price, sufficient to cover its obligations.

Strategy’s finances. (Strategy)

Strategy’s finances. (Strategy)

The company pointed out that it is not required to settle all its debt simultaneously, as the repayment schedules are distributed over 2027 and 2032.

To alleviate concerns further, Strategy indicated that it intends to convert existing convertible debt into equity to prevent the issuance of more senior debt. Convertible debt allows lenders to exchange their loans for MSTR shares if the stock price rises sufficiently.

Not everyone is impressed

Critics remain skeptical.

Observers such as pseudonymous macro asset manager Capitalists Exploits highlight that while an $8,000 bitcoin might technically suffice to cover the $6 billion net debt, Strategy reportedly acquired its bitcoin holdings at a cost of around $54 billion, averaging $76,000 per BTC. A decline to $8,000 would result in an enormous $48 billion unrealized loss, making the financial statements appear unfavorable to lenders and investors.

Available cash would only suffice for approximately 2.5 years of debt and dividend obligations at current levels, the observer noted, and the software sector generates only $500 million annually. This is insufficient to meet the $8.2 billion in convertible bonds, plus $8 billion in preferred shares, which require substantial ongoing dividends akin to continuous interest expenses.

All these factors imply that refinancing may not be easily accessible if bitcoin falls to $8,000.

"Traditional lenders are unlikely to refinance a company whose primary asset has depreciated significantly, with conversion options rendered economically worthless, deteriorating credit metrics, and a stated policy of holding BTC long-term (limiting collateral liquidity)," the observer stated in a post on X. "Issuing new debt would likely necessitate yields of 15-20% or higher to attract investors, or could entirely fail under stressed market conditions."

Dump on retail investors

Anton Golub, chief business officer at crypto exchange Freedx, referred to the "equitizing" strategy as a planned "dump on retail investors."

He clarified that purchasers of Strategy’s convertible bonds have primarily been Wall Street hedge funds, who are not necessarily advocates of bitcoin but are "volatility arbitrageurs."

The arbitrage involves hedge funds capitalizing on discrepancies between the anticipated or implied volatility of a convertible bond’s embedded options and the actual volatility of the underlying stock.

Funds typically acquire inexpensive convertible bonds and bet against, or "short," the stock. This arrangement allows them to navigate significant price fluctuations while profiting from bond interest, volatility ups and downs, and a "pull-to-par" gain where deeply discounted bonds appreciate toward full value at maturity.

According to Golub, Strategy’s convertible bonds were priced for minor fluctuations. However, the stock experienced significant volatility, enabling hedge funds to profit from the arbitrage: purchasing the bonds at a low price while betting against the stock.

This strategy was effective when shares traded above $400, the point at which bondholders would convert debt into equity. Hedge funds then closed their short positions, bonds were eliminated through conversion, and Strategy avoided cash disbursements.

At $130 per share, conversion is not economically viable. Therefore, hedge funds are likely to demand full cash repayment upon bond maturity, potentially placing strain on Strategy’s finances.

Golub anticipates the firm will respond by diluting its shares.

"Strategy will: dilute shareholders by issuing new shares, dump on retail via ATM sales, to raise cash to pay hedge funds," he stated in an explanatory post on LinkedIn.

"Strategy only appears brilliant during Bitcoin bull markets. In bear markets, dilution is significant and harms MSTR shareholders," he concluded.