Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

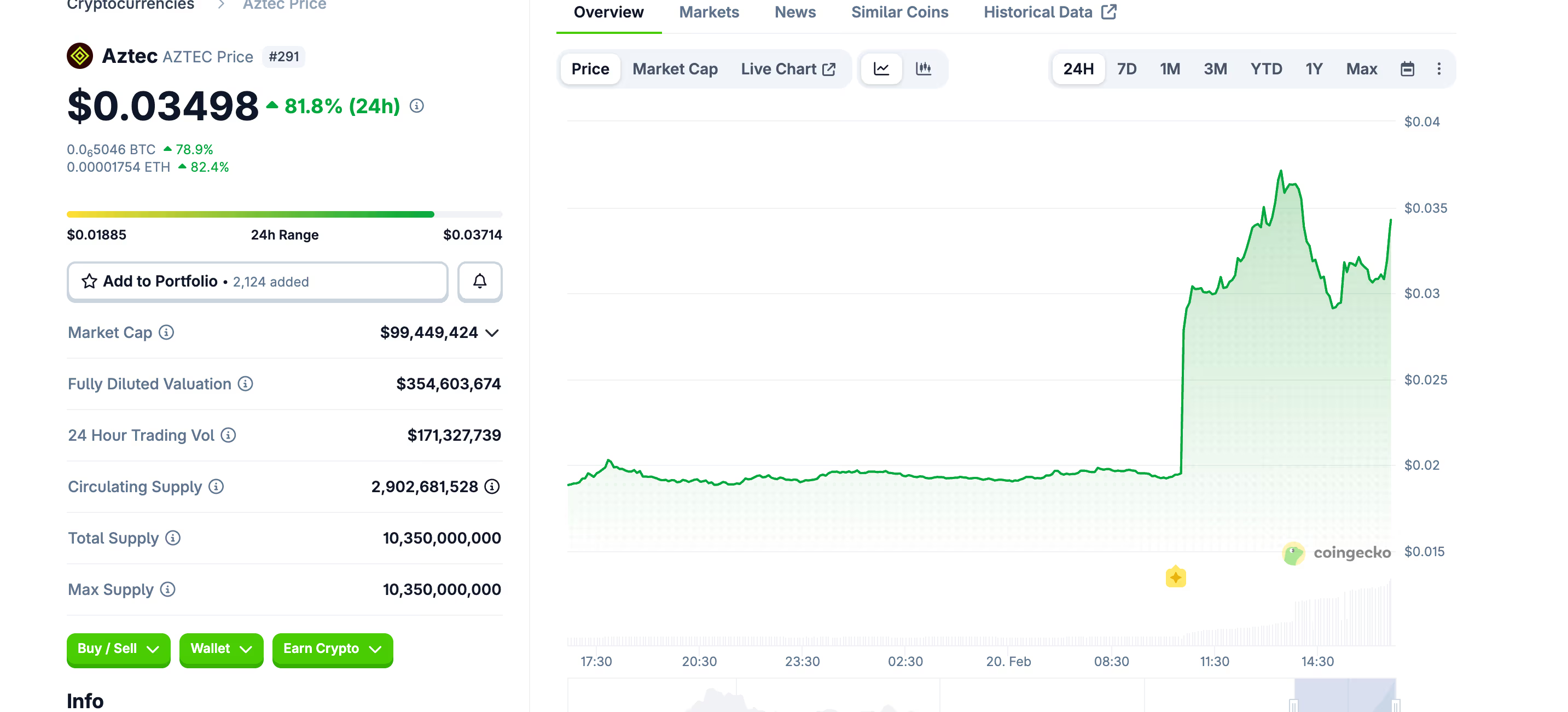

South Korean dual listings propel Ethereum layer-2 token AZTEC to an 82% increase.

Korean exchanges Upbit and Bithumb both introduced local currency pairs for the privacy-oriented layer-2 token, resulting in a significant movement in a lightly traded market.

What to know:

- Aztec’s token experienced an increase of approximately 82 percent to about $0.035 after South Korean exchanges Upbit and Bithumb listed it with won trading pairs, generating substantial KRW-denominated demand in a lightly traded market.

- New KRW listings on prominent Korean platforms can quickly adjust the prices of smaller tokens by providing direct access to an exceptionally active local retail base and initiating momentum-driven purchases.

- The price surge in AZTEC prompted a widening of the so-called kimchi premium before arbitrage trading helped to reduce the gap, while the project’s emphasis as a privacy-oriented Ethereum layer 2 provides a narrative beyond the immediate uptick.

In this article

BTC$67,572.99◢1.58%

BTC$67,572.99◢1.58%

Aztec (AZTEC) rose about 82% within 24 hours to nearly $0.035 following the listing of the token with local currency pairs by South Korean exchanges Upbit and Bithumb, igniting a wave of KRW-denominated buying in a lightly traded market.

STORY CONTINUES BELOWDon’t miss another story.Subscribe to the Crypto Daybook Americas Newsletter today. See all newslettersSign me up

STORY CONTINUES BELOWDon’t miss another story.Subscribe to the Crypto Daybook Americas Newsletter today. See all newslettersSign me up

Korean listings remain significant as they transition a token from being crypto-exclusive to one that a large retail audience can purchase directly with local currency.

South Korea consistently ranks among the top three nations by crypto trading volume relative to its population, with Upbit frequently matching or surpassing Coinbase in daily spot turnover during active periods.

A KRW pair eliminates the additional step through USDT, integrates into Korea’s notably active spot trading environment, and places the token on the screens that local traders monitor. Such visibility can profoundly impact smaller-cap tokens like AZTEC.

Traders often perceive new listings on Upbit and Bithumb as momentum opportunities, rushing in prior to liquidity expansion and before the initial premium diminishes. This pattern has repeatedly occurred — tokens such as VIRTUAL have shown double-digit movements solely based on Korean listing announcements, regardless of the underlying project’s status at that time.

In limited order books, this dynamic results in the vertical candle exhibited by AZTEC. Once prices rise locally, arbitrageurs engage, purchasing on global exchanges and selling into the Korean demand, which aids in elevating prices across the board. The so-called “kimchi premium” — the consistent gap between Korean and international prices — typically widens significantly during these instances before shrinking as arbitrage activities catch up.

Aztec itself is positioned as an Ethereum-based, privacy-centric layer 2 that employs zero-knowledge proofs to facilitate encrypted transactions on a public blockchain. This aspect provides the token with a narrative beyond the listing event.

The premium had slightly decreased by the evening session in Asia as arbitrage activities aligned and the price surge exhibited signs of fatigue.