Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Short-Term Bitcoin Holders Sold Off $5 Billion in BTC as Price Approached $40,000

- Short-term holders of Bitcoin (BTC) are in a state of panic following a decline in BTC price towards $40,000, with traders cautioning that further declines may be imminent.

As Bitcoin (BTC) enters the third week of January, it remains around $40,000 after a highly volatile beginning to the year, but the future direction of the BTC price remains uncertain.

Since the introduction of the first spot Bitcoin exchange-traded funds (ETFs) in the United States, the price dynamics have changed significantly.

Sudden price movements in both directions have caught both long and short BTC traders off guard, as evidenced by the liquidation figures.

BTC Liquidation

BTC Liquidation

As a new week commences, Bitcoin is confronted with two competing narratives: some market participants believe that the dip following the ETF launch will serve as a healthy support retest, while others think that the previous local peak will remain in place for an extended period.

There may be a window of up to two weeks to assess the situation before additional significant catalysts emerge.

US macroeconomic data is expected to moderate somewhat prior to the Federal Reserve’s interest rate decision at the end of the month.

Speculative traders might also be reaching their limits, having sold billions of dollars in BTC at a loss in the previous week.

Bitcoinworld examines the current condition of BTC markets as they recover from a pivotal moment in Bitcoin’s history.

See Also: BTC ETFs Hype Is Over As Bitcoin Price Drops To 2024 Lows

Bearish Bitcoin Price Targets Emerge Following ETF Dip

After hitting $49,000 on the day of the ETF launch, BTC/USD was unable to maintain that momentum for long.

A subsequent decline brought the market back to the lower end of its established trading range, but sellers could not achieve a genuine retest of the $40,000 level.

Instead, two local bottoms were observed near $41,500, with the second occurring at the weekly close on January 14, according to data from TradingView.

At the time of this report, Bitcoin is approaching $43,000 following a slight relief bounce overnight.

BTC Price Chart | Source: Coinstats

Before the close, trading resource Material Indicators noted order book data indicating early signs of an impending support test, although this could occur at a significantly lower level.

“The Binance order book shows ~$270M in bids spread from $41.3k-$36.5k with $68M of it focused on the $38.5k-$39.4k range. Additionally, the buy wall at $26.5k has been broken up and moved up,” part of comments on X (formerly Twitter) stated.

“These are all early signs that bulls are positioning for another retest of resistance. Watching the weekly close for more clues.”

Later, well-known trader Skew provided a list of indicators suggesting that the bounce off the lows could be sustained.

These included reclaiming $42,500 on daily timeframes, the relative strength index (RSI) remaining above 50/100, and Bitcoin maintaining its yearly opening price near $42,250 as support.

$BTC 1H

Nice bounce so far, looking for further confirmationsConfirmations for a rally higher:

Reclaim of consolidation lows ~ $42.5K

RSI above 50

Trade yearly open as support

4H 200EMA reclaim https://t.co/aPvYj5Xx6X pic.twitter.com/PMsE0FriBi— Skew Δ (@52kskew) January 15, 2024

The magnitude of the retracement from $49,000, however, appeared to take many bulls by surprise.

Data from the statistics resource CoinGlass indicated that January 12 saw approximately $112 million in BTC longs liquidated, marking it as one of the most costly days in recent months.

Analyst Matthew Hyland noted that the range top around $48,000 continues to pose a challenge, suggesting that Bitcoin may require additional time to surpass it based on recent developments.

See Also: Does The Approval Of The BTC Spot ETFs Make Bitcoin Centralized?

In his latest posts on X, he warned that a decline into the mid-$30,000 range could still be a possibility.

#BTC looking like the lower path is more likely after testing the $48k area

Still a chance to rebound here however but odds favoring mid 30s currently: https://t.co/fdaKmF9nNi

— Matthew Hyland (@MatthewHyland_) January 14, 2024

This aligns with a prevalent theory suggesting a further drop towards $30,000, but while Hyland and others anticipate a continuation of the bull market, this perspective is not universally accepted.

As previously reported, controversial trader Il Capo of Crypto maintains that new macro lows are forthcoming, potentially reaching as low as $12,000.

Markets Anticipate Fed Cuts In March Despite CPI Overshoot

Those seeking relief from volatility may find their wishes granted this week — at least from a macroeconomic standpoint.

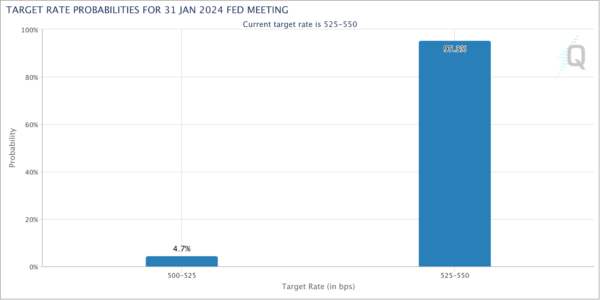

Fed Target Rate

Fed Target Rate

Aside from ETF trading, U.S. economic data is expected to cool in the coming days, with unemployment figures leading the upcoming releases.

With just two weeks remaining until the next Fed meeting to determine interest rate changes, the inflation situation remains precarious.

Last week’s somewhat overlooked Consumer Price Index (CPI) figures indicated that prices rose again in December 2023 by more than anticipated.

While markets do not expect the Fed to lower rates this month, the figures did not go unnoticed by analysts.

In response, trading resource The Kobeissi Letter remarked that the Fed’s task is “not done yet.”

It was great to see that November PPI inflation was revised down to 0.8%.

However, it's apparent that the final push lower against inflation is going to be tough.

Especially with geopolitical tensions rising.

Follow us @KobeissiLetter for real-time analysis as this develops.

— The Kobeissi Letter (@KobeissiLetter) January 12, 2024

Despite this, it continued, markets are anticipating rate cuts — a positive development for risk assets, including cryptocurrencies — to commence in quick succession from March onward.

There it is folks:

Markets are now expecting a rate cut at EVERY MEETING in 2024 beginning in March.

That's right.

7 STRAIGHT interest rate cuts this year to bring the Fed Funds rate down to 3.50% to 3.75% in December.

Meanwhile, the Fed's latest guidance showed 3 cuts in… pic.twitter.com/NaW2K1ulQE

— The Kobeissi Letter (@KobeissiLetter) January 12, 2024

According to data from CME Group’s FedWatch Tool, the likelihood of a freeze on January’s rate change — already in effect for several months — currently exceeds 95%.

Bitcoin Short-term Holders Panic Sell Nearly $5 Billion In A Day

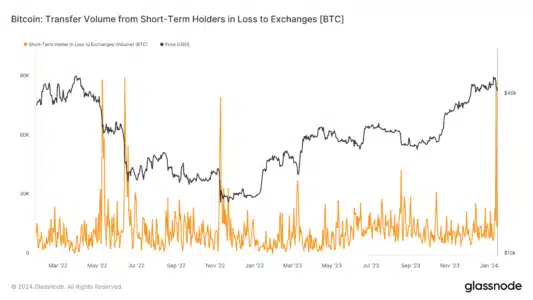

For many, the week of the ETF ultimately turned into a week of selling rather than acquiring Bitcoin.

Despite institutions finally having the opportunity to increase BTC exposure, the price movements reflected the psychological effects of volatility in a traditional manner.

The $50,000 threshold proved too challenging for bulls, with large holders distributing to latecomers, while the retreat towards $40,000 triggered considerable panic.

This was evident in the volume of BTC sold at a loss. Data from on-chain analytics firm Glassnode indicated that on January 12, this reached 88,000 BTC ($3.75 billion).

BTC Transfer From Short-Term Holders

BTC Transfer From Short-Term Holders

“That is mental,” remarked James Van Straten, research and data analyst at crypto insights firm CryptoSlate, noting that total sales amounted to 111,000 BTC (currently $4.7 billion).

The sales, however, were primarily from short-term holders (STHs) — entities that have held a given BTC investment for up to 155 days.

BTC Transfer From Long-Term Holders

BTC Transfer From Long-Term Holders

The ETF announcement seemingly provided speculators with an incentive to buy, anticipating further upward movement.

In contrast, Glassnode shows that long-term holders (LTHs) exhibited minimal reaction to the events, keeping at-a-loss sales subdued.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

The post Bitcoin Short-Term Holders Panic-dropped $5B BTC After Price Dropped Toward $40,000 appeared first on BitcoinWorld.