Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

SEC subtly transitions to brokers’ stablecoin assets that could yield significant outcomes.

The securities regulator has advanced its Project Crypto initiative to implement unofficial policy modifications, allowing broker-dealers to classify stablecoins as capital.

The U.S. Securities and Exchange Commission made an important update to its guidance regarding stablecoin holdings. (Jesse Hamilton/CoinDesk)

The U.S. Securities and Exchange Commission made an important update to its guidance regarding stablecoin holdings. (Jesse Hamilton/CoinDesk)

What to know:

- The inclusion of additional details in a frequently-asked-questions section on the U.S. Securities and Exchange Commission’s website could facilitate the use of stablecoins in capital computations for U.S. broker-dealers.

- The agency is advising brokers that they should apply a 2% deduction when assessing how much their stablecoins can be counted as regulatory capital.

Broker-dealers overseen by the U.S. Securities and Exchange Commission (SEC) are now permitted to classify their stablecoin holdings as regulatory capital, following an adjustment this week to a frequently-asked-questions document managed by the agency.

STORY CONTINUES BELOWDon’t miss another story.Subscribe to the State of Crypto Newsletter today. See all newslettersSign me up

This constitutes a significant change introduced through a minor addition to the SEC’s “Broker Dealer Financial Responsibilities” FAQ. It aligns with a trend of the regulator making incremental adjustments to its approach to cryptocurrency through informal guidance, industry communications, and staff statements since the establishment of its Crypto Task Force during the administration of President Donald Trump.

A new question No. 5 was included concerning the type of “haircut” that firms should apply to their stablecoin holdings — the dollar-pegged tokens such as Circle’s USDC and Tether’s USDT. The response indicated a 2% haircut, which means that rather than the previous understanding that these assets were not eligible for inclusion in a broker-dealer’s capital calculations (100% haircut), firms can now account for 98% of those assets.

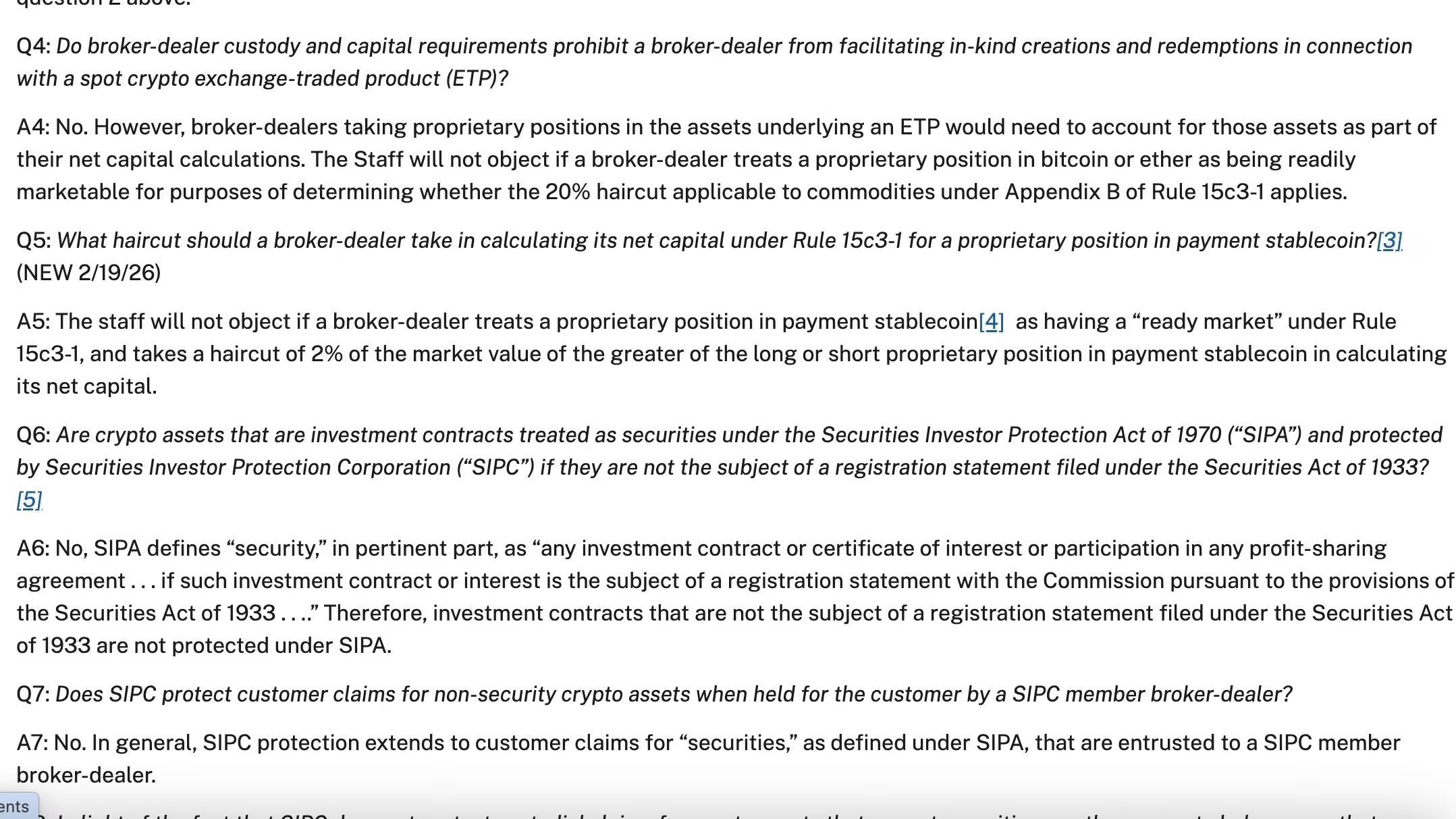

Securities and Exchange Commission FAQ (screen capture, SEC website)

Securities and Exchange Commission FAQ (screen capture, SEC website)

"While this guidance does not introduce new regulations, it assists in alleviating uncertainty for firms aiming to operate within the framework of existing securities laws," stated Cody Carbone, CEO of the Digital Chamber.

This positions stablecoins comparably to other financial instruments.

"This indicates stablecoins are now regarded similarly to money market funds on a firm’s balance sheet," remarked Tonya Evans, a former professor who currently leads a crypto education enterprise and serves on the board of directors at Digital Currency Group, in a post on social media platform X. "Until now, some broker-dealers were completely disregarding stablecoin holdings in their capital assessments. Maintaining them was a financial liability. That has changed."

Previously, the more restrictive SEC regulations meant that those entities — firms registered with the SEC to facilitate customers’ securities transactions and also trade securities on their own behalf — faced challenges in custodying tokenized securities or functioning as intermediaries for trading. Now, firms adhering to this guidance from the agency will find it easier to provide liquidity, support settlement, and promote tokenized finance.

"From Robinhood to Goldman Sachs, these calculations are fundamental," explained Larry Florio, deputy general counsel at Ethena Labs, in an analysis shared on LinkedIn. Stablecoins are now considered working capital, he stated.

SEC Commissioner Hester Peirce leads the agency’s task force and issued remarks regarding the modification, asserting that utilizing stablecoins "will enable broker-dealers to participate in a wider array of business activities related to tokenized securities and other crypto assets." She also expressed interest in exploring how the existing SEC regulations "could be revised to account for payment stablecoins."

However, the drawback of informal staff guidelines is that they can be easily retracted and lack the authority (and legal safeguards) of a formal rule.

The SEC has been developing certain crypto regulations in recent months, but they have not yet been finalized, and this process typically spans several months — sometimes years. Even a formal regulation can still be overturned by new leadership at the agency, which underscores why crypto advocates are urging Congress for more legislation that would enshrine the government’s approach to digital assets into law, such as the Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act proposed last year.

UPDATE (February 20, 2026, 22:23 UTC): Adds comment from Digital Chamber CEO.