Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Searches for ‘Bitcoin to zero’ surge in the U.S., though indicators of a market bottom are inconclusive.

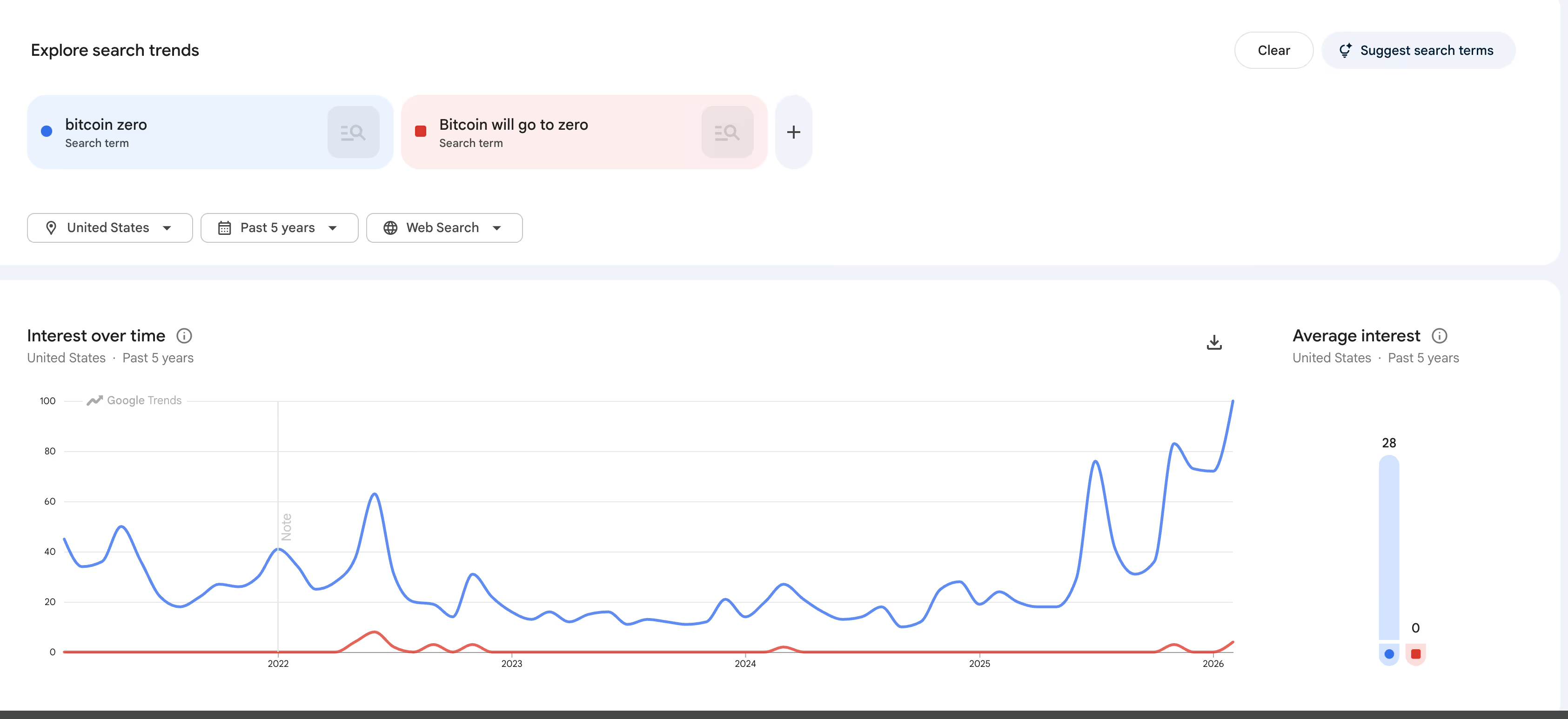

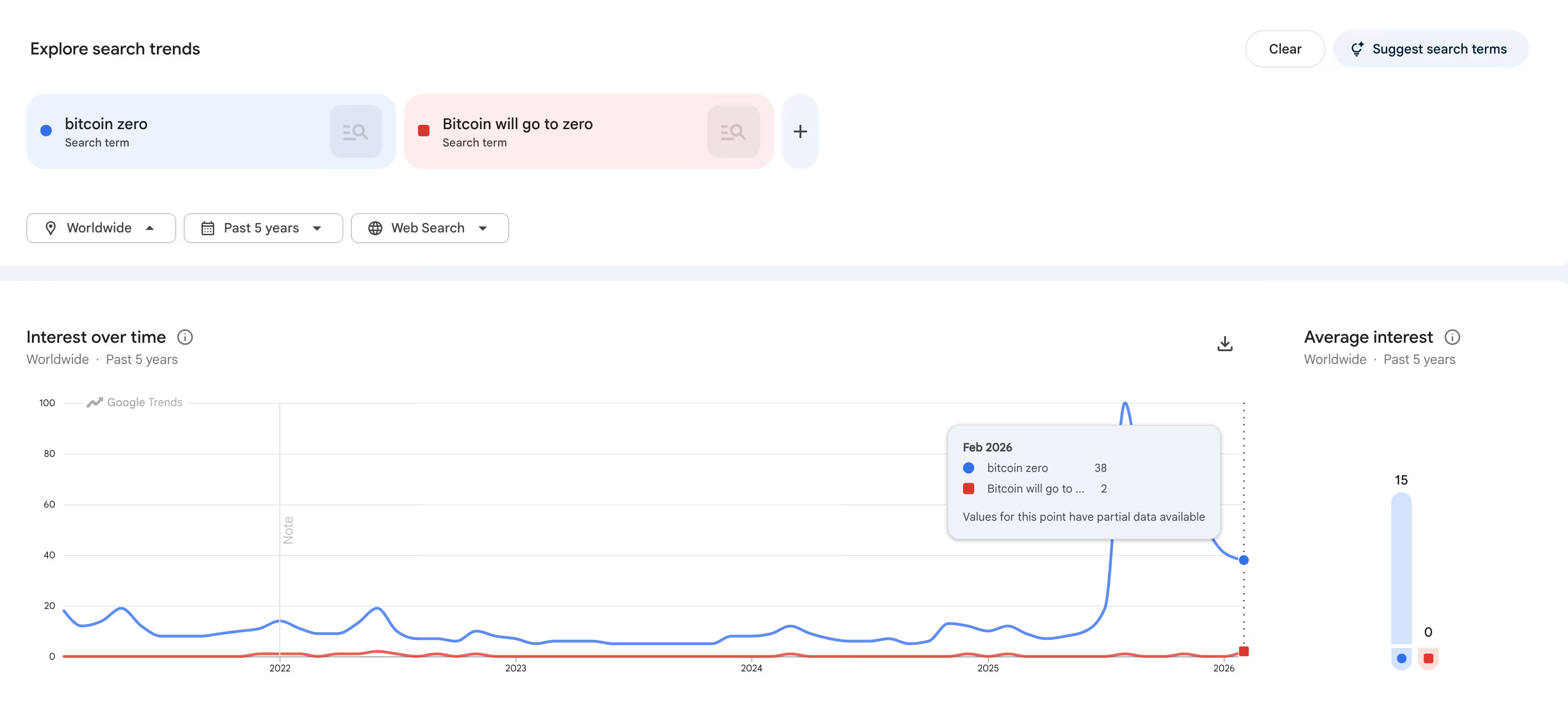

Data from Google Trends indicates that the term reached an all-time high in the U.S. this month, even though global interest has decreased since its peak in August.

Key points:

- Searches in the U.S. for “bitcoin zero” reached a record high in February as BTC approached $60,000 after a decline of over 50% from its October peak.

- Globally, searches for the term peaked in August, indicating that concern is more pronounced in the U.S. compared to the rest of the world.

- Similar spikes in U.S. searches during 2021 and 2022 coincided with local price bottoms.

- Since Google Trends measures relative interest on a scale of 0 to 100, amidst a significantly larger bitcoin user base today, the recent spike in the U.S. indicates increased retail anxiety, yet it does not ensure a straightforward contrarian reversal.

In February, Google searches in the U.S. for “bitcoin zero” surged to a peak of 100 on the company’s relative interest scale, aligning with bitcoin’s descent toward $60,000 after experiencing a decline of over 50% from its all-time high in October.

STORY CONTINUES BELOWDon’t miss another story.Subscribe to the Crypto Daybook Americas Newsletter today. See all newslettersSign me up

STORY CONTINUES BELOWDon’t miss another story.Subscribe to the Crypto Daybook Americas Newsletter today. See all newslettersSign me up

The surge might be interpreted as a sign of widespread capitulation and potentially a contrarian buying opportunity. Comparable peaks in 2021 and 2022 were observed near local lows in bitcoin’s pricing.

However, the global data presents a contrasting narrative. Internationally, the same term peaked at 100 back in August, dropping to a low of 38 this month. Instead of reaching new highs, global fear-related searches have been on a downward trend for several months.

The disparity suggests that any panic is more focused within the U.S. rather than being a global phenomenon. This aligns with the current context, where U.S.-specific factors — including tariff increases, tensions with Iran, and a general risk-off shift in domestic equities — have dominated the macroeconomic narrative in recent weeks.

Retail investors in the U.S. may be responding to these developments more intensely than those in Asia or Europe, where bitcoin’s price drop is coinciding with a different news cycle.

Additionally, there is a methodological nuance to consider. Google Trends does not provide raw search volume; it measures interest on a relative 0-to-100 scale, where 100 indicates a term’s peak within the selected timeframe.

A score of 100 in February 2026, when the U.S. retail audience for bitcoin is significantly larger than during the 2022 bear market, does not necessarily imply that more individuals are searching in absolute terms. It signifies that the term surged relative to a higher baseline.

Bitcoin’s user base and visibility in mainstream discussions have expanded considerably since 2021. The key takeaway is that while retail anxiety in the U.S. is evidently heightened, the concept of “searches hitting a bottom” may not hold the same significance when the global trend is declining. It could still serve as contrarian support, though not the kind that ensures a straightforward trend reversal.