Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Retail investors are hastily withdrawing in response to the decline in bitcoin’s value, whereas ‘mega-whales’ are discreetly taking advantage of the lower prices by purchasing more.

Data from Glassnode indicates that substantial bitcoin investors are in a phase of accumulation, while retail investors are engaged in distribution.

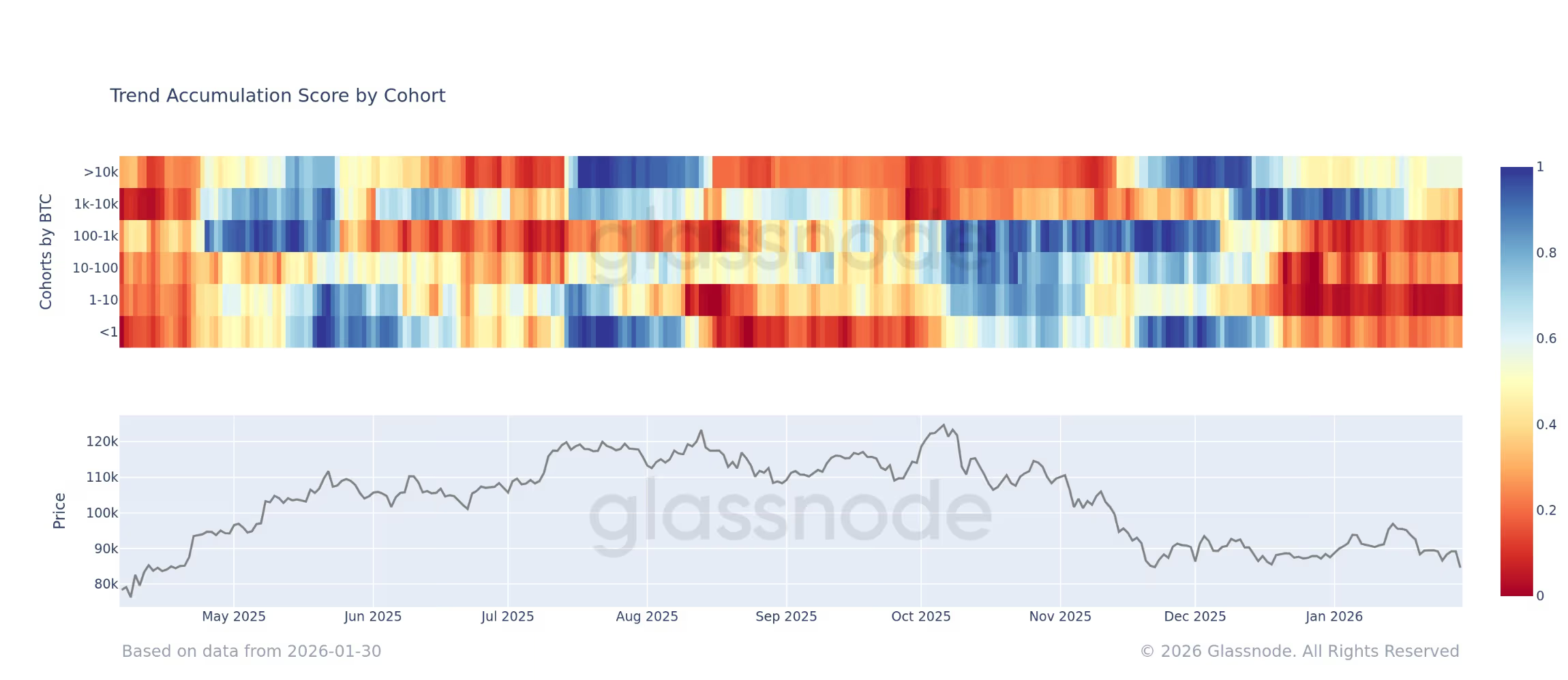

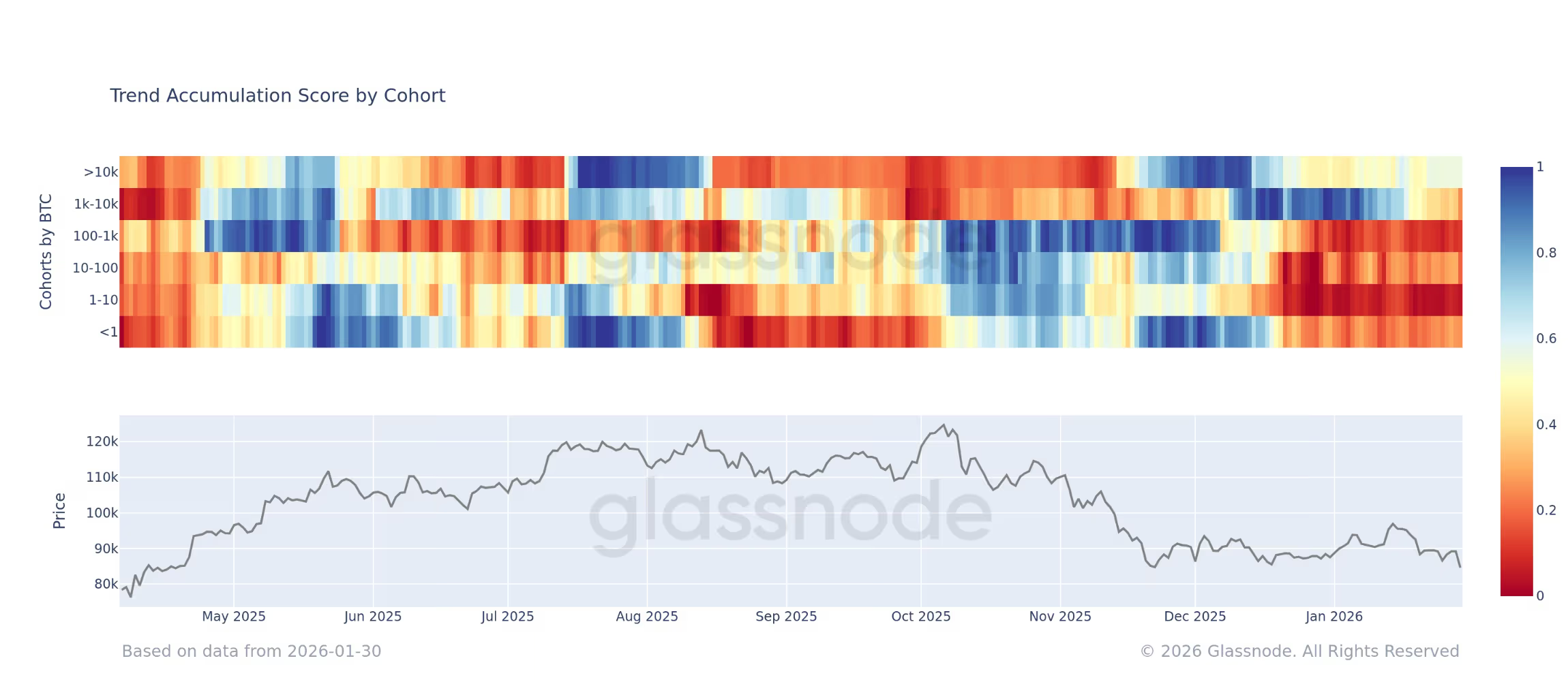

Accumulation Trend Score by Cohort (Glassnode)

Accumulation Trend Score by Cohort (Glassnode)

Key Points:

- Wallets containing 10,000 BTC or more are the sole group in aggregate that is accumulating, maintaining a neutral to slightly positive trend.

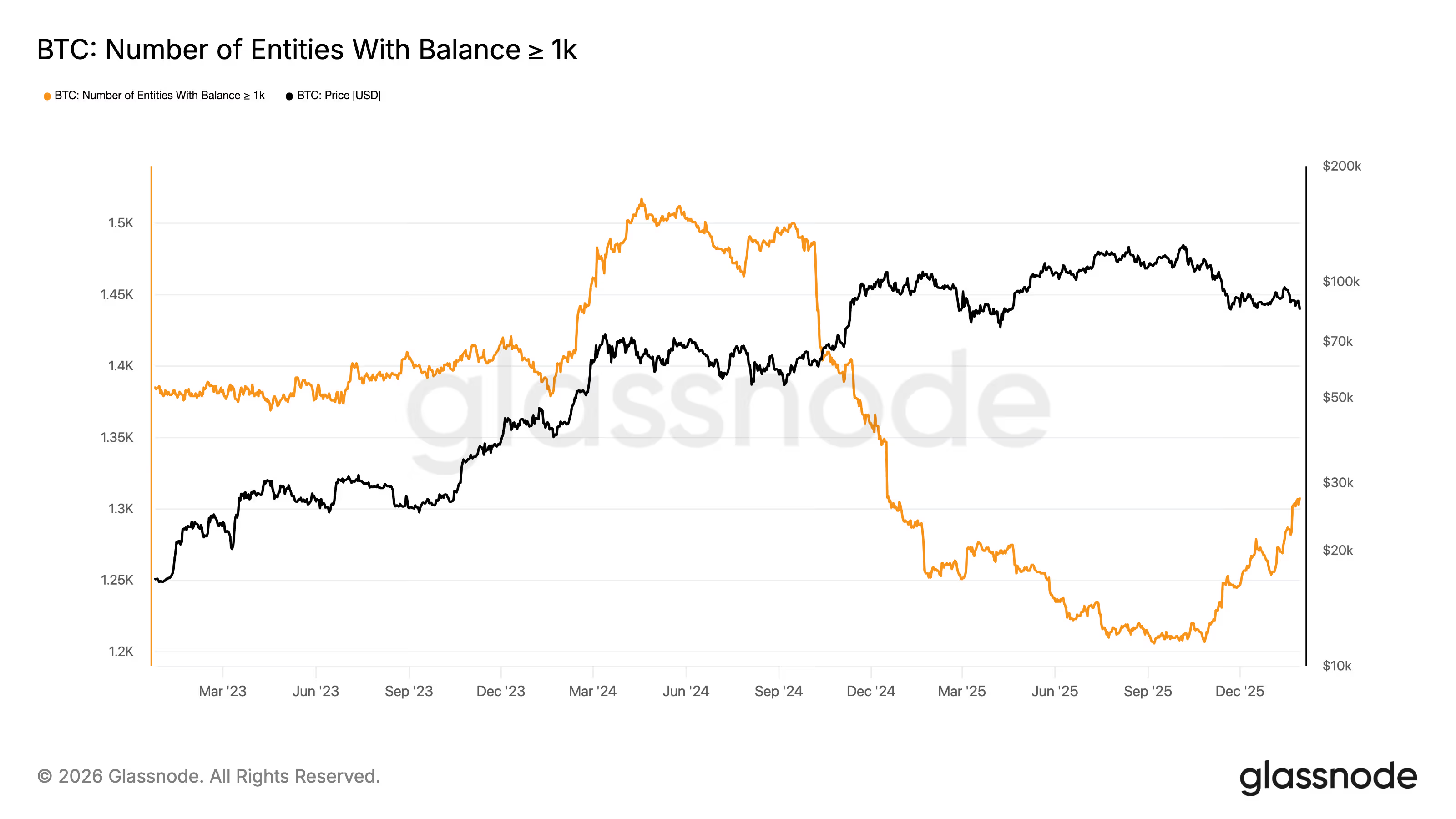

- The count of entities with at least 1,000 BTC has grown from 1,207 in October to 1,303, indicating that significant players are investing during the bitcoin correction.

- Conversely, all smaller groups, particularly those holding less than 10 BTC, are in a selling mode.

Major investors, referred to as whales, who possess 10,000 bitcoin or more, are presently the only ones acquiring the largest cryptocurrency amidst declining prices.

All other holder demographics are opting to sell, as per on-chain analysis.

STORY CONTINUES BELOWDon’t miss another story.Subscribe to the Crypto Daybook Americas Newsletter today. See all newslettersSign me up

This discrepancy is emphasized by Glassnode’s Accumulation Trend Score by wallet cohort, which evaluates the relative actions of various entity sizes based on both their balance and the quantity of bitcoin acquired over the last 15 days. Scores approaching 1 indicate purchasing activity, whereas values near 0 indicate selling.

Bitcoin accumulation trend (Glassnode)

Bitcoin accumulation trend (Glassnode)

As per Glassnode’s findings, the largest whales are currently experiencing a “light accumulation” phase, having sustained a neutral-to-slightly-positive balance trend since bitcoin plummeted to $80,000 in late November. Throughout this timeframe, the price has largely stabilized, oscillating between $80,000 and $97,000 until the end of January.

Bitcoin is presently trading around $78,000, according to CoinDesk data.

In contrast, all smaller groups are net sellers, especially retail holders with less than 10 BTC. This demographic has been consistently selling for over a month, indicative of ongoing downside risk and aversion among smaller investors.

Simultaneously, the number of unique entities with at least 1,000 BTC has increased from 1,207 in October to 1,303.

Number of Entities with balance 1k BTC (Glassnode)

Number of Entities with balance 1k BTC (Glassnode)

Since the all-time high of bitcoin in October, the growth within this cohort indicates that larger holders have been taking advantage of the correction. Whales with a minimum of 1,000 BTC are now back to the highs seen in December 2024, underscoring the notion that major players are absorbing the supply while smaller holders are continuing to exit.