Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Researchers from the U.S. Federal Reserve highlight the effectiveness of prediction markets.

An in-depth examination of forecasts on Kalshi indicates that such platforms are valuable assets for policymakers and researchers, as outlined in a recent Federal Reserve paper.

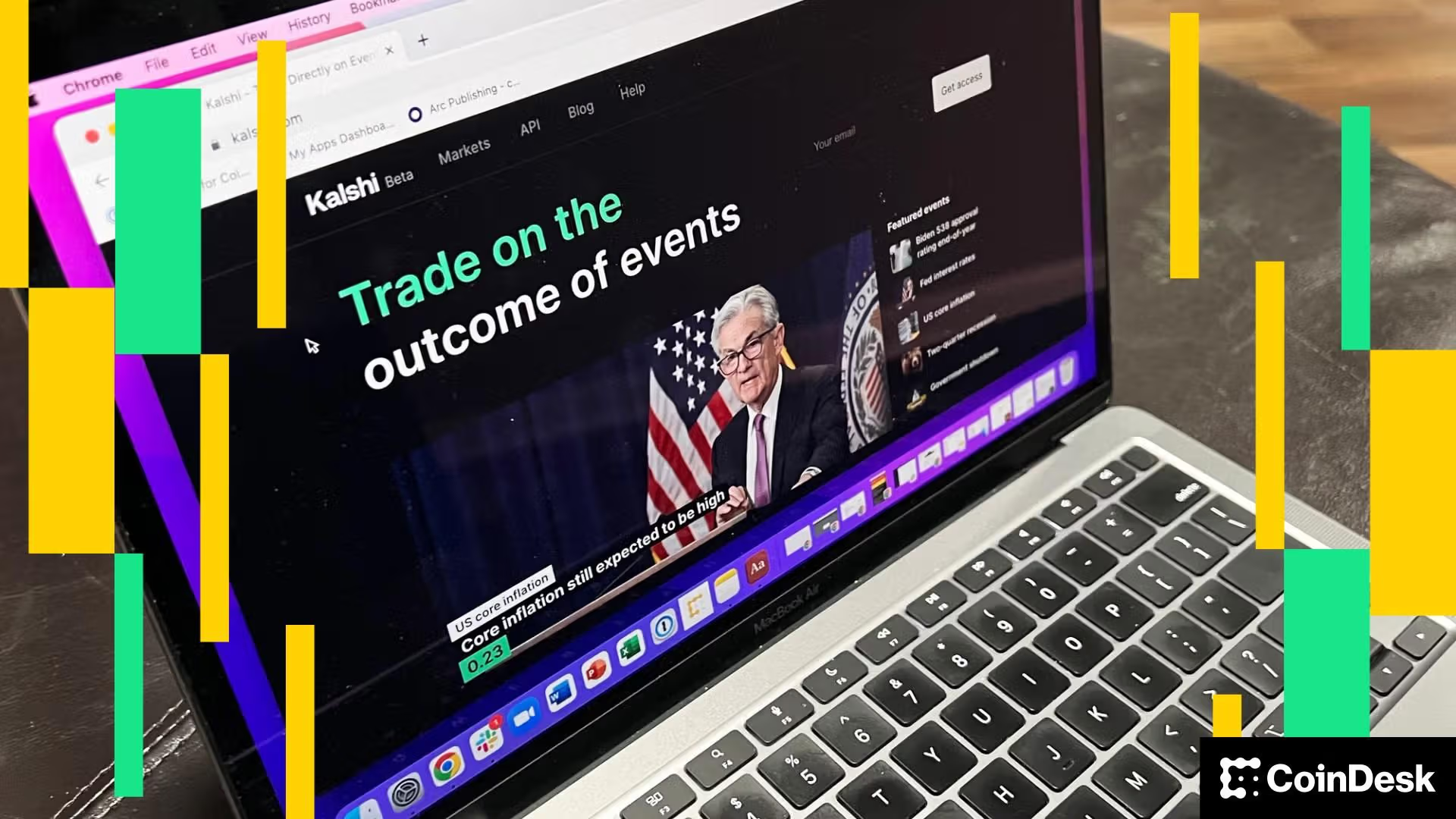

Researchers from the U.S. Federal Reserve have highlighted the significance of prediction markets as a valuable tool for economic analysis. (Jesse Hamilton/CoinDesk)

Researchers from the U.S. Federal Reserve have highlighted the significance of prediction markets as a valuable tool for economic analysis. (Jesse Hamilton/CoinDesk)

Key points:

- Researchers at the U.S. Federal Reserve examined the economic implications of prediction markets and concluded that these platforms serve as a highly beneficial analytical resource.

- The recent research paper explored the efficacy of predictions made on Kalshi, commending it for delivering precise analyses and probing into areas lacking alternative data.

A paper from the U.S. Federal Reserve commended the effectiveness of prediction markets — with a particular focus on Kalshi — in providing timely insights into economic policy.

STORY CONTINUES BELOWStay informed with our latest updates.Subscribe to the State of Crypto Newsletter today. Explore all newslettersSign me up

"Kalshi’s predictions for the federal funds rate and [the U.S. Consumer Price Index] demonstrate statistically significant improvements compared to fed funds futures and expert forecasts, all while offering continuously updated full distributions rather than sporadic point estimates," the paper stated on Thursday.

The markets allow retail investors to purchase contracts on virtually any yes-no question across various fields such as economics, politics, and sports, addressing issues in real-time that are not covered by other information sources.

Prediction markets "offer distinct insights — especially for variables like [gross domestic product] growth, core inflation, unemployment, and payrolls, for which no other market-based distributions currently exist."

In this study, Kalshi predictions "accurately reflected the actual federal funds rate by the day of each meeting since 2022, a milestone not attained by either surveys or futures."

A key factor that distinguishes prediction markets as a valuable resource may be the involvement of retail participants, which sets them apart from markets dominated by institutional investors, as noted in the paper.