Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Real estate magnate Barry Sternlicht is prepared to tokenize assets, yet he claims U.S. regulations hinder progress.

The $125 billion real estate company aims to provide blockchain-based tokens to clients but faces regulatory hurdles.

(Craig Barritt/Getty Images)

(Craig Barritt/Getty Images)

Key points:

- Barry Sternlicht, whose Starwood Capital oversees more than $125 billion in assets, has indicated that the firm is prepared to tokenize real-world assets but is hindered by U.S. regulatory constraints.

- Sternlicht believes that the tokenization of assets such as real estate on blockchains could create new avenues for capital generation and provide investors with access to illiquid markets.

- He has characterized the technology as “the future,” comparing the current phase of tokenization to an earlier stage of artificial intelligence, asserting that the global landscape must adapt accordingly.

Billionaire real estate entrepreneur Barry Sternlicht stated that his firm, Starwood Capital Group, which manages assets exceeding $125 billion, is poised to start tokenizing tangible assets but is unable to proceed due to regulatory obstacles in the United States.

“We want to do it right now and we’re ready,” Sternlicht remarked on Wednesday during the World Liberty Forum in Palm Beach. “It’s absurd that our clients can’t engage in token transactions,” he added, alluding to the use of blockchain-based tokens for real-world assets like real estate.

STORY CONTINUES BELOWDon’t miss another story.Subscribe to the Crypto Daybook Americas Newsletter today. See all newslettersSign me up

Tokenization involves transforming the ownership of physical assets, such as real estate or fine art, into blockchain-based tokens that can be traded. For companies like Starwood, this could present a novel method for raising capital or granting investors access to markets that were previously illiquid.

Integrating real estate onto the blockchain is not a novel concept, and several other companies are already advancing on a limited scale to enhance efficiency in the substantial market, which continues to depend largely on manual processes.

One such company is Propy, which outlined its strategy last year for a $100 million expansion aimed at acquiring mid-sized property title firms across the United States, with the goal of optimizing industry operations.

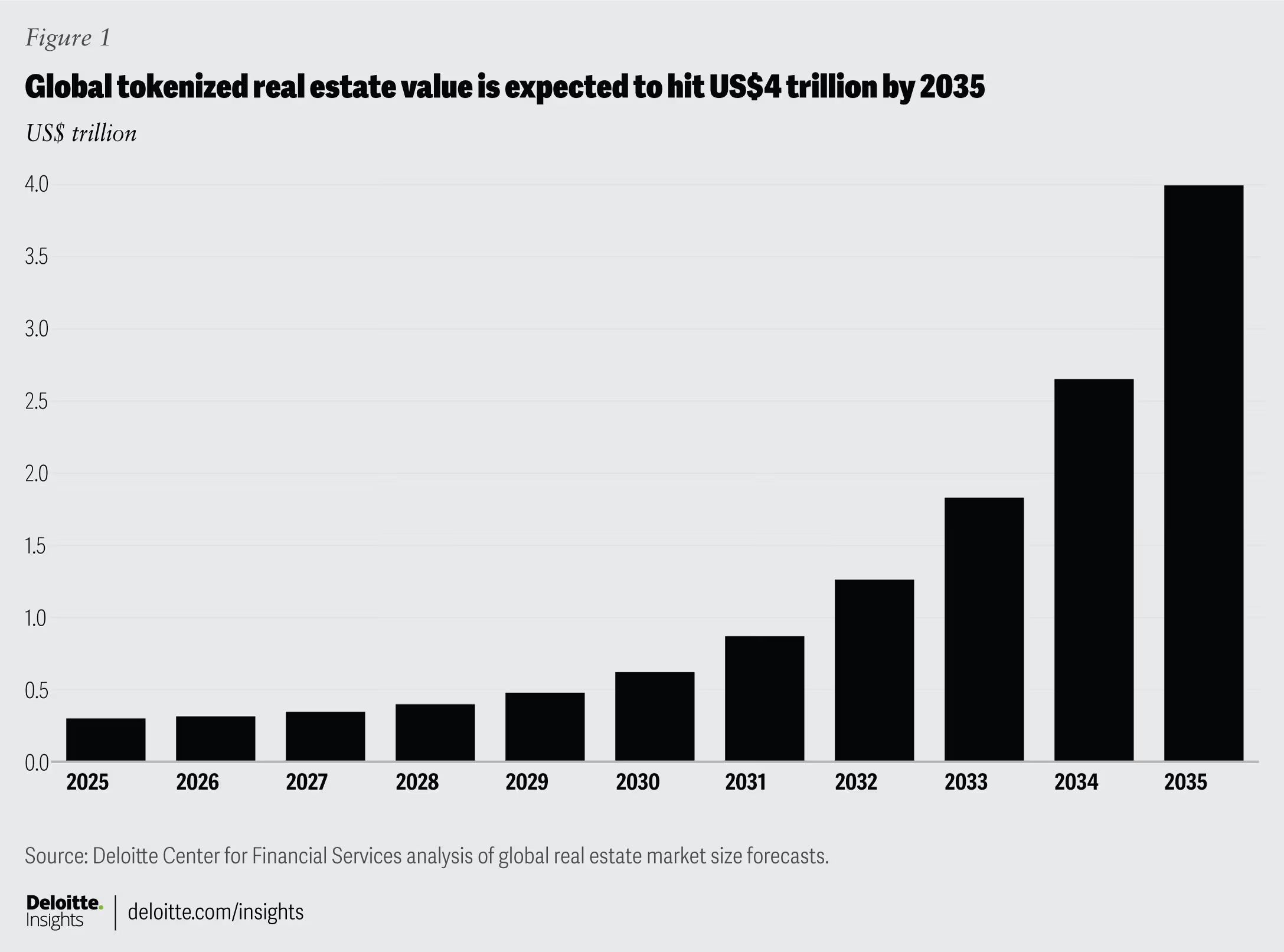

Indeed, consulting firm Deloitte reported last year that $4 trillion worth of real estate is projected to be tokenized by 2035, rising from less than $0.3 trillion in 2024. If this comes to fruition, it would represent a 27% CAGR for tokenized real estate.

"Tokenized real estate has the potential to not only create new markets and products but also provide real estate companies the chance to address issues related to operational inefficiencies, high administrative expenses for investors, and limited retail involvement," Deloitte noted.

‘It’s a fantastic thing’

Sternlicht appears to align with the perspective that tokenization can transform the sector by acknowledging the significant potential of the underlying technology.

“The technology is superior,” he stated. “This is the future.

He even compared the current status of tokenization to artificial intelligence, indicating that it lags far behind where AI currently stands.

“This is even earlier in the physical realm than AI is.” Sternlicht described tokenization as “exciting as can be,” asserting, “It’s a fantastic thing for the world; the world simply needs to keep pace with it.”