Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Potential US government shutdown approaches — 5 key points regarding Bitcoin this week

Bitcoin (BTC) begins the final week of September with a retest of $26,000 as a persistent trading range continues.

An unremarkable weekly close sets the stage for the conclusion of a typically subdued month for BTC price movements.

After navigating a tumultuous week of macroeconomic developments, Bitcoin faces additional challenges before the end of September. The United States gross domestic product figures for Q2 will be released on Sept. 28, followed by Personal Consumption Expenditures (PCE) data the next day.

The main event, however, is expected to be a speech from Jerome Powell, chair of the Federal Reserve, a week after the decision to maintain U.S. interest rates at their current elevated levels.

Inflation continues to be a significant topic as Q4 approaches, and Bitcoin remains directionless as weeks pass without a definitive upward or downward trend emerging.

Will this week bring a change? The countdown to the monthly close has begun.

BTC price weekly chart shows “death cross”

BTC price activity, while stable over the weekend, declined following the weekly close on Sep. 24.

BTC/USD dipped to $26,000, according to data from Cointelegraph Markets Pro and TradingView, with this level still acting as support at the time of writing before the week’s first Wall Street opening.

BTC/USD 1-hour chart. Source: TradingView

BTC/USD 1-hour chart. Source: TradingView

Observing the situation on exchanges, analysts noted liquidations occurring for both long and short BTC positions.

Both sides nearly liquidated.

A notable long squeeze. Bulls caught. https://t.co/FxUGbwxx3v pic.twitter.com/us8Cxno5PZ— IT Tech (@IT_Tech_PL) September 24, 2023

Bitcoin remains close to two-week lows, reinforcing concerns from cautious analysts regarding potential future movements.

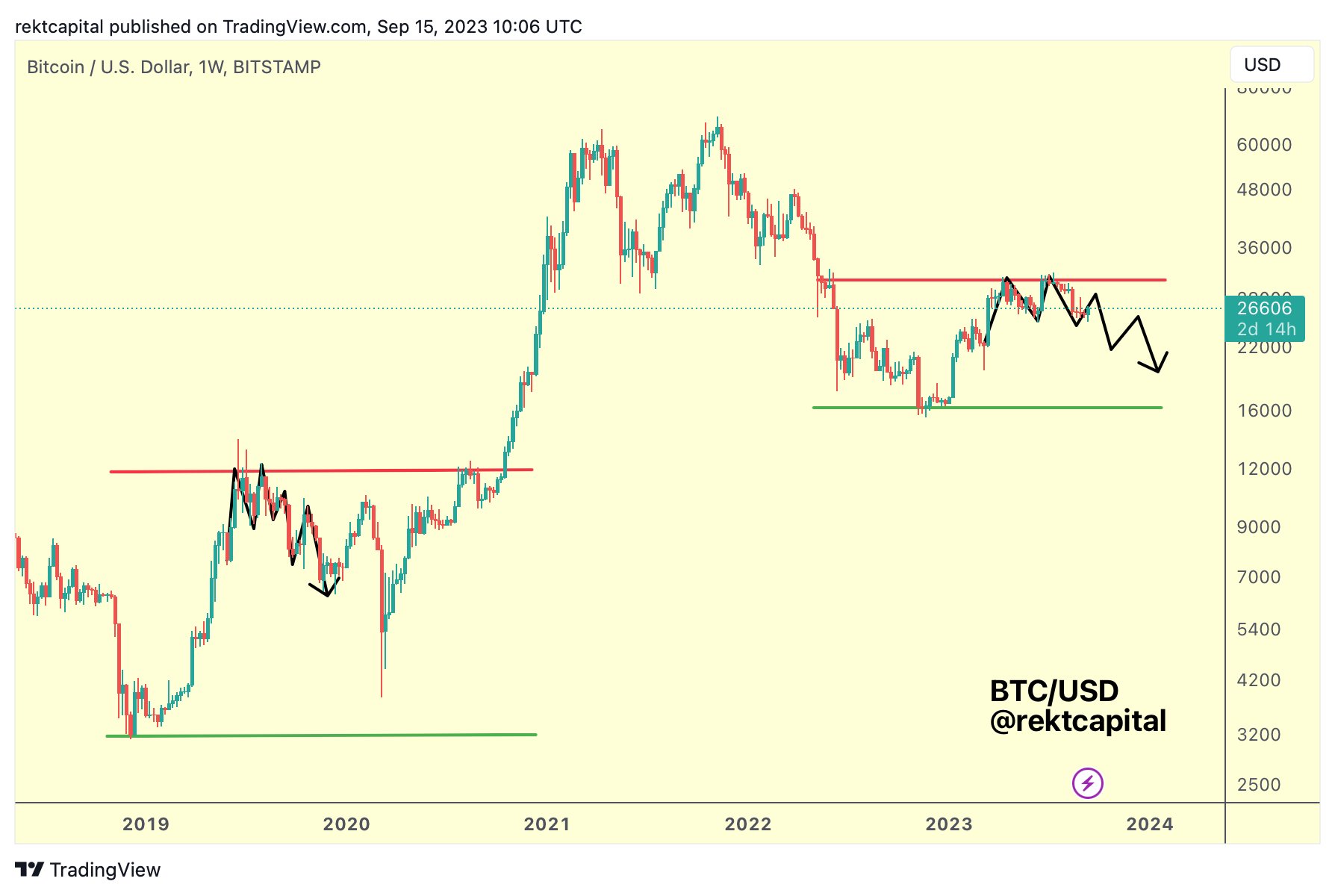

Well-known trader and analyst Rekt Capital continued to monitor what he suggested could be a recurrence of past BTC price patterns. He argued that 2023 might mirror 2019 — its counterpart from the previous cycle.

“Bitcoin could replicate the same bearish fractal from 2019 to decline further within this Macro Range,” he indicated alongside a comparative chart.

In a subsequent discussion on X, Rekt Capital estimated the potential fractal downside target to be around $20,000.

BTC/USD annotated chart. Source: Rekt Capital/X

BTC/USD annotated chart. Source: Rekt Capital/X

Keith Alan, co-founder of the monitoring resource Material Indicators, identified a so-called “death cross” on weekly timeframes.

In this instance, the declining 21-week simple moving average (SMA) has crossed below its rising 200-week counterpart — a phenomenon that underscores the relative weakness of recent price movements.

Sharing a chart that illustrates a downside warning from Material Indicators’ proprietary price tools, Alan noted that this would be negated if BTC/USD were to reclaim $26,500.

A #DeathCross + a new Trend Precognition ⬇️ Signal on the #btc Weekly Chart (Pump > $26.5 to invalidate).

Any questions? pic.twitter.com/aBa64Be56D— Keith Alan (@KAProductions) September 25, 2023

A more positive perspective came from trader and analyst Credible Crypto, who believed a rebalancing of market composition could lead to a return to $27,000.

“We observed clear, visible, and confirmed accumulation occurring in the green square,” he remarked on a chart, building on analysis from the weekend.

“This latest downturn appears to be manipulation to the downside (red square) before a potential upward expansion. 27k incoming in my opinion.”

BTC/USD annotated chart. Source: Credible Crypto/X

BTC/USD annotated chart. Source: Credible Crypto/X

September 2023 maintains “green” status

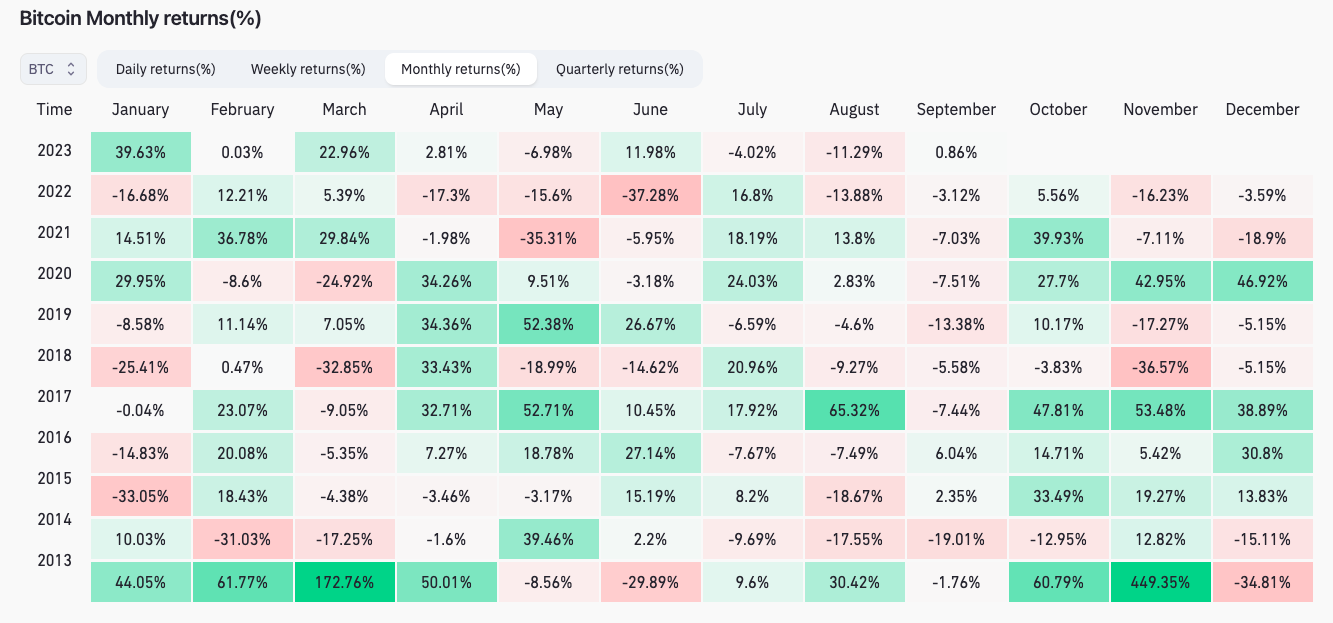

Despite the overnight weakness, Bitcoin remains in positive territory for September overall — a rare achievement by historical standards.

The latest live data from monitoring resource CoinGlass indicates BTC/USD is up 0.8% month-to-date.

BTC/USD monthly returns (screenshot). Source: CoinGlass

BTC/USD monthly returns (screenshot). Source: CoinGlass

While this increase seems modest compared to the volatility typically associated with the pair, September often serves as a bearish precursor to the more significant gains traditionally observed in October.

Thus, 2023 is still on track to mark Bitcoin’s strongest September performance in seven years.

October, informally referred to as “Uptober” among holders due to its alignment with BTC and broader crypto gains, is already a topic of discussion.

Michaël van de Poppe, founder and CEO of trading firm Eight, suggested that the beginning of next month could provide the momentum needed for the total crypto market cap to surpass the 200-week exponential moving average (EMA).

“Total market capitalization for Crypto is contending with resistance at the 200-Week EMA,” he informed X subscribers late last week.

“I believe it’s only a matter of time before we break above it. Probably 1-2 weeks if Ethereum ETF Futures could be approved and Uptober commences.”

Total crypto market cap annotated chart. Source: Michaël van de Poppe/X

Total crypto market cap annotated chart. Source: Michaël van de Poppe/X

Bitcoin’s 200-week EMA continues to serve as support and is currently positioned at $25,700.

PCE data, Fed’s Powell headline macro week

If last week’s macroeconomic events did not generate significant volatility across Bitcoin and crypto markets, perhaps the month-end data will have the intended impact.

Revised U.S. Q2 GDP figures will precede remarks from Fed Chair Powell, along with five other speakers, including Governor Lisa Cook, later on Sept. 28. Markets will be closely monitoring the language used — particularly by Powell — to gauge how future economic policy may unfold.

PCE data will be released the following day; this is recognized as one of the Fed’s preferred metrics for assessing inflation trends.

“A very busy week just as volatility has returned,” financial commentary resource The Kobeissi Letter summarized in an X outlook.

The resurgence of volatility is excellent news for traders.

More Fed uncertainty is back, and we are prepared for it.

We’re publishing our trades for the week shortly.

In 2022, our calls achieved 86%.

Subscribe to access our analysis and see what we’re trading: https://t.co/SJRZ4FrNBc— The Kobeissi Letter (@KobeissiLetter) September 24, 2023

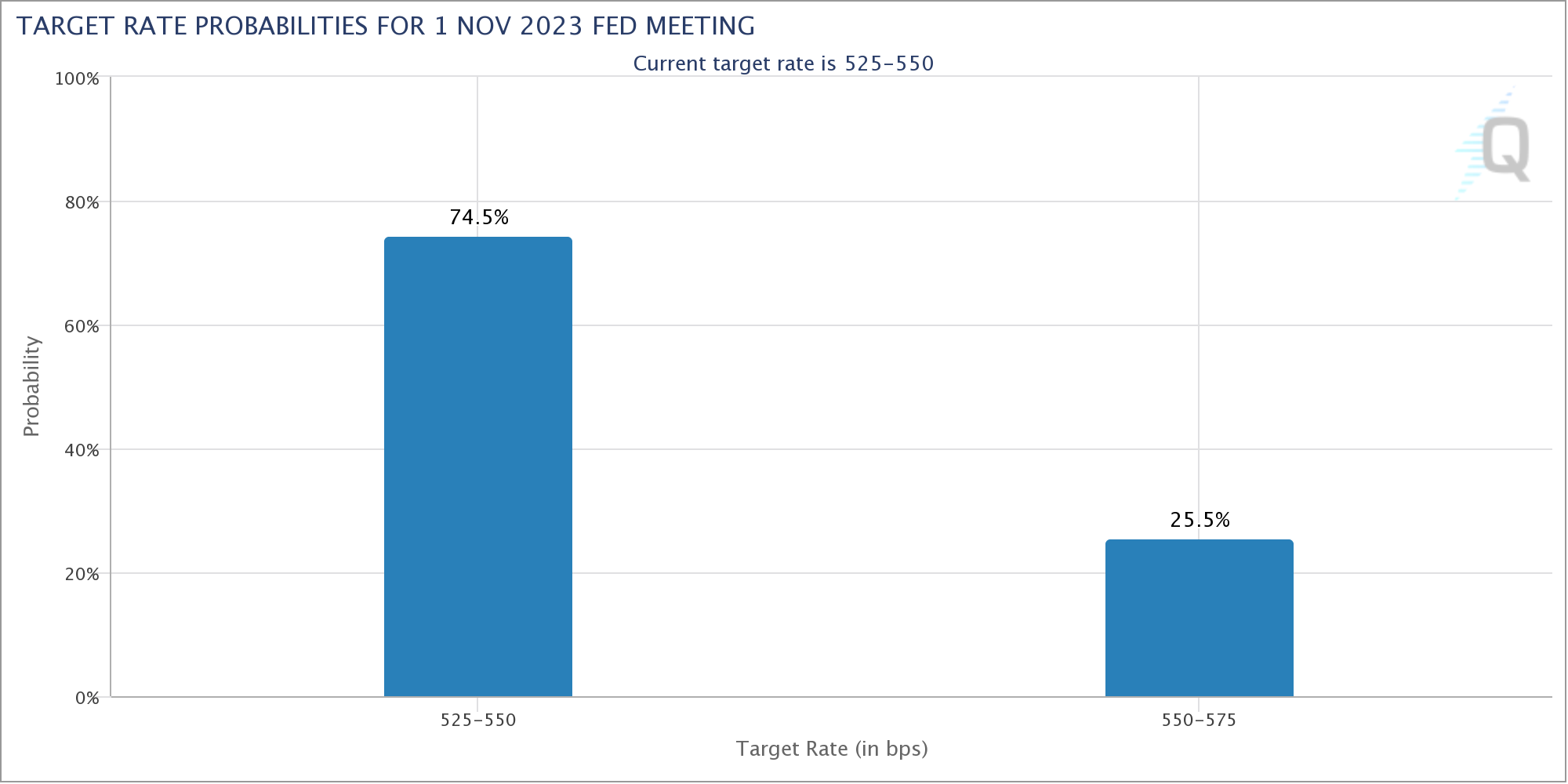

Before the data and Fed speakers, markets are pricing in a 75% likelihood that interest rates will remain stable at current levels during the next decision meeting in November, according to data from CME Group’s FedWatch Tool.

Fed target rate probabilities chart. Source: CME Group

Fed target rate probabilities chart. Source: CME Group

Meanwhile, looming ahead is the potential for a new U.S. government shutdown due to budget negotiations. Politicians have until Oct. 2 to prevent this, as noted by pro-Bitcoin commercial litigator Joe Carlasare.

Major October Catalysts (Part 2)

Predictive markets now anticipate a 70% chance of a Government Shutdown on October 2.

Millions of federal employees face delayed paychecks if the government shuts down, including many of the approximately 2 million military personnel and over 2 million… pic.twitter.com/XTrt0g06t2— Joe Carlasare (@JoeCarlasare) September 24, 2023

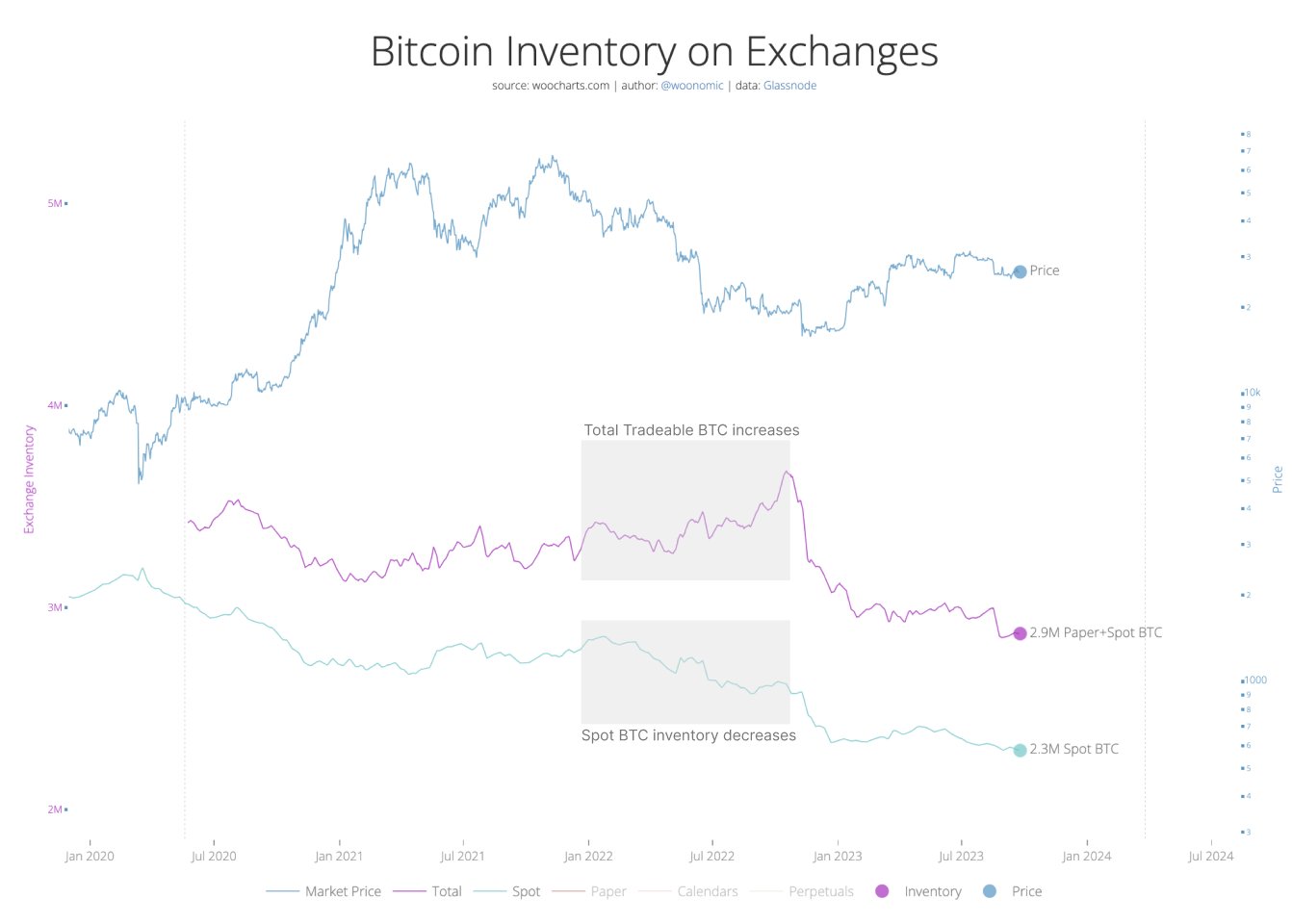

Analysis dismisses BTC exchange balance drop

Bitcoin available for purchase on exchanges may be at its lowest levels since 2018, but this does not warrant celebration or even bullish sentiment, according to one veteran analyst.

Willy Woo, creator of the statistics platform Woobull, argues that the “synthetic” nature of exchanges’ BTC balances means that their multi-year decline does not indicate that the BTC supply is becoming more illiquid or scarce.

“Will purchasing the inventory of BTC on exchanges drive the price up? NO! This is a misconception,” he informed X subscribers in a thread over the weekend.

“This occurred throughout the 2022 bear market. There’s no supply shock because synthetic BTC via futures markets contributed to inventory. The market reached a bottom when futures markets eased.”

Bitcoin inventory on exchanges annotated chart. Source: Willy Woo/X

Bitcoin inventory on exchanges annotated chart. Source: Willy Woo/X

Woo contended that the approval of a Bitcoin spot price exchange-traded fund in the U.S. would help to “rectify” the issue.

He added that futures were the significant factor that distorted his market perspective at the beginning of 2022 before BTC/USD reached two-year lows of $15,600 in November.

“I perceived the market as bullish in early 2022 by analyzing on-chain (spot) flows as positive, while the overwhelming influence of futures was suggesting the contrary,” he acknowledged.

Bitcoin offers “fascinating” 2020 similarities

Regardless of the short-term BTC price trends, some maintain a universally optimistic outlook regarding Bitcoin’s overall health this year.

Related: Bitcoin short-term holders ‘panic’ amid nearly 100% unrealized loss

Among these is the well-known trader and analyst known as Moustache, who now believes that current price levels could represent the final opportunity to “buy the dip” on BTC in 2023.

Sharing a chart that compares the current situation to that of 2020, Moustache also pointed out “fascinating” similarities in Bitcoin’s relative strength index (RSI).

#Bitcoin 2020 vs. #Bitcoin 2023

Isn’t it intriguing?

Perhaps the last “buy the dip” chance in 2023. pic.twitter.com/1S88g4Nc4x— ⓗ (@el_crypto_prof) September 22, 2023

He subsequently emphasized the importance of the 200-week EMA holding as support.

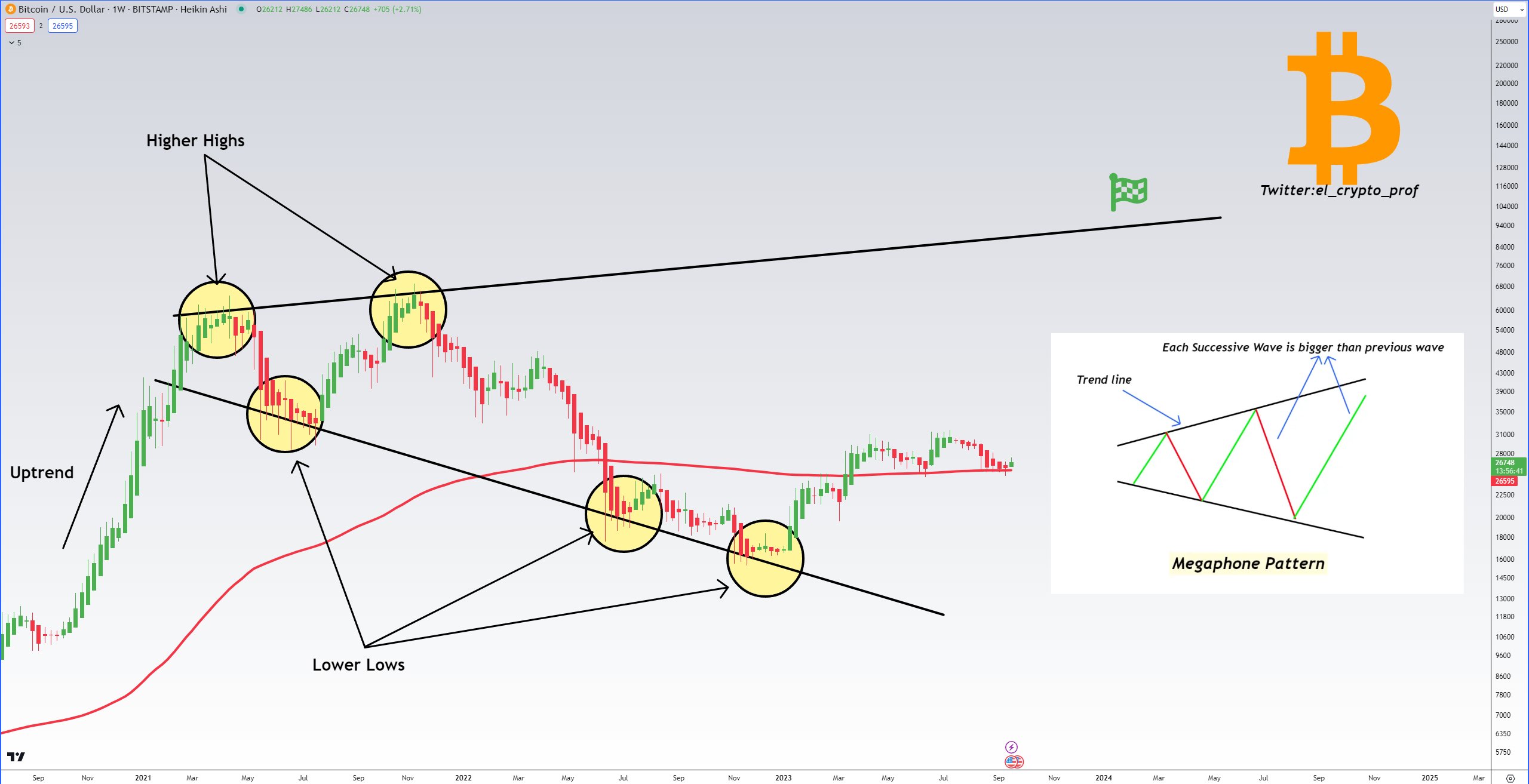

“95% wait for lower prices that won’t materialize,” he wrote in part of the accompanying commentary, with another chart illustrating BTC/USD in an expanding “megaphone” structure.

BTC/USD annotated chart. Source: Moustache/X

BTC/USD annotated chart. Source: Moustache/X

This article does not provide investment advice or recommendations. Every investment and trading decision carries risk, and readers should conduct their own research before making a choice.