Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Optimistic bitcoin investors secure crash safeguards as the $8.9 billion expiration on Friday approaches.

Options for bitcoin and ether totaling billions of dollars are scheduled to expire this Friday.

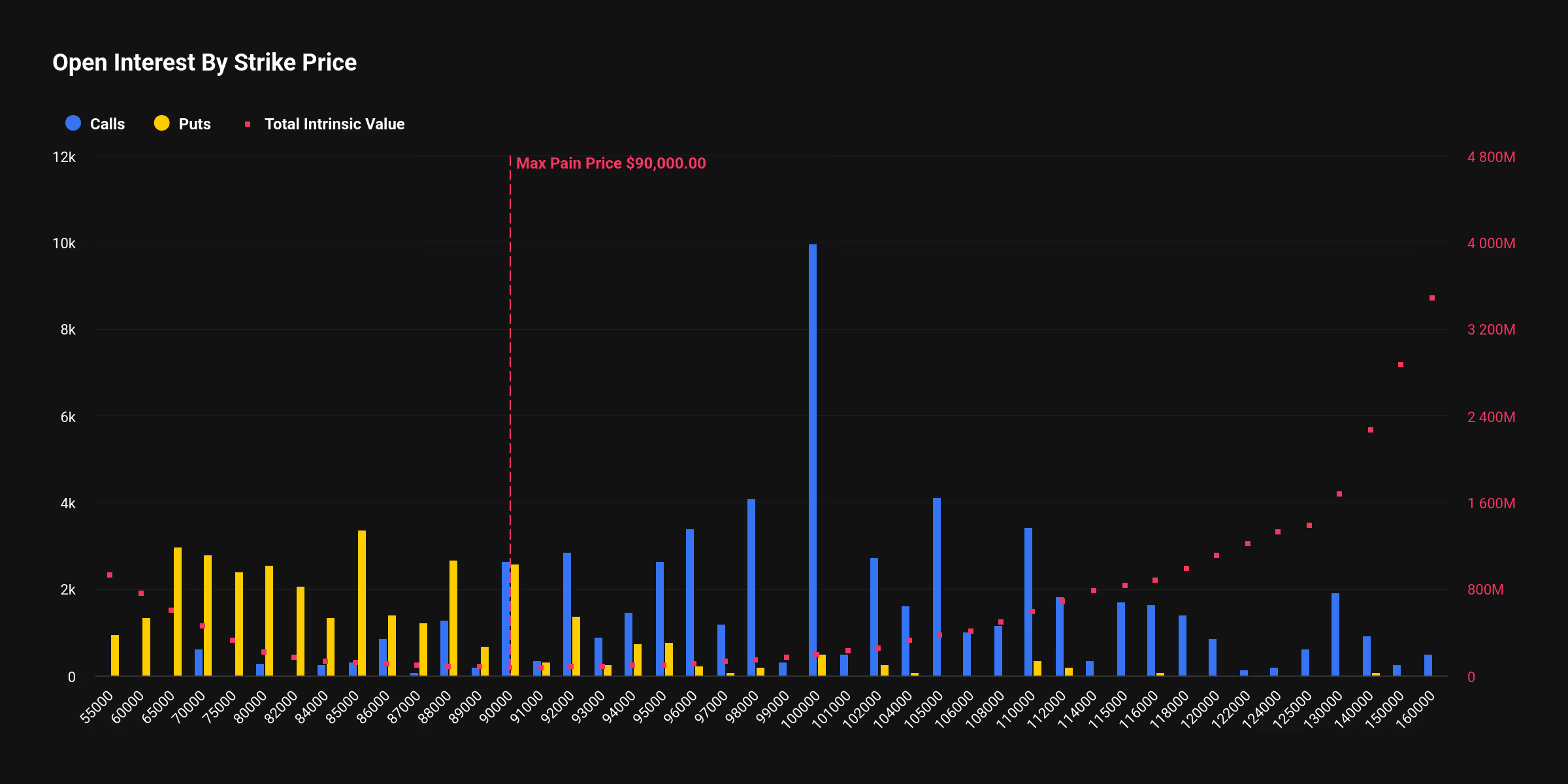

Open Interest by strike price (Deribit)

Open Interest by strike price (Deribit)

Key Points:

- Bitcoin options valued at $8.5 billion and ether options worth $1.3 billion are set to expire on Friday on Deribit, with a leaning toward bullish call positions.

- The bitcoin put-call ratio stands at 0.56, indicating that traders entered January with expectations of stronger bitcoin appreciation.

- In light of the Federal Reserve’s upcoming rate decision, some traders are acquiring downside protection to manage short-term fluctuations.

Crypto traders are adopting a bullish stance while also seeking downside protection as Friday’s deadline for bitcoin options worth billions approaches.

Bitcoin options valued at $8.5 billion will reach expiration on Deribit at 8:00 UTC on Friday, the largest cryptocurrency exchange globally by trading volume and open interest. These amounts reflect the U.S. dollar notional value of active options contracts at the time of this report, with each contract representing one BTC or one ETH.

STORY CONTINUES BELOWDon’t miss out on another story.Subscribe to the Crypto Daybook Americas Newsletter today. See all newslettersSign me up

Since the crash caused by COVID in 2020, the options market has rapidly grown as institutions have increased their risk hedging and yield strategies. Options are derivative agreements that allow you to pay a fee now for a choice in the future regarding crypto: purchase it at a lower price through a call option or sell it at a higher price through puts at a price secured today. A call buyer is implicitly optimistic about the market, while a put buyer is pessimistic, aiming to mitigate downside risks.

Traders are positioned with a bullish outlook ahead of the expiration, as indicated by the ratio of open puts to calls.

“The put-call ratio for this expiration is at 0.56, suggesting that overall positioning towards the end of the month is skewed towards [bullish] calls,” Sidrah Fariq, the global head of retail sales and business development at derivatives exchange Deribit, informed CoinDesk in a Telegram conversation.

This bullish inclination indicates that traders anticipated significant price movements in January. However, Bitcoin has only increased by 2% this month, according to CoinDesk data.

The situation may improve by the end of the month if the Federal Reserve’s rate decision on Wednesday indicates a tendency towards increased fiat liquidity. Similar to technology stocks, Bitcoin typically benefits from lower interest rates and easing.

Nonetheless, some traders are acquiring put options prior to the meeting, aiming to hedge against possible downside risks ahead of the Federal Reserve’s decision.

“Recent activity shows substantial use of put diagonal calendar spreads, along with concentrated downside interest in January 30 strikes, notably in 88k and 85k Bitcoin puts over the last 24 hours,” Fariq mentioned.

“With markets generally expecting the Federal Reserve to maintain interest rates, traders seem to be hedging against short-term volatility linked to macroeconomic events, rather than preparing for a policy-induced sell-off,” she clarified.

Friday’s event will also witness the expiration of ether options valued at $1.3 billion alongside their bitcoin equivalents.

Monthly and quarterly options expirations often trigger short-term fluctuations, but significant lasting impacts are improbable, given that the options market remains small compared to spot trading. For instance, the upcoming $8.5 billion bitcoin expiration is less than 1% of its $1.7 trillion market, which is too small to induce long-term disturbances.