Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Ongoing macroeconomic challenges may postpone Bitcoin’s upward trend, according to ARK Invest.

2023 has been a tumultuous year for investor sentiment, and while equity markets have surpassed expectations, a recent report from ARK Invest outlines potential economic hurdles that may arise in the remainder of 2023.

ARK oversees $13.9 billion in assets, with its CEO, Cathie Wood, being a prominent supporter of cryptocurrencies. In collaboration with the European asset management firm 21Shares, ARK Investment initially submitted an application for a Bitcoin exchange-traded fund (ETF) in June 2021. Their latest application for a spot BTC ETF, which is currently under review by the U.S. Securities and Exchange Commission (SEC), was filed in May 2023.

Long-term optimistic, short-term pessimistic?

Although ARK maintains a positive outlook on Bitcoin, bolstered by their research on the potential synergy between Bitcoin and Artificial Intelligence to enhance corporate efficiency and reduce costs, the investment firm does not anticipate a straightforward trajectory for a Bitcoin bull market given the prevailing macroeconomic landscape.

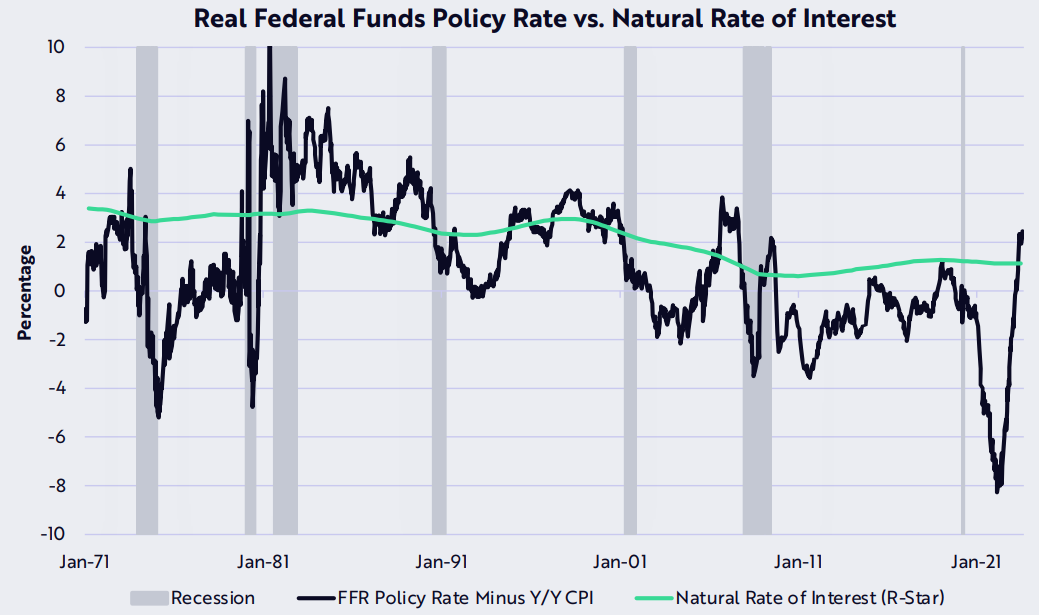

In their newsletter, ARK outlines several factors contributing to their cautious perspective on cryptocurrencies, including interest rates, gross domestic product (GDP) projections, unemployment, and inflation. One notable point is that the U.S. Federal Reserve (Fed) is enacting a restrictive monetary policy for the first time since 2009, as indicated by the “Natural Rate of Interest.”

Federal Reserve “Natural Rate of Interest”. Source: ARK Investment

Federal Reserve “Natural Rate of Interest”. Source: ARK Investment

The “Natural Rate of Interest” is a theoretical rate at which the economy neither grows nor contracts. ARK clarifies that when this indicator surpasses the “Real Federal Funds Policy Rate,” it creates pressure on lending and borrowing rates.

ARK predicts that inflation will continue to decelerate, which would elevate the “Real Federal Funds Policy Rate” and widen the gap above the “Natural Rate of Interest.” Essentially, the report adopts a bearish macroeconomic stance due to this indicator.

The analysts also examined the discrepancy between real GDP (production) and GDI (income). The report states that GDP and GDI should closely correlate, as the income generated should match the value of goods and services produced.

However, the latest data indicates that Real GDP is roughly 3% higher than Real GDI, suggesting that downward adjustments in production data are likely.

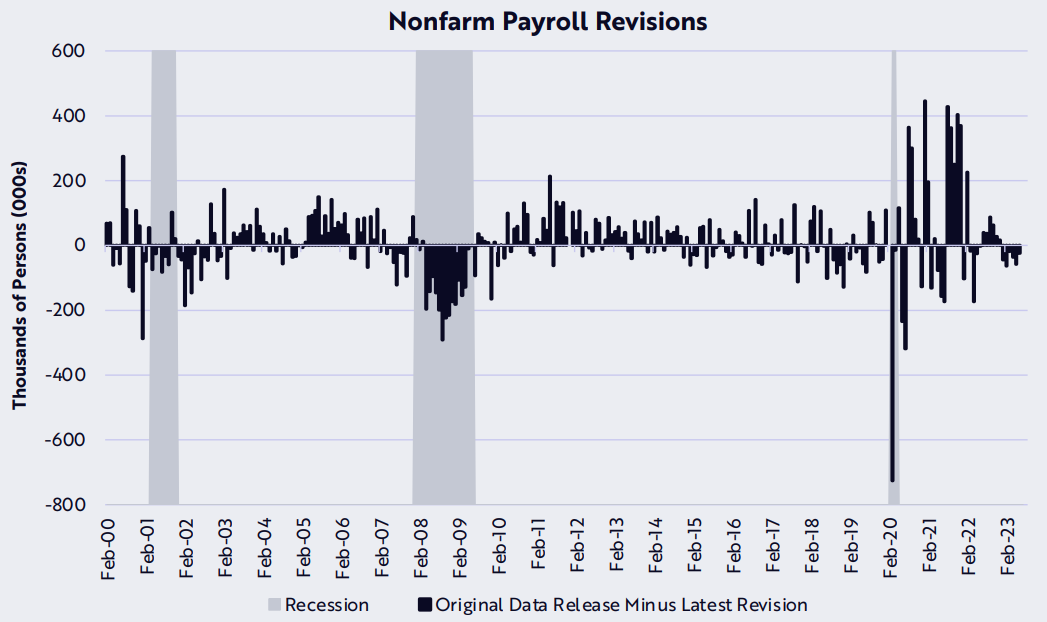

Another area of focus was U.S. employment statistics, with analysts noting that the government has consistently revised these figures downward for six consecutive months.

U.S. nonfarm payroll revisions. Source: ARK Investment

U.S. nonfarm payroll revisions. Source: ARK Investment

The chart above illustrates a labor market that seems weaker than previously reported. It is also significant that the last occurrence of six consecutive months of downward revisions was in 2007, just prior to the onset of the Great Financial Crisis.

Related: Bitcoin short-term holders capitulate as data highlights potential generational buying opportunity

“Stagflation” is typically unfavorable for risk-on assets

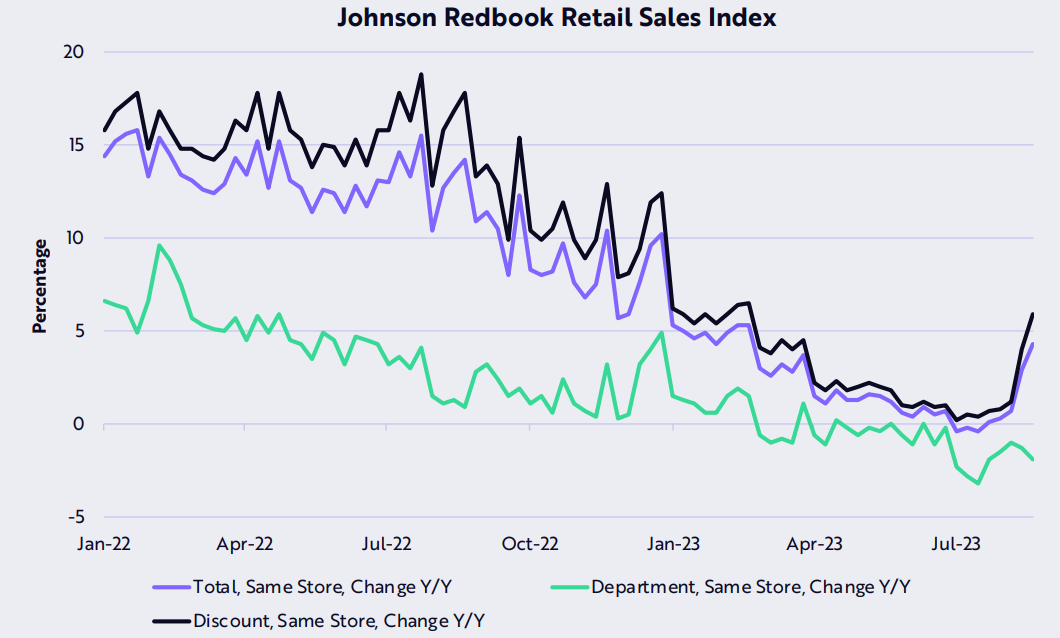

Another concerning trend to monitor is “stagflation.” The authors emphasize the reversal of a year-long trend of price discounts fueled by increased consumer spending. Citing the Johnson Redbook Index, which includes over 80% of the “official” retail sales data compiled by the U.S. Department of Commerce, it is evident that total same-store sales increased in August for the first time in 12 months, indicating that inflation may be applying upward pressure.

Johnson Redbook retail sales index. Source: ARK Investment

Johnson Redbook retail sales index. Source: ARK Investment

The data suggests that ongoing macroeconomic uncertainty may persist in the upcoming months. However, it does not provide a definitive indication of how cryptocurrency investors might respond if this trend confirms lower economic growth and higher inflation—a scenario generally viewed as highly unfavorable for risk-on assets.

This article is for informational purposes only and is not intended to serve as legal or investment advice. The views, thoughts, and opinions expressed herein are solely those of the author and do not necessarily reflect or represent the views and opinions of Cointelegraph.