Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Nine Bitcoin ETFs Accumulate Over 100,000 BTC Within a Week of Their Introduction

- Nine spot Bitcoin ETFs secured over 100,000 BTC within just seven days, whereas MicroStrategy took approximately 300 days to reach this figure.

In contrast to Grayscale’s Bitcoin (BTC) exchange-traded fund (ETF), which sold more than 80,000 BTC shortly after its trading debut, the other nine spot BTC exchange-traded funds (ETFs) have collectively acquired over 100,000 BTC.

Nine #Bitcoin ETFs have gathered over 100,000 BTC in merely 7 days of trading.

![Nine Bitcoin ETFs Accumulate Over 100,000 BTC Within a Week of Their Introduction1]()

Saylor took three years to accumulate around 190,000 BTC.

Do not underestimate the influence of the established financial sector.

They aim for you to part with your Bitcoin.

WE ARE NOT SELLING

— The ₿itcoin Therapist (@TheBTCTherapist) January 23, 2024

The nine spot Bitcoin ETFs — including notable Bitcoin ETFs such as BlackRock’s iShares Bitcoin Trust (IBIT) and Fidelity’s Wise Origin Bitcoin Fund (FBTC) — acquired 102,613 BTC in the initial seven days following the trading launch on January 11.

This total is valued at approximately $4.1 billion at the time of this writing, according to CoinGecko.

The quantity of Bitcoin obtained by spot Bitcoin ETFs in just seven trading days represents 53% of the total Bitcoin accumulated by the major BTC investor MicroStrategy over the last three years.

See Also: Spot Bitcoin ETFs Triggered A Sell-off Causing Bitcoin To Drop Below $40,000

As per MicroStrategy’s latest BTC acquisition report, the company held a total of 189,150 BTC as of December 26, 2023.

After commencing Bitcoin purchases in August 2020, MicroStrategy surpassed the 100,000 BTC threshold in about 300 days, announcing it possessed 105,085 BTC in June 2021.

According to publicly available data, BlackRock’s IBIT and Fidelity’s FBTC emerged as the largest Bitcoin purchasers among spot BTC ETFs since the trading launch, acquiring 37,304 BTC and 29,232 BTC, respectively.

The Bitwise Bitcoin ETF (BITB) and the ARK 21Shares Bitcoin ETF (ARKB) follow, purchasing 16,451 BTC and 10,630 BTC, respectively.

In contrast to other Bitcoin ETFs, the Grayscale Bitcoin Trust ETF (GBTC) — the largest Bitcoin ETF by BTC holdings — has been actively liquidating BTC since its trading initiation, offloading 82,526 BTC.

This amount is valued at around $3 billion at the time of writing.

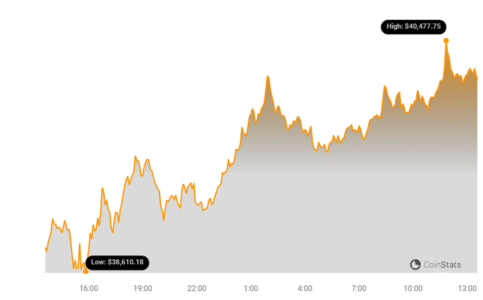

The substantial selling by GBTC has led to a notable decline in Bitcoin’s price, with the cryptocurrency dropping nearly 20% from above $48,000 on January 11 to a low of $38,700 on January 23, according to data from Coinstats.

As of this writing, Bitcoin is trading at $40,243.17, reflecting an increase of about 2% over the past 24 hours.

BTC Price Chart | Source: Coinstats

BTC Price Chart | Source: Coinstats

Some industry analysts have associated the GBTC selling with the estate of the collapsed FTX crypto exchange liquidating $902 million in GBTC shares.

Numerous analysts have also indicated that GBTC’s elevated trading fees may have contributed to the outflows.

As previously noted, GBTC imposes trading fees of up to 1.5% without waivers, while other ETF sponsors charge fees ranging from 0.2% to 0.4%, often providing temporary waivers.

The post Nine Spot Bitcoin ETFs Acquired Over 100K Bitcoin (BTC) In Just Seven Days After Launch appeared first on BitcoinWorld.