Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Miners face challenges as bitcoin’s price of $70,000 does not meet production expenses of $87,000.

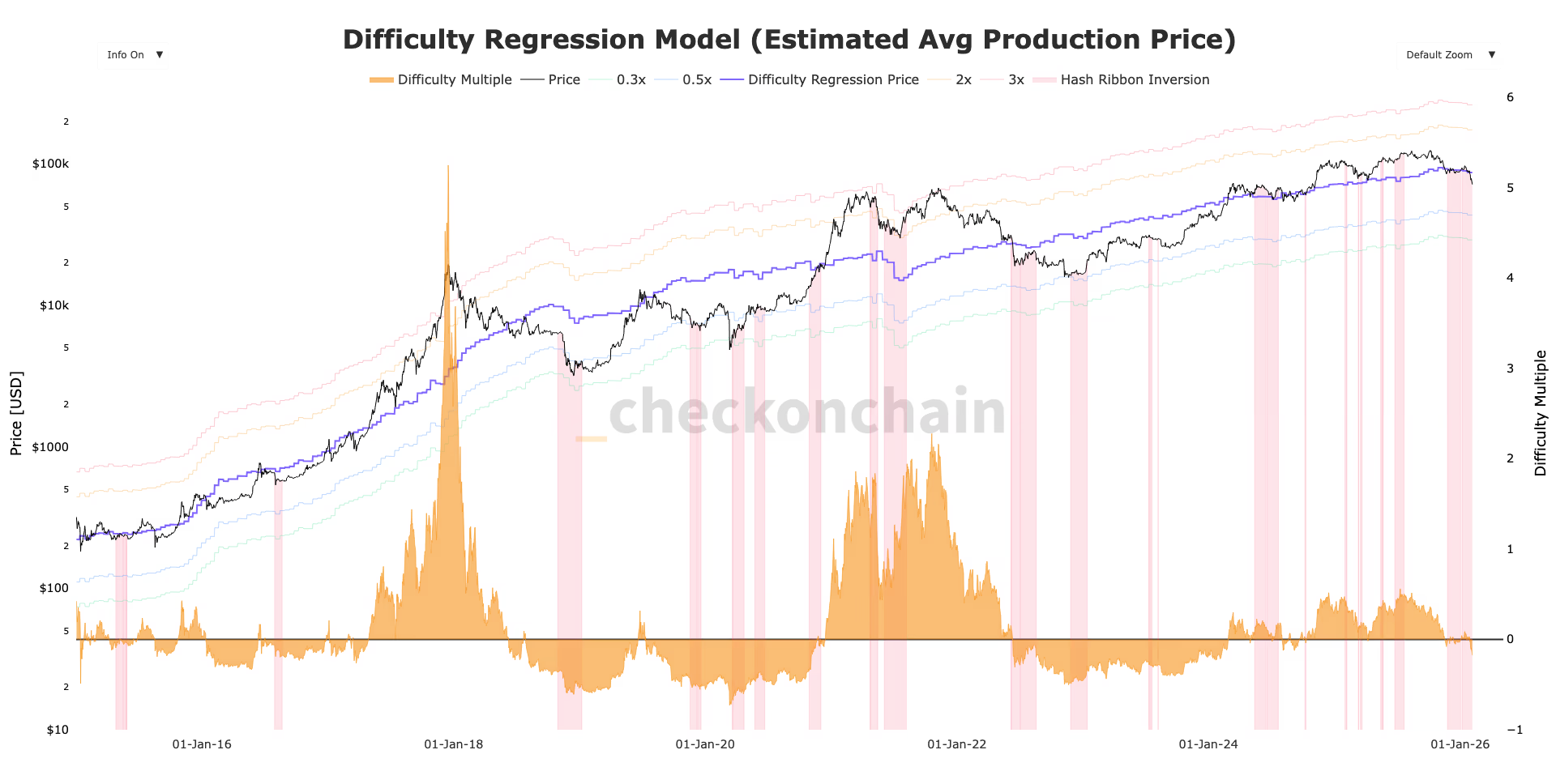

Bitcoin is currently around 20% below its estimated average production cost, which has historically indicated a bear market.

Average Production Cost (Checkonchain)

Average Production Cost (Checkonchain)

Key information:

- Bitcoin priced near $70,000 is roughly 20% below the estimated average production cost of about $87,000, a characteristic often seen during bear markets.

- In prior bear markets, such as those in 2019 and 2022, bitcoin traded below its production cost before gradually returning to that level.

- Hashrate has recovered following a 20% decline from record highs close to 1.1 ZH/s in October.

Bitcoin is now situated about 20% below its estimated average production cost, intensifying financial strains within the BTC mining industry.

The average expense for mining one bitcoin is approximately $87,000, based on data from Checkonchain, while the current spot price has decreased towards $70,000. Historically, trading below production costs has been a hallmark of a bear market.

STORY CONTINUES BELOWDon’t overlook another story.Subscribe to the Crypto Daybook Americas Newsletter today. See all newslettersSign me up

The production estimate utilizes network difficulty as a proxy for the sector’s overall cost structure. By associating difficulty with bitcoin’s market capitalization, the model yields an estimate of average mining expenses.

In earlier bear markets, such as those in 2019 and 2022, bitcoin traded below its production cost before slowly returning to that threshold.

Hashrate, which indicates the total computational capacity securing the bitcoin network, reached a peak of nearly 1.1 zettahash (ZH/s) in October, subsequently dropping by approximately 20% as less efficient miners were driven offline. Recently, the hash rate has bounced back to 913 EH/s, indicating some degree of stabilization.

Nonetheless, many miners still operate at a loss under current price conditions. With revenue falling short of operational costs, miners are increasingly liquidating bitcoin holdings to sustain daily operations, cover energy expenses, and manage debt. This ongoing capitulation among miners underscores ongoing pressures within the sector.