Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

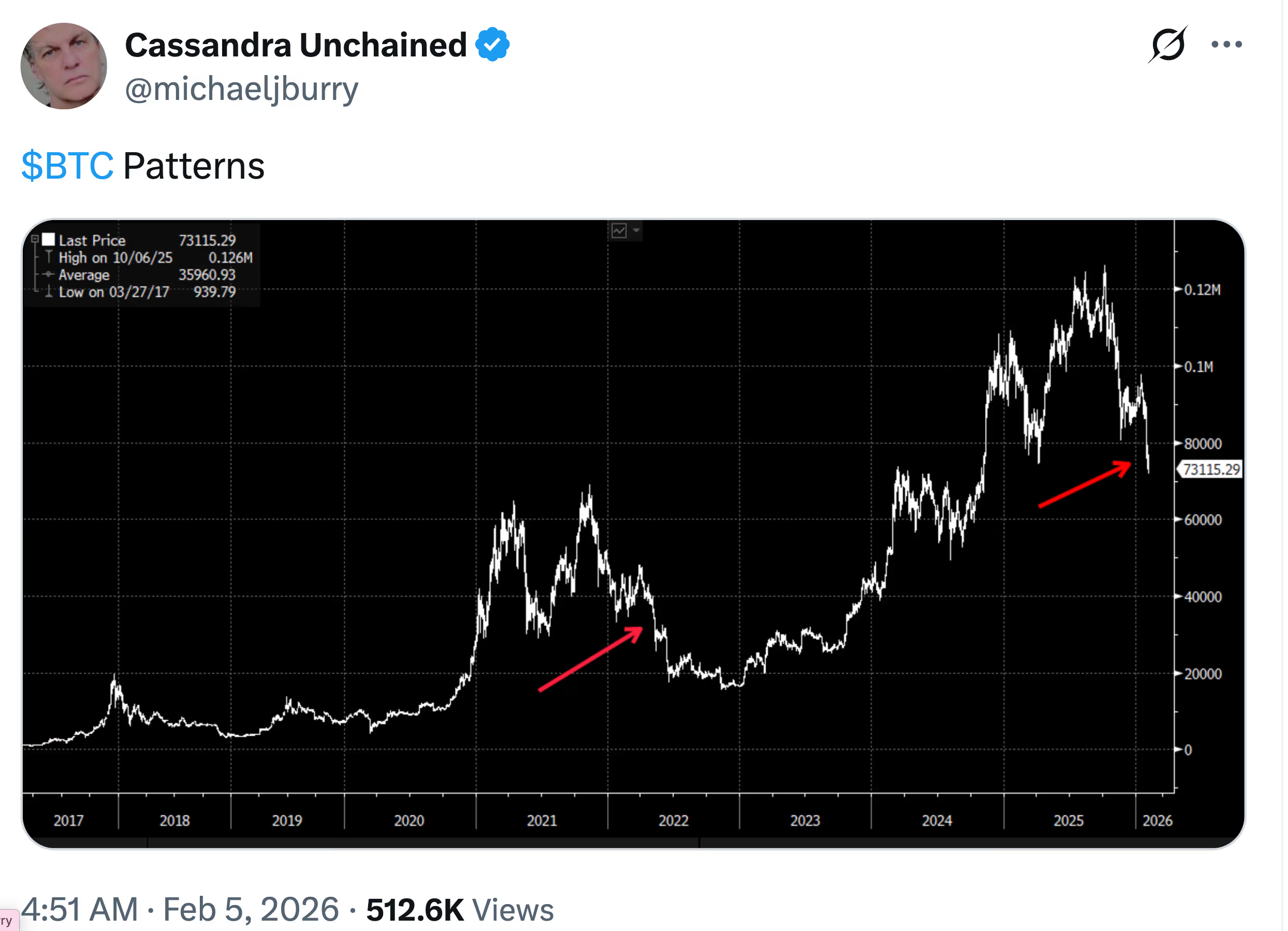

Micheal Burry identifies parallels to 2022 during the bitcoin downturn.

The ‘Big Short’ investor has drawn parallels between the current downturn and a previous cycle collapse that caused BTC to lose nearly half its value before finding stability.

What to know:

- Michael Burry, known for "The Big Short," presented a bitcoin chart that likens the current downturn to the 2021–22 decline, indicating a potential for a more significant reset before a stable bottom is achieved.

- The previous cycle witnessed bitcoin decrease from roughly $35,000 to under $20,000, which some believe suggests possible downside towards the low $50,000s based on present price levels.

- Experts are split on the accuracy of this comparison, pointing out that the earlier crash was influenced by Federal Reserve tightening and retail-driven leverage, while the current market is affected by spot ETFs, institutional liquidity, and broader cross-asset volatility.

Perma-bears, similar to their overly optimistic counterparts, often attempt to fit patterns into the unpredictability to support their pessimism.

Michael Burry, the oracle of "The Big Short" known for his ominous predictions, is now drawing parallels between bitcoin’s current bear market and the severe downturn in 2022, suggesting this decline may extend further.

STORY CONTINUES BELOWDon’t miss another story.Subscribe to the Crypto Daybook Americas Newsletter today. See all newslettersSign me up

In a post on X early Thursday in Asian hours, Burry pointed out the similarities between BTC‘s decline from the October peak of $126,000 to $70,000 and Bitcoin’s drop in late 2021 and 2022, asserting that the patterns align closely so far.

The previous bear market saw bitcoin decline from approximately $35,000 to below $20,000 before it found stability — a move that, when compared to current price levels, indicates potential risk toward the low $50,000s.

While Burry did not specify a target, the visual analogy was sufficient to rekindle discussions regarding whether bitcoin is following an established pattern or if the comparison is being overstretched.

Analysts and traders questioned whether a single historical event constitutes a significant pattern.

“Is it a pattern if it occurred once?” queried trading firm GSR, reflecting a broader skepticism toward market predictions based on historical analogies.

This critique extends beyond mere semantics, as bitcoin’s 2021–22 collapse transpired under very different circumstances, characterized by aggressive Federal Reserve tightening, a collapse of crypto-native leverage, and substantial retail participation.

Conversely, the current market is influenced by spot bitcoin ETFs, increased institutional liquidity, and a macroeconomic backdrop where rate hikes are less pronounced and cross-asset volatility is more tied to equities, commodities, and concerns over artificial intelligence spending.

Nonetheless, Burry’s remarks have come at a critical time.

This week, bitcoin has experienced significant volatility, dipping below $71,000 before recovering and then declining again as global risk sentiment worsened.

Burry’s track record lends weight to the conversation, even when his forecasts are contentious. His analysis frequently focuses on shifts in market positioning and psychology rather than exact predictions.

In this context, the chart serves more as a cautionary note regarding unsuccessful rebounds and weakened conviction rather than a definitive forecast.