Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

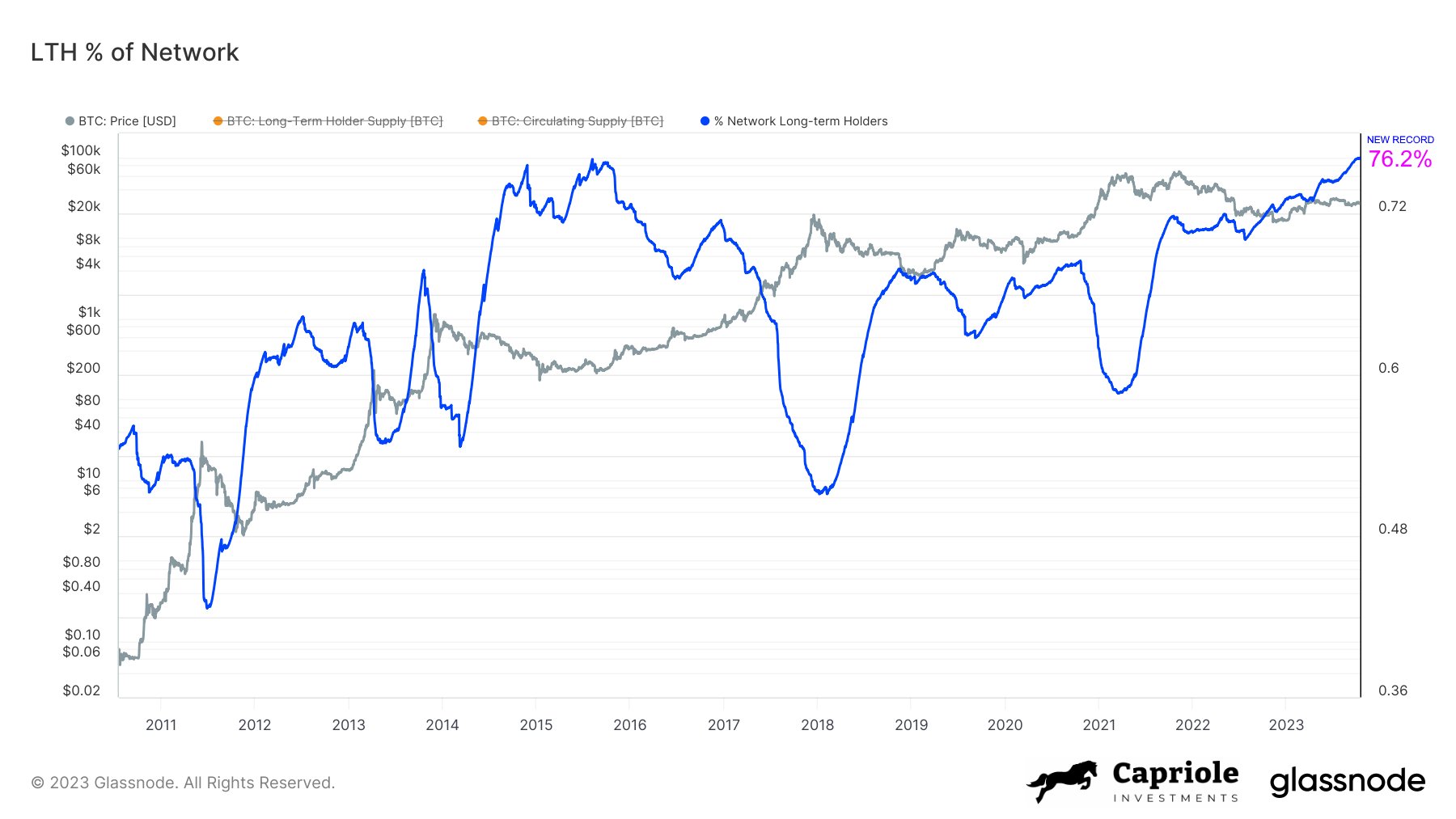

Long-term holders possess more than 76% of all Bitcoin for the first time.

Bitcoin (BTC) is becoming increasingly scarce — particularly for those speculating on BTC prices or newcomers to the market.

The most recent information from on-chain analytics company Glassnode indicates that an unprecedented share of the available BTC supply is held in long-term storage.

Bitcoin long-term holder presence surpasses previous highs

With over 76%, Bitcoin’s long-term holders (LTHs) possess a greater portion of the BTC supply than ever before.

Although the supply continues to grow with each block, the percentage of low-time preference Bitcoin investors has reached a historic market share.

Charles Edwards, founder of the quantitative Bitcoin and digital asset fund Capriole Investments, highlighted that this milestone is a first in Bitcoin’s history.

“A record 76.2% of the Bitcoin network is currently held by long-term holders,” he stated on X on Oct. 18.

“Surpassing the record established in 2015. A less liquid supply means the same individuals are competing for fewer coins. You can do the math.”

Bitcoin long-term holder (LTH) % BTC supply share chart. Source: Charles Edwards/X

Bitcoin long-term holder (LTH) % BTC supply share chart. Source: Charles Edwards/X

Edwards pointed out the subsequent impact of the LTH record — that coins available for other market participants are becoming increasingly scarce.

A corresponding chart from Glassnode illustrates that LTHs have significantly increased their BTC holdings since mid-2021, “hodling” throughout the entire bear market that followed. The percentage of supply they control has only decreased during brief intervals since then.

In private remarks to Cointelegraph, Edwards further noted that while Bitcoin demand may vary, the overall trend is evident.

"I don't mean demand is the same as in 2015. I mean that for the same level of demand, a reduced supply necessitates a price increase (supply/demand economics)," he clarified.

"However, in reality, demand has risen significantly since 2015, which should exert even more upward pressure on prices for this cycle. We have never encountered such a constricted Bitcoin supply leading up to a halving."

BTC speculators remain inactive

As Cointelegraph has reported, the counterpart to LTHs — short-term hodlers (STHs), or speculators, are also of significant interest to market analysts.

Related: BTC price models suggest a $130K target following the 2024 Bitcoin halving

The realized price of the STH group has acted as support for much of this year, and recent data indicates that this trend continues.

The STH realized price — the price at which all STH-held coins last changed hands — is just under $27,000, and BTC/USD surpassing this level this week is seen as a crucial bullish signal, according to analysis.

Data from Cointelegraph Markets Pro and TradingView reveals that Bitcoin is maintaining $28,000 support after reaching two-month highs.

BTC/USD 1-day chart. Source: TradingView

BTC/USD 1-day chart. Source: TradingView

In August, the historically low BTC exposure among STH entities was already noted.

This article does not provide investment advice or recommendations. Every investment and trading decision carries risk, and readers should perform their own research before making a choice.