Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

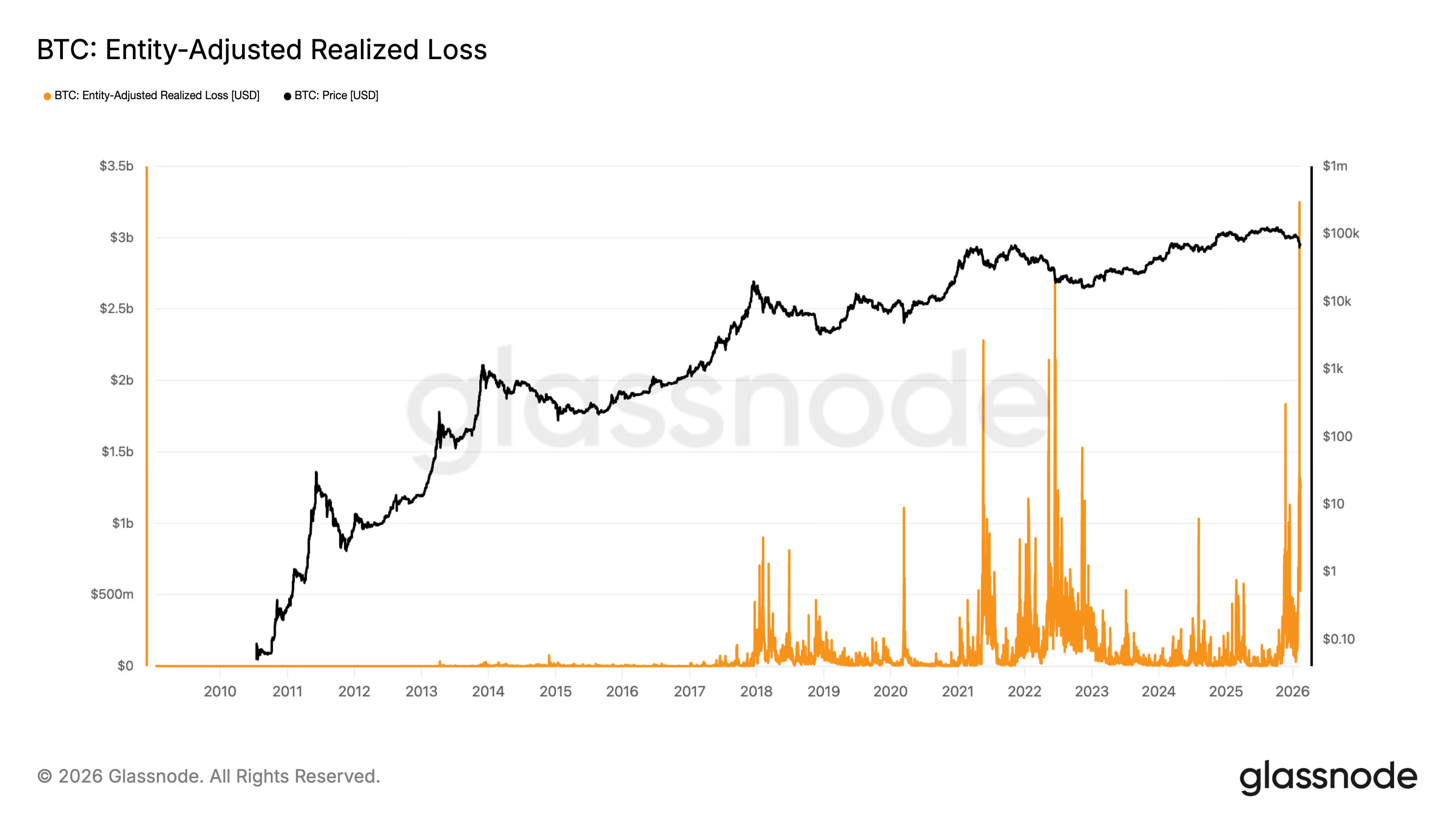

Last week’s defeat resulted in the largest realized loss for bitcoin to date; indicators of a potential bottom increase.

The Feb. 5 incident recorded the largest realized loss in bitcoin history, totaling $3.2 billion.

Entity Adjusted Realized Loss (Glassnode)

Entity Adjusted Realized Loss (Glassnode)

Key points:

- The February 5 decline in bitcoin resulted in realized losses of $3.2 billion, officially surpassing the 2022 Terra Luna collapse as the largest loss event in bitcoin’s history.

- As per data from Checkonchain, daily net losses exceeded $1.5 billion.

The most significant realized loss in bitcoin’s history took place during last week’s market decline, breaking previous records as the value fell from $70,000 to $60,000 on February 5.

According to Glassnode, the Entity-Adjusted Realized Loss reached $3.2 billion. This metric specifically monitors the USD value of coins that were sold for less than their acquisition price, while excluding internal transfers within the same entity.

STORY CONTINUES BELOWStay informed on the latest news.Subscribe to the Crypto Daybook Americas Newsletter today. See all newslettersSign me up

This significant capitulation has even surpassed the most challenging periods of 2022, exceeding the $2.7 billion loss recorded during the collapse.

As stated by Checkonchain, “The bitcoin sell-off last week qualifies as a classic capitulation event. It occurred swiftly, with high trading volume, and crystallized losses from the least committed holders.”

With daily net losses surpassing $1.5 billion, the magnitude of this sell-off signifies the largest absolute USD loss ever recognized in the network’s history. This indicates further signs of a bear market bottom.

At the time of this report, bitcoin is trading at approximately $67,600.