Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

K33 indicates that Bitcoin mirrors the bottom of the bear market seen in late 2022.

Vetle Lunde stated that the present levels present an appealing opportunity for long-term investors, even if their endurance will be challenged.

Long-term investors might view these levels as a zone for accumulation. (Austin Distel/Unsplash/Modified by CoinDesk)

Long-term investors might view these levels as a zone for accumulation. (Austin Distel/Unsplash/Modified by CoinDesk)

Key points:

- K33 analyst Vetle Lunde indicated that Bitcoin is currently in a late-stage bear market phase, akin to late 2022.

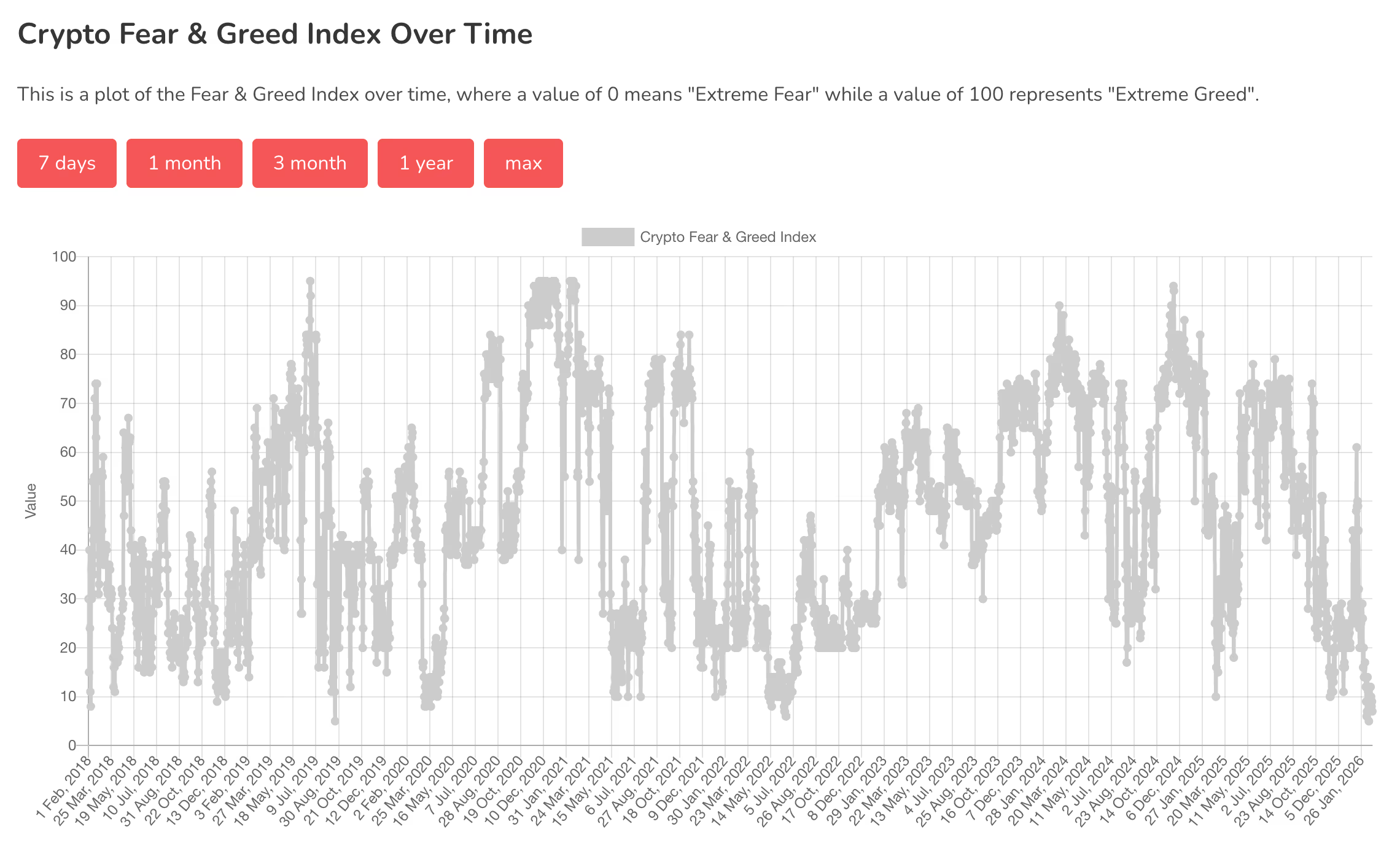

- Metrics from trading activities and derivatives indicate a complete purge of speculative excess, while sentiment indicators like the Crypto Fear and Greed Index have dropped to levels of extreme fear.

- Nonetheless, Bitcoin is expected to remain within a range of $60,000 and $75,000 for a prolonged period, establishing a potentially appealing yet patience-demanding accumulation zone for long-term investors, according to Lunde.

Bitcoin’s dramatic sell-off earlier this month may indicate a transition to a late-stage bear market, yet investors should not anticipate a rapid rebound, Vetle Lunde, head of research at K33, noted.

"Current conditions are reminiscent of late September and mid-November 2022, times close to the bear market’s bottom that were followed by extended periods of consolidation," he stated.

STORY CONTINUES BELOWDon’t miss another story.Subscribe to the Crypto Daybook Americas Newsletter today. See all newslettersSign me up

During that period, Bitcoin fluctuated between $15,000 and $20,000, approximately 70% below its peak in 2021.

Currently, Bitcoin has stabilized within a narrower range of $65,000 to $70,000, and K33 Research’s regime model — which integrates derivatives data, ETF flows, technical signals, and macroeconomic indicators — suggests that the market is nearing a cyclical bottom.

The quiet grind

A notable indication of this quiet consolidation phase is the significant decline in trading activity, with speculative excess completely eradicated.

According to the K33 report, spot volumes have decreased by 59% week-over-week. In addition, perpetual futures open interest has fallen to a four-month low, and funding rates remain negative across the board.

This type of cooldown phase is typical after substantial liquidation events as market participants process losses and adjust their positions, Lunde explained.

Additionally, U.S.-listed Bitcoin ETFs have experienced a record peak-to-trough drop in exposure of 103,113 BTC since early October. However, Lunde pointed out that despite BTC retracing nearly 50%, over 90% of the peak exposure in Bitcoin terms still exists.

Sentiment indicators also reflect a negative outlook, with the “Crypto Fear and Greed” Index plunging to a record low of 5 last week and remaining below 10 for most of the week.

Crypto Fear and Greed Index (Alternative.me)

Crypto Fear and Greed Index (Alternative.me)

Long-term value area

What does this signify? Bitcoin is "likely approaching, or at, a global bottom but poised for a prolonged consolidation between $60,000 and $75,000," according to Lunde. Historical patterns suggest that such regimes have produced subdued returns.

Nevertheless, for long-term focused investors, the current levels appear favorable for accumulation, although patience may be necessary, he emphasized.

James Check, an on-chain analyst and co-founder of Checkonchain, also remarked that Bitcoin’s sideways trends present a chance for positioning.

He noted that Bitcoin often "remains inactive," followed by sharp repricing surges rather than gradual trends. These explosive movements typically occur within a limited number of trading days, frequently at the start of a bull cycle and again during later stages.

"It remains inactive for most of the time, and then occasionally it can rise 100% in a quarter, and if you miss that quarter, you essentially forfeit the entire rally."

He advised investors to avoid attempting to perfectly time market tops and bottoms, as they often miss the initial price surge.

In summary, while extended consolidation may be frustrating, history indicates that the market tends to reward patient positioning over precisely timing entries and exits.