Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

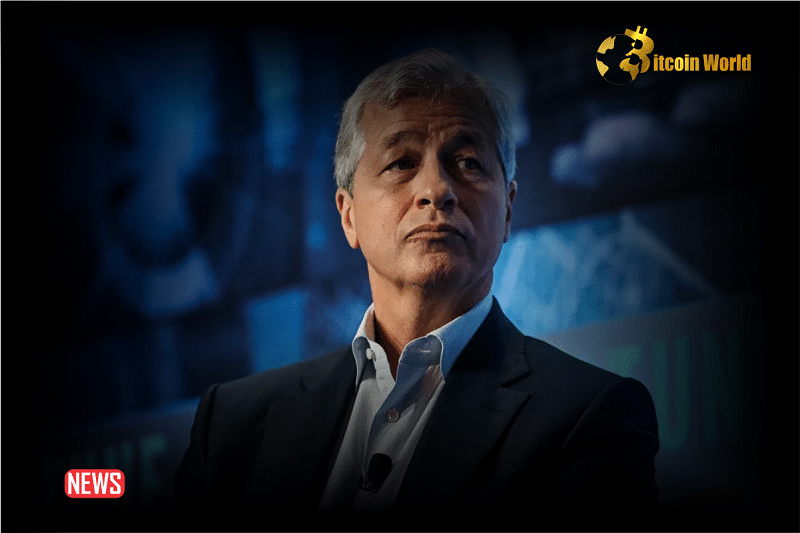

JPMorgan’s Jamie Dimon Advocates for the Shutdown of Cryptocurrency

- Jamie Dimon informs senators that the government ought to shut down the entire crypto sector.

- However, his bank is moving towards the blockchain domain.

If it were solely up to JPMorgan CEO Jamie Dimon, the crypto sector would be “shut down,” he stated to US senators on Wednesday during the Financial Services Committee’s annual banking oversight hearing.

CEOs from leading banks globally, including Morgan Stanley, Goldman Sachs, Bank of America, and BNY Mellon, among others, joined Jamie Dimon last Wednesday to respond to lawmakers’ inquiries regarding how well the banking sector is serving the American populace.

Sen. Elizabeth Warren, D-Mass., a prominent critic of the banking sector, found a rare point of consensus with Dimon when she transitioned the discussion from Basel III — the international accord prompted by the 2008 financial crisis — to cryptocurrencies.

“Today’s terrorists have a new method to circumvent the Bank Secrecy Act: cryptocurrency,” Warren remarked during her five-minute segment. “Last year, an estimated $20 billion in illicit crypto transactions financed various forms of dangerous criminal activity. North Korea has financed at least half of its missile program, including nuclear weapons, through the proceeds of crypto crime.”

Warren seemed to reference a January 2023 report from data analytics firm Chainalysis, which indicated that over $23 billion in cryptocurrency was laundered in 2022.

A mid-year report from Chainalysis released in July, however, revealed that illicit crypto activities had decreased by 65% in the first half of 2023.

Warren continued to question Jamie Dimon about why, based on his experience at JPMorgan, criminals are attracted to crypto.

See Also: Bitcoin Price Shot Up to $44K While Altcoins Explode by Double Digits

“I’ve always been fundamentally opposed to crypto, bitcoin, etc.,” Dimon replied. “You highlighted that the only genuine use case for it is criminals, drug traffickers, anti-money laundering, tax evasion, and that is a use case because it is somewhat anonymous, not entirely, and because you can transfer money instantaneously.”

“If I were in the government, I’d shut it down,” Jamie Dimon added.

Dimon’s remarks come as his institution continues to advance into the blockchain arena. The banking giant introduced its corporate stablecoin, JPM Coin, in 2017, which remains available to select institutional clients today.

The bank also launched its blockchain platform, Onyx, in 2020, at that time promoting it as the first-ever bank-led initiative of its kind.

Warren did not inquire about any of JPMorgan’s crypto-related projects. She directed her next question to each witness: “Do you believe that crypto companies facilitating financial transactions should adhere to the same anti-money laundering regulations that your bank must follow?”

“Absolutely,” each of the eight banking representatives affirmed.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

The post Jamie Dimon Of JPMorgan Wants Crypto To Be ‘Closed Down’ appeared first on BitcoinWorld.