Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Investors in Bitcoin consider opportunities as prices decline, while searches for ‘capitulation’ increase.

Your day-ahead look for Feb. 9, 2026

Bitcoin buyers eye price declines (Tumisu/Pixabay modified by CoinDesk)

Bitcoin buyers eye price declines (Tumisu/Pixabay modified by CoinDesk)

What to know:

You are viewing Crypto Daybook Americas, your morning briefing on what transpired in the crypto markets overnight and what is anticipated for the upcoming day. Crypto Daybook Americas will initiate your morning with detailed insights. If you are not already subscribed to the email, click here. You will not want to begin your day without it.

By Francisco Rodrigues (All times ET unless specified otherwise)

Bitcoin has decreased by almost 2.5% in the last 24 hours after failing to maintain gains achieved during an end-of-week rise that brought it back up to $71,000.

STORY CONTINUES BELOWDon’t miss another story.Subscribe to the Crypto Daybook Americas Newsletter today. See all newslettersSign me up

The decline came after a volatile few days during which the cryptocurrency plummeted to as low as $60,000 before recovering. BTC remains down over 11% in the last week.

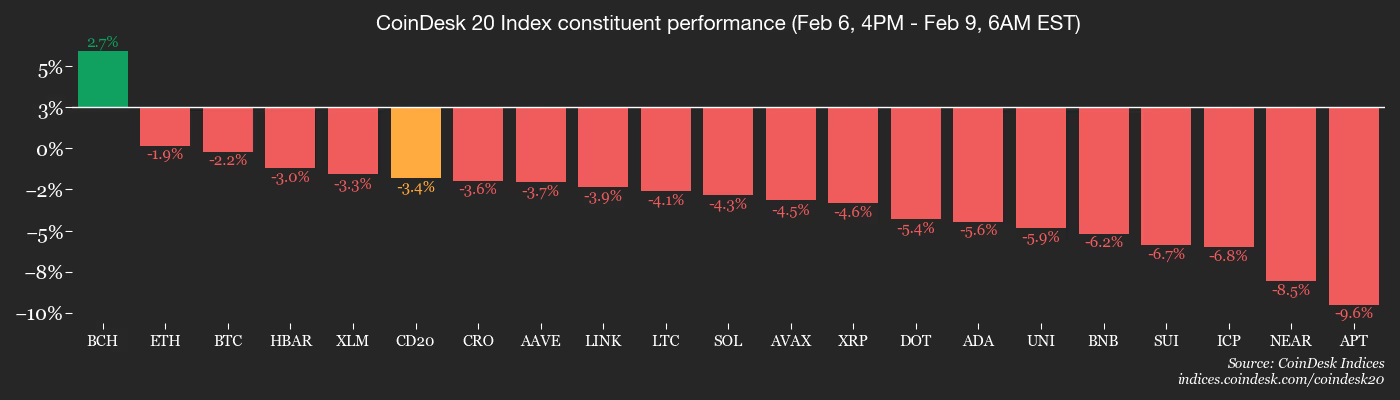

Nonetheless, it is outperforming the broader market, which saw the CoinDesk 20 (CD20) index decrease by 13.5% over 24 hours and 13.7% over the week.

The downturn prompted institutional movement. In a conversation with CNBC, Bitwise CEO Hunter Horsley mentioned late last week that the firm experienced substantial inflows as prices fell.

“I think long-time holders are feeling uncertain, and I think the new investor segment — institutions — are sensing they’re getting another chance and viewing prices they believed they had permanently missed,” Horsley stated.

Spot bitcoin ETFs on Friday ended a three-day streak of outflows, attracting a net $371 million, according to SoSoValue data. However, retail sentiment remained delicate. Julio Moreno, head of research at CryptoQuant, observed on social media that U.S. investors are re-entering the market, indicated by the Coinbase Premium Index turning positive for the first time since mid-January.

Online search interest for phrases like “crypto capitulation” surged during the selloff and remained high, as reported by crypto analytics firm Santiment, providing a chance for value investors to engage.

Meanwhile, capital shifted towards traditional safe havens. Gold and silver continued their recovery following a selloff late last month, with gold surpassing $5,000 again as investors consider a weaker U.S. dollar and major buyers kept accumulating. Among these are Tether, whose gold reserves have exceeded $23 billion, and China’s central bank.

Stock market futures are down ahead of the opening, after Japanese equities rallied following the ruling party’s overwhelming victory in a snap election. Prime Minister Sanae Takaichi campaigned on low interest rates and significant fiscal expenditure.

The yield on Japanese government bonds continued to rise, further unwinding the yen carry trade and affecting risk assets including cryptocurrencies. This unwind could potentially bring nearly $5 trillion of foreign investments back into the nation. Stay vigilant!

Read more: For analysis of today’s activity in altcoins and derivatives, see Crypto Markets Today

What to Watch

For a more comprehensive list of events this week, see CoinDesk’s "Crypto Week Ahead".

- Crypto

- Feb. 9: Maple Finance has identified and fixed a compromise on its web application, which remains offline.

- Macro

- Feb. 9, 11 a.m.: U.S. consumer inflation expectations for January (Prev. 3.4%)

- Earnings (Estimates based on FactSet data)

- Nothing scheduled.

Token Events

For a more comprehensive list of events this week, see CoinDesk’s "Crypto Week Ahead".

- Governance votes & calls

- No major governance votes.

- Unlocks

- No major unlocks.

- Token Launches

- Feb. 9: Pendle to initiate sPENDLE buybacks with initial yield distributions commencing Feb. 13, and rewards time-weighted from Jan. 29.

- Feb. 9: ZKsync to launch Season 1 of the ZKnomics Staking Pilot Program via Tally

Conferences

For a more comprehensive list of events this week, see CoinDesk’s "Crypto Week Ahead".

- Feb. 9: Liquidity 2026 (Hong Kong)

Market Movements

- BTC is down 2.90% from 4 p.m. ET Sunday at $69,045.23 (24hrs: -2.44%)

- ETH is down 4.07% at $2,034.28 (24hrs: -4.40%)

- CoinDesk 20 is down 3.09% at 1,973.38 (24hrs: -3.46%)

- Ether CESR Composite Staking Rate is down 25 bps at 2.74%

- BTC funding rate is at -0.037% (-4.0362% annualized) on Binance

- DXY is down 0.33% at 97.31

- Gold futures are up 1.67% at $5,033.80

- Silver futures are up 5.62% at $81.05

- Nikkei 225 closed up 3.89% at 56,363.94

- Hang Seng closed up 1.76% at 27,027.16

- FTSE 100 is up 0.31% at 10,402.44

- Euro Stoxx 50 is up 0.39% at 6,021.78

- DJIA closed on Friday up 2.47% at 50,115.67

- S&P 500 closed up 1.97% at 6,932.30

- Nasdaq Composite closed up 2.18% at 23,031.21

- S&P/TSX Composite closed up 1.49% at 32,471.00

- S&P 40 Latin America closed down 2.89% at 3,653.05

- U.S. 10-Year Treasury rate is up 2 bps at 4.23%

- E-mini S&P 500 futures are unchanged at 6,949.25

- E-mini Nasdaq-100 futures are down 0.20% at 25,113.25

- E-mini Dow Jones Industrial Average futures are unchanged at 50,246.00

Bitcoin Stats

- BTC Domin