Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

“Investors anticipate Bitcoin rally: 5 key points to understand in cryptocurrency this week”

Bitcoin (BTC) begins a new week in a vulnerable state after experiencing its largest declines since November 2022.

Following a significant drop from ten-month peaks, BTC/USD fell approximately 10% before the weekly candle closed.

At roughly $27,600, the culmination of a challenging few days for long traders indicates that BTC/USD is now struggling to maintain last month’s support.

Market participants are divided on the potential outcomes — some are anticipating further declines, while others remain optimistic about revisiting those multi-month highs.

Potential catalysts may arise from upcoming macroeconomic data releases in the United States later this week, as markets also prepare for the next Federal Reserve interest rate decision.

With the recent correction reducing some of the “greed” in crypto sentiment, the question remains whether this shock can transition into a more sustainable upward trend or if the bull market has concluded, at least temporarily.

Cointelegraph examines the data and perspectives surrounding the current BTC price movements.

BTC price seeks support amid warnings of a "bigger corrective move"

Bitcoin experienced a relatively stable weekly close, finishing at $27,600, which is still $2,700 lower than its opening position.

This represented its most challenging week since the FTX crisis in November of the previous year, according to data from Cointelegraph Markets Pro and TradingView.

BTC/USD 1-week candle chart (Bitstamp). Source: TradingView

BTC/USD 1-week candle chart (Bitstamp). Source: TradingView

Currently aiming for $27,000, BTC/USD faces a critical choice — remain near current support, which was also a focal point in March, or break out.

“Spot premium has returned to previous levels while trading in this price range. Funding rates are slightly negative across the board. Nothing extreme yet,” noted popular trader Daan Crypto Trades on the day.

Another trader, Crypto Tony, maintained his target of $26,600, while Caleb Franzen, a senior market analyst at Cubic Analytics, stated that higher levels must be achieved for bulls to regain control.

“Bitcoin has struggled to break and hold above $27,820 (green range), which is a crucial level I’ve been highlighting,” he explained alongside a chart.

“For short-term momentum to shift in favor of the bulls, I believe we need to see the price get (and stay) above this range. It continues to act as resistance…”

BTC/USD annotated chart. Source: Caleb Franzen/ Twitter

BTC/USD annotated chart. Source: Caleb Franzen/ Twitter

Recent data from the Binance order book indicated increasing resistance at $28,000.

As per monitoring resource Material Indicators, this was an effort to push the spot price lower to fill bids at more attractive levels.

#FireCharts shows a new block of ask liquidity suppressing #Bitcoin price, likely attempting to push the price into their bids in the $27.3k – $26.7k range. #NFA pic.twitter.com/ThOwqUT09R

— Material Indicators (@MI_Algos) April 23, 2023

On a more cautious note, trader Mark Cullen predicted that the worst may still be ahead.

“A nice bear flag formed over the weekend, appearing very corrective with volatility decreasing while the price rises & H4 bear divergences forming,” he tweeted on the day.

“I am anticipating the range lows to be swept before Bitcoin undergoes a larger corrective move.”

BTC/USD annotated chart. Source: Mark Cullen/Twitter

BTC/USD annotated chart. Source: Mark Cullen/Twitter

PCE print expected as markets "price in" new Fed rate hike

This week’s macro triggers primarily consist of corporate earnings and economic data releases from the U.S.

These will focus on GDP and jobless claims on April 27, along with the March print of the Personal Consumption Expenditures (PCE) Index the following day.

Corporate earnings will also continue, while the May meeting of the Federal Open Market Committee (FOMC) looms, where the Fed will determine its next interest rate adjustments.

The strength, or lack thereof, of the intervening macro data significantly influences that decision, as confirmed by Chair Jerome Powell, leading markets to adopt a “wait and see” approach until all figures are available.

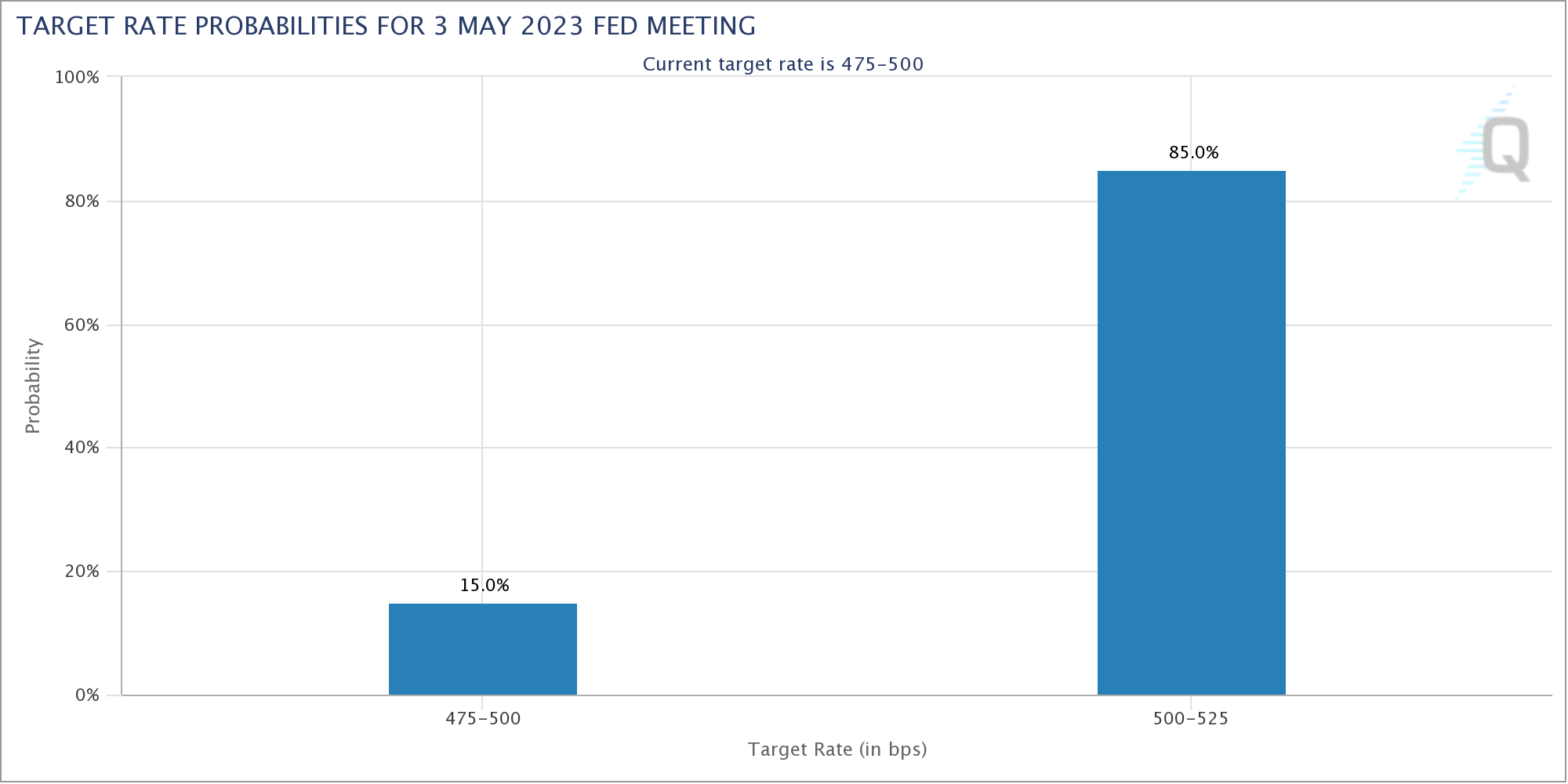

According to CME Group’s FedWatch Tool, however, the consensus is now heavily leaning towards another rate hike, which could further pressure U.S. banks and the broader financial system.

The likelihood of an additional 0.25% hike currently stands at 85%.

Fed target rate probabilities chart. Source: CME Group

Fed target rate probabilities chart. Source: CME Group

“Expectations for a +25bps hike in the next FOMC meeting are high, but not guaranteed due to fluctuations,” investor Crypto Awakenings commented in part of his analysis on the day.

“A pause announcement by Powell could trigger a break above $30k for Bitcoin. If a hike is announced, it’s likely already priced in by the market and confirms that a ‘sell in May and go away’ scenario won’t occur in 2023. The pause may happen in May or July, with May being more likely.”

Trader Ash WSB similarly pointed out that the May hike was likely “priced in” by the market, indicating a reduced chance of a surprise if the Fed proceeds as expected.

BTC 4hr trading in down trend from

last 3 days after hitting $31k.

$27,700 and $26,600 are important

support on chart.

FOMC is on May 3rd and looks like

market is already pricing 25BPS pic.twitter.com/TDGG4bsquB— Ash WSB (@Ashcryptoreal) April 21, 2023

“Technically, I believe we’ll experience the classic Monday drop followed by a reversal,” Michaël van de Poppe, founder and CEO of trading firm Eight, added in part of his analysis covering shorter timeframes.

“GDP & FED are upcoming. Markets are pricing in a scenario where 25bps is likely. Waiting for a clear reclaim of $27,800 or bullish divergences in the $26,800 area for long positions on Bitcoin.”

Panicking Bitcoin traders realizing losses

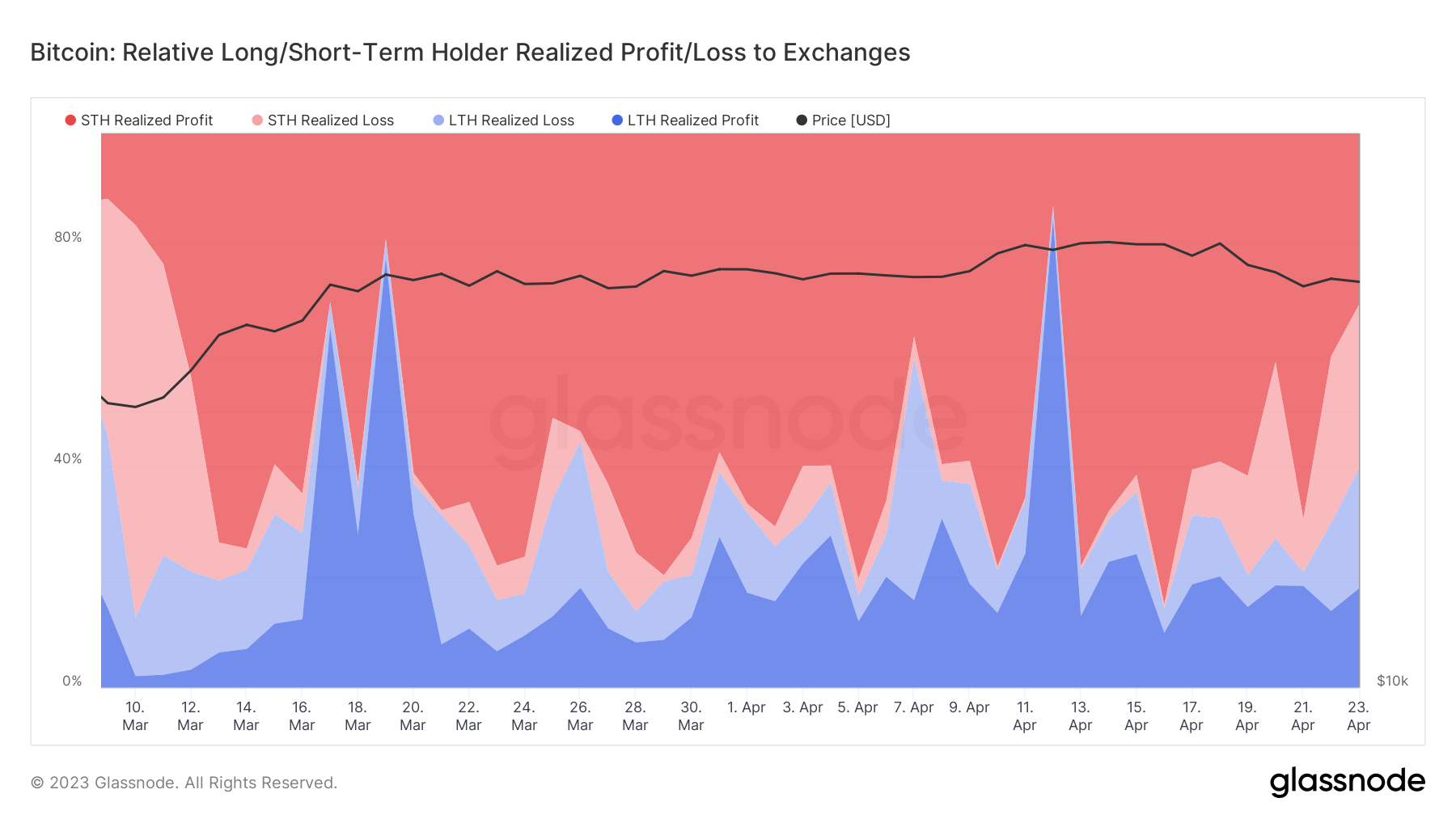

The recent week’s BTC price movements have unsettled many inexperienced traders, and data supports this observation.

According to figures from on-chain analytics firm Glassnode, the number of younger coins being sent to exchanges at a loss surged last week.

Glassnode typically categorizes the BTC supply by age, with “long-term holders” (LTHs) referring to wallets holding coins for 155 days or more. Coins held for less time are classified as “short-term holders” (STHs) — often representing the more speculative segment of the Bitcoin investor base.

The data indicates that since around April 16, STH coins — those that last moved within the 155 days prior — were increasingly sent to exchanges at a lower price than their previous transaction price.

These STH realized losses suggest rising panic, with LTH realized losses also increasing among those transferring funds to exchanges.

Bitcoin Relative Long/Short-Term Holder Realized Profit/Loss to Exchanges chart. Source: Glassnode

Bitcoin Relative Long/Short-Term Holder Realized Profit/Loss to Exchanges chart. Source: Glassnode

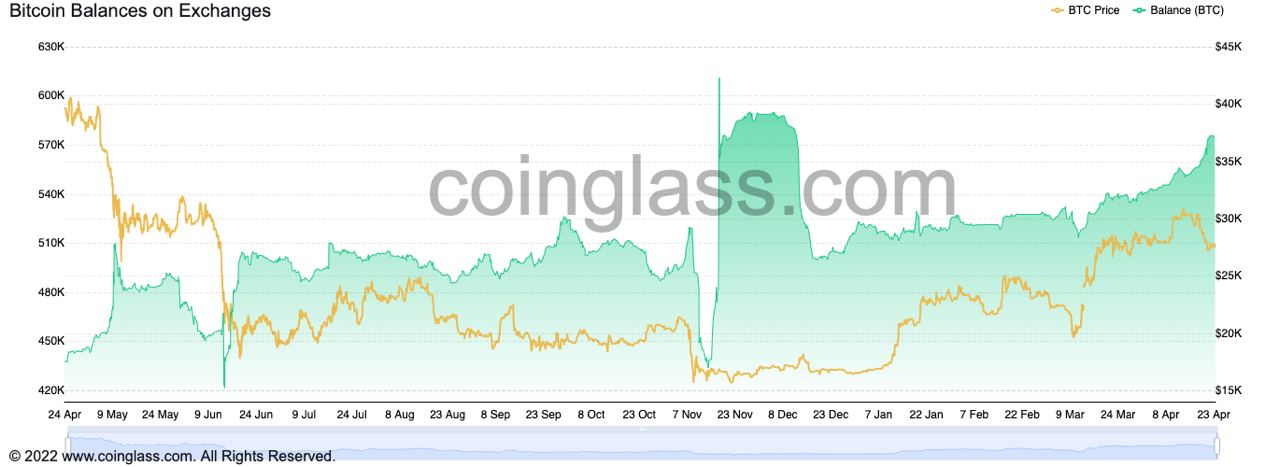

Separate data from Coinglass shows weekly inflows to the largest exchange Binance at 21,000 BTC.

Bitcoin exchange balance chart. Source: Coinglass

Bitcoin exchange balance chart. Source: Coinglass

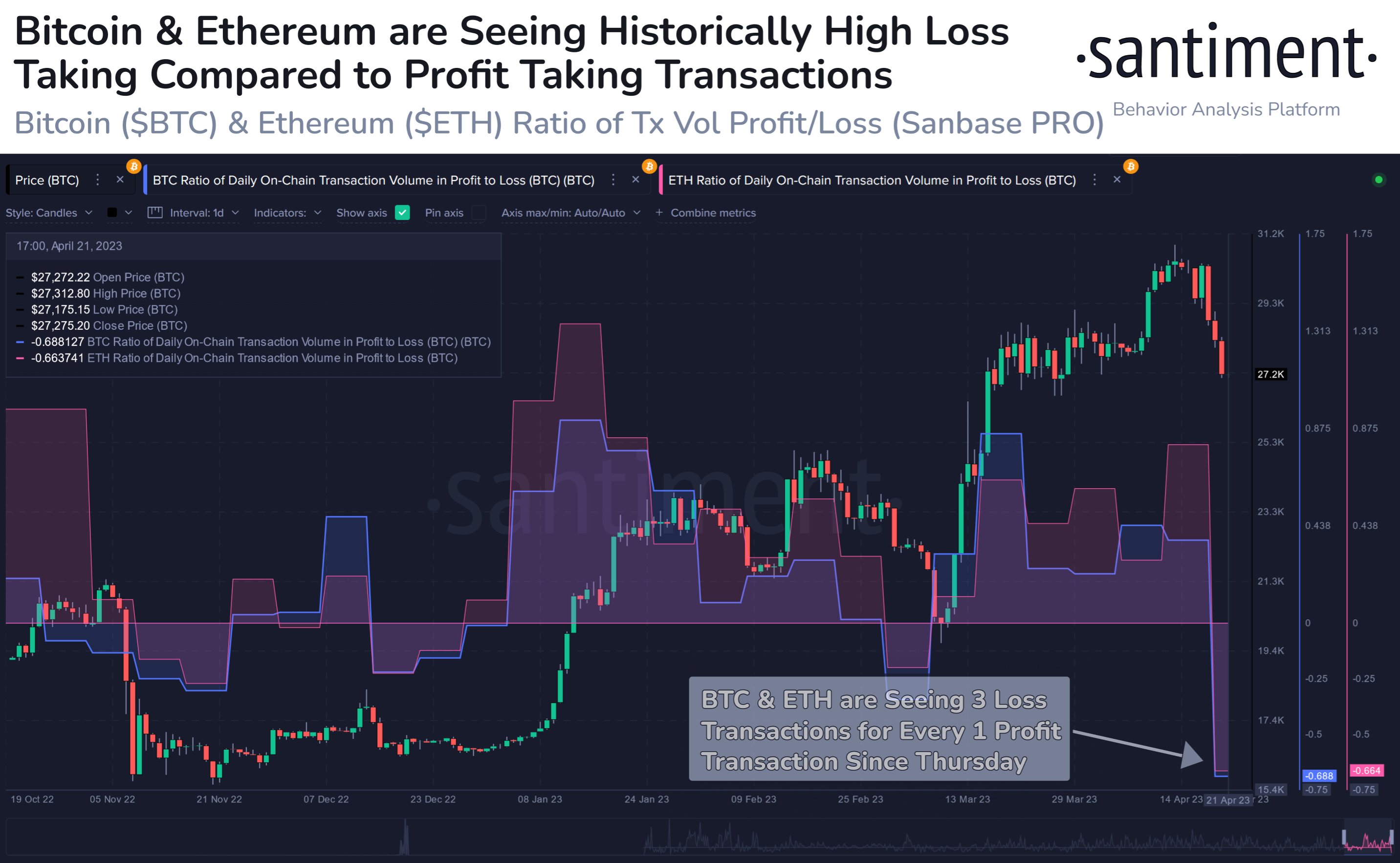

Examining the ratio of transaction volume profit and loss across both Bitcoin and Ether (ETH), research firm Santiment notes some intriguing behavior.

Recent days have witnessed an unusual amount of loss-making volume compared to profit-making volume, despite the relatively minor price retracement of both assets.

“With many traders FOMO’ing into Bitcoin above $30k and Ethereum above $2k this past week, loss transactions have increased as markets retraced,” it explained over the weekend.

“Since Thursday, traders are moving coins below the prices they acquired them at three times as often as above.”

Bitcoin, Ethereum transaction volume profit/ loss data annotated chart. Source: Santiment/ Twitter

Bitcoin, Ethereum transaction volume profit/ loss data annotated chart. Source: Santiment/ Twitter

Analyst: "Smart money is done accumulating BTC"

If the above phenomenon indicates a shakeout of speculative traders, it may have occurred just in time — at least by historical standards.

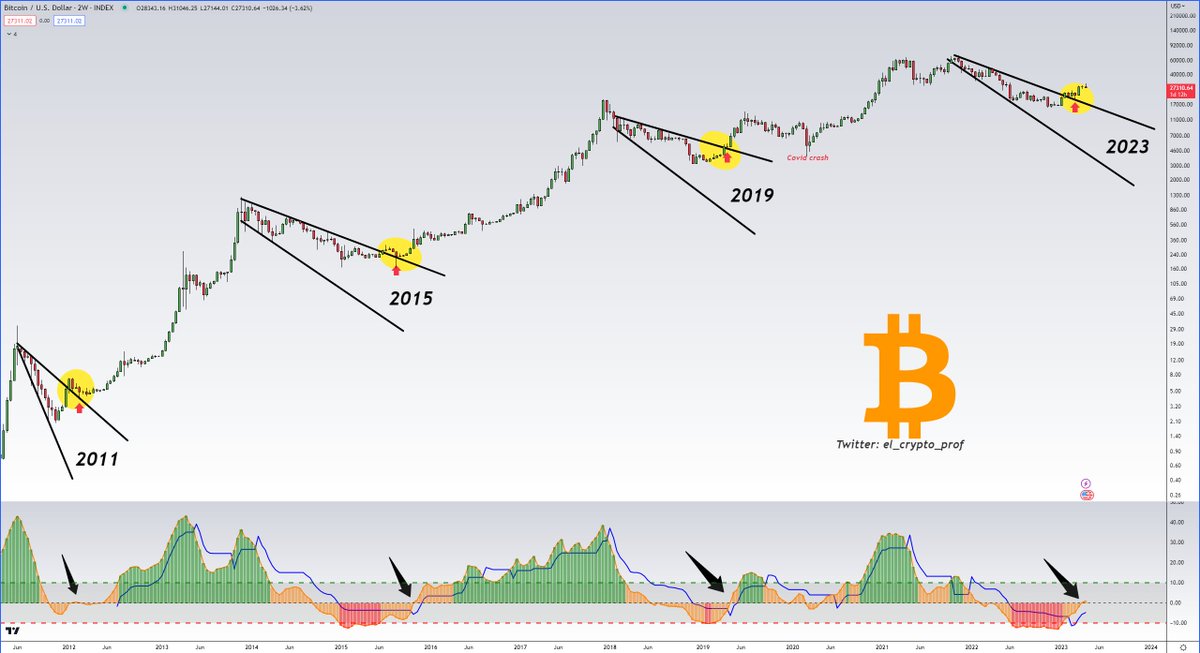

In his latest update on market strength, well-known Bitcoin analyst Moustache revealed that the current Bitcoin bull run is unfolding similarly to previous ones.

Utilizing the Qualitative Quantitative Estimation (QQE) — a variant of the Relative Strength Index (RSI) — Moustache suggested that Bitcoin is at a crucial juncture.

“Smart money,” he asserted, has already purchased the dip and is now poised for the genuine upside to commence.

“Smart money is finished accumulating BTC. I mentioned a few weeks ago that once QQE >0 = Accumulation ends,” he stated.

“We have consistently observed a strong bull run following this.”

BTC/USD annotated chart with QQE Index. Source: Moustache/ Twitter

BTC/USD annotated chart with QQE Index. Source: Moustache/ Twitter

Moustache added that the losses from the past week could provide bears with a misleading sense of security.

“We’re not the same. It’s time to buy the dip,” he concluded.

Crypto sentiment cools to "neutral"

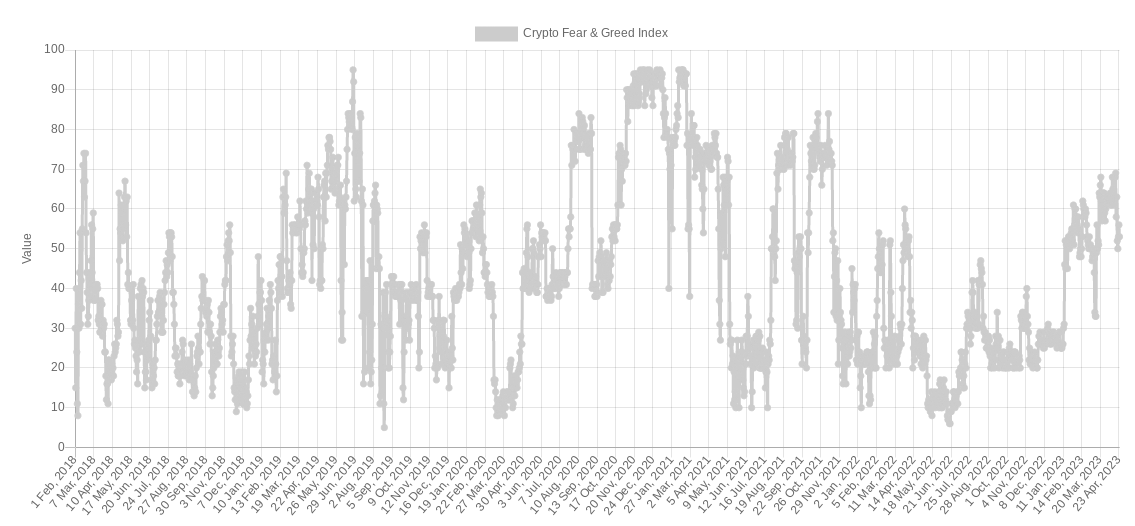

One potential advantage linked to the recent BTC price decline pertains to the broader crypto market sentiment.

Related: Bitcoin price crawls 2.5% off lows as weekly chart risks ‘bearish engulfing’

According to the Crypto Fear & Greed Index, the sentiment among market participants is swiftly returning to more rational levels.

Previously, the Fear & Greed Index reached its highest levels since November 2021, coinciding with Bitcoin’s latest all-time highs. This, some cautioned at the time, could be unsustainable and lead to a rapid market correction as traders grew complacent and placed bets on continued upside.

With the decline now in full effect, the Index has moved out of the “fear” zone entirely, transitioning to “neutral” with a score of 53/100 as of April 24.

Crypto Fear & Greed Index (screenshot). Source: Alternative.me

Crypto Fear & Greed Index (screenshot). Source: Alternative.me

This score is around the lowest — or least “greedy” — since mid-March.

Magazine: Crypto regulation: Does SEC Chair Gary Gensler have the final say?

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.