Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Hong Kong is working to enhance its cryptocurrency regulations: State of Crypto

Several officials in Hong Kong have initiated efforts to enhance the region’s regulatory landscape.

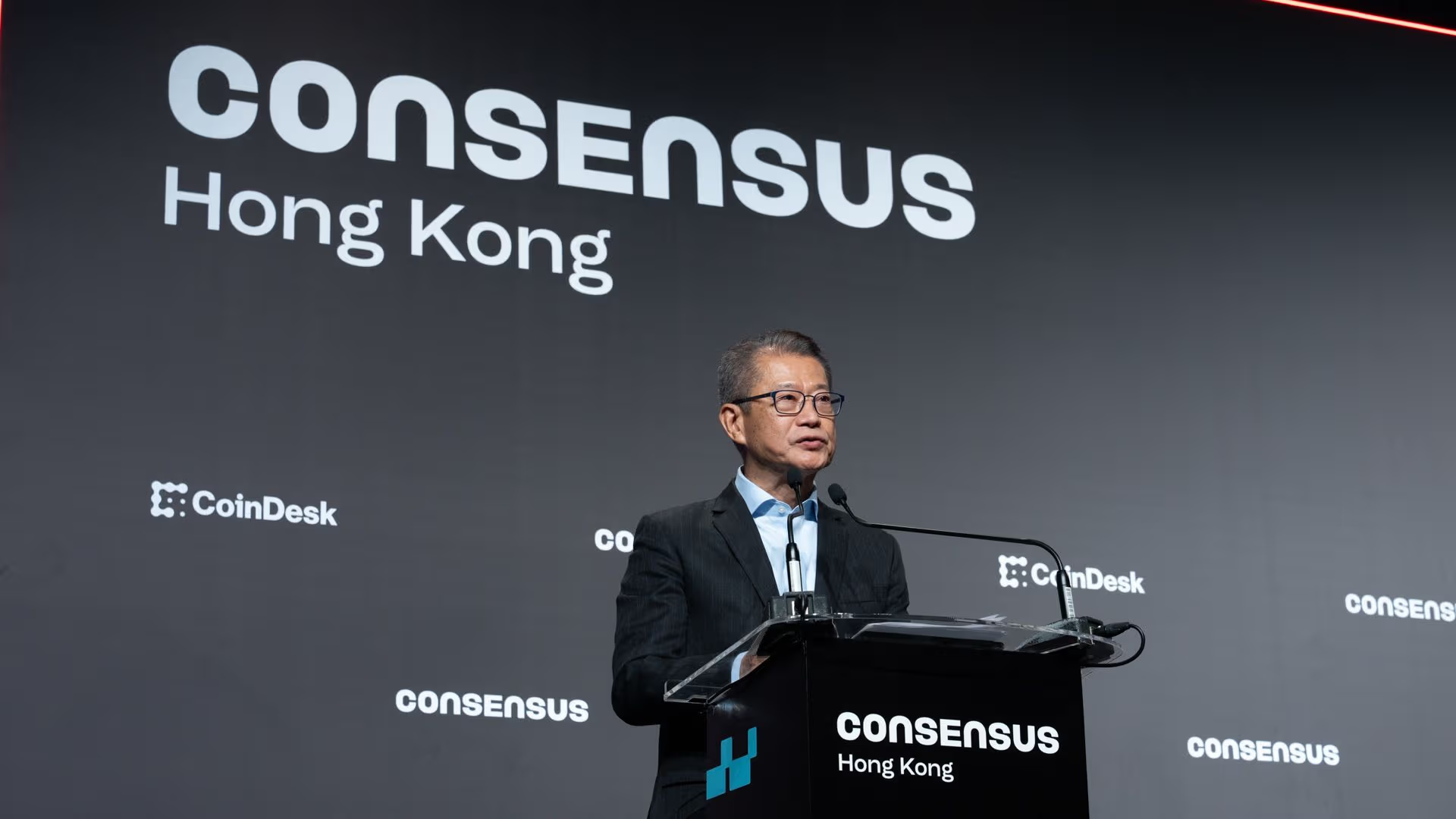

Hong Kong Financial Secretary Paul Chan Mo-po (David Paul Morris/Consensus)

Hong Kong Financial Secretary Paul Chan Mo-po (David Paul Morris/Consensus)

Consensus Hong Kong concluded successfully as policymakers unveiled new initiatives aimed at expanding the digital assets sector.

You’re reading State of Crypto, a CoinDesk newsletter that examines the connection between cryptocurrency and government. Click here to subscribe for future editions.

STORY CONTINUES BELOWDon’t miss another story.Subscribe to the State of Crypto Newsletter today. See all newslettersSign me upSlow and steady

The narrative

Officials at Consensus Hong Kong revealed a series of initiatives designed to bolster the local digital asset ecosystem.

Why it matters

Conceptually, the ongoing relevance of this industry remains a critical topic. Consensus demonstrated that despite the occasionally absurd projects and unattainable hype cycles, entities continue to find real utility in the technology.

Breaking it down

Regulators in Hong Kong are working to promote growth within the local digital asset ecosystem, introducing a framework for perpetual contracts and indicating that stablecoin licenses will be forthcoming in the next month.

"This clarity of direction provides many companies with the confidence to invest in Hong Kong and to expand their operations further," stated Jason Atkins, the chief commercial officer of crypto trading firm Auros.

While the Special Administrative Region of China has not yet reached a point of approving all applicants and activities, the willingness of regulators such as the Securities & Futures Commission and the Hong Kong Monetary Authority to engage and adapt their strategies regarding digital assets is significant, he informed CoinDesk. They are inquiring what companies require to foster investment, he added.

"We’ve visited the SFC multiple times and discussed with the HKMA in think tanks and panels where they are genuinely trying to comprehend how our businesses function and what we need to invest further into the city, which is quite encouraging," he remarked.

The regulators have shown a proactive approach, aiming to understand what companies need to operate in the area. This includes questioning whether specific regulations should be modified to meet market requirements, he noted.

"Thus, they are considering ways to relax or ease certain regulations for different types of investor classes," he explained.

This aligns with a broader trend of traditional institutions seeking to enter the crypto space — or at least the blockchain sector.

Numerous panelists, representing firms like Franklin Templeton and Swift, mentioned that they are utilizing or investigating blockchain technology to enhance their operations. This mirrors the 2018 era of "blockchain, not Bitcoin", but these organizations are actively implementing rather than merely announcing pilot projects.

The increasing movement of traditional organizations into blockchain may be a key narrative for 2026, noted Edge & Node CEO Rodrigo Coelho.

Companies are "racing to understand this landscape," he told CoinDesk. "Businesses are actively seeking consulting and expertise."

Shawn Chan from Singapore Gulf Bank described these types of infrastructure as superior for value transfer.

While international regulatory challenges remain to be addressed, he estimated that a growing number of companies will adopt blockchain technology over the next decade.

This week

This week

- Congress and federal regulators are not holding any hearings related to crypto this week.

If you have thoughts or inquiries on topics I should cover next week or any other feedback you would like to provide, feel free to email me at [email protected] or connect with me on Bluesky @nikhileshde.bsky.social.

You can also join the group conversation on Telegram.

See you all next week!