Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

GBTC ‘discount’ reaches lowest point since 2021 as BTC price falls to three-month lows

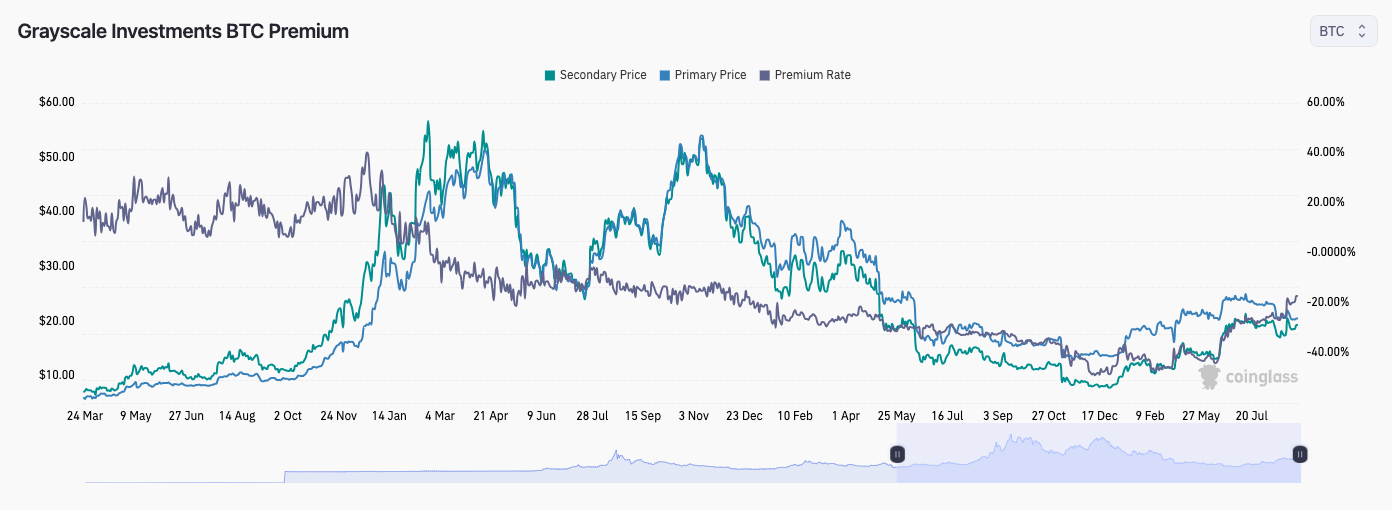

The Grayscale Bitcoin Trust (GBTC), an investment vehicle for Bitcoin (BTC), is currently trading at a mere 17% below the price of BTC.

Recent information from the monitoring platform CoinGlass indicates that as of September 9, shares of GBTC were priced at 17.17% lower than BTC/USD.

GBTC recovers nearly two years of declines

As the largest institutional investment vehicle for Bitcoin, GBTC has experienced a notable turnaround following the announcement from BlackRock, the largest asset management firm globally, regarding its intention to file for the first Bitcoin spot price-based exchange-traded fund (ETF) in the United States.

This development was welcomed by Grayscale executives, who were already engaged in a legal dispute with U.S. regulators aimed at converting GBTC into a spot ETF.

The U.S. Securities and Exchange Commission (SEC) has yet to approve any spot ETF applications, having recently postponed decisions on several proposals.

Nevertheless, Grayscale achieved a significant victory against the SEC last month, providing a positive boost to the industry that further enhanced GBTC’s price performance.

The discount of GBTC shares relative to the Bitcoin price—previously known as the “GBTC Premium”—was recorded at 17.17% on September 9, representing its most favorable position since December 2021.

This premium has been negative, referred to as a discount to net asset value (NAV), since then, reaching nearly 50% at one point.

GBTC premium vs. asset holdings vs. BTC/USD chart (screenshot). Source: CoinGlass

GBTC premium vs. asset holdings vs. BTC/USD chart (screenshot). Source: CoinGlass

No relief for Bitcoin bulls

Consequently, GBTC has started to diverge from the strength of BTC prices, which continue to decline as it tests levels not frequently observed in the past six months.

Related: Double top ‘likely’ confirmed — 5 things to know in Bitcoin this week

At the time of writing, BTC was trading below $25,500, according to data from Cointelegraph Markets Pro and TradingView, with the Wall Street opening contributing to an already weak market.

As reported by Cointelegraph, September is typically a challenging month for BTC/USD, often resulting in losses of up to 10%.

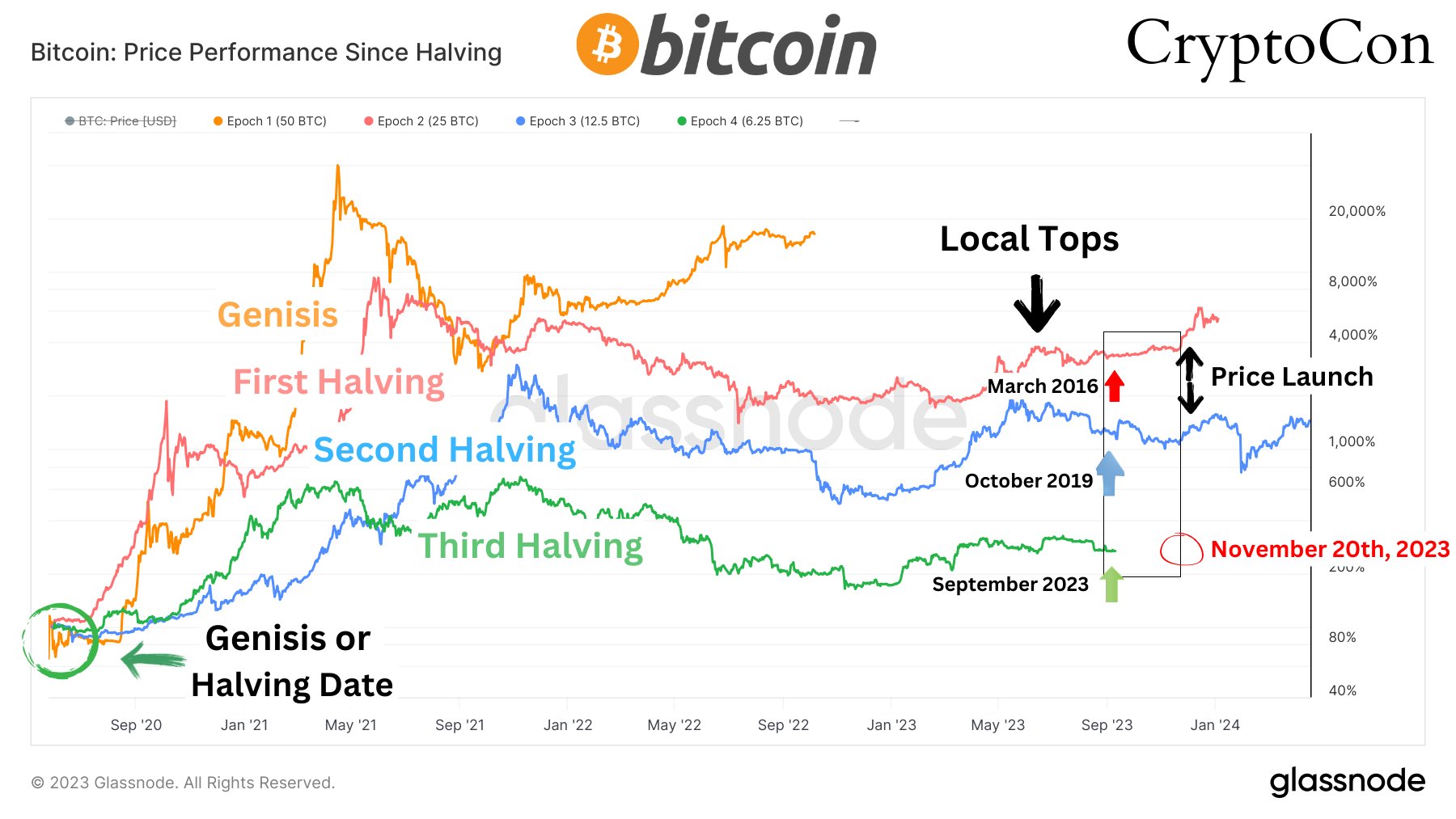

“September is historically a pretty bad month for Bitcoin, that’s just the facts. October is historically very bullish,” noted popular trader and analyst CryptoCon in a commentary shared with X followers.

CryptoCon also highlighted a chart indicating late November as a crucial period to observe for signs of recovery in Bitcoin during pre-halving years.

This aligns with an existing theory that specifically identifies November 28 as the “bull run launch” date for Bitcoin price every four years.

BTC/USD annotated chart. Source: CryptoCon/X

BTC/USD annotated chart. Source: CryptoCon/X

This article does not provide investment advice or recommendations. All investment and trading activities carry risks, and readers should perform their own research before making any decisions.