Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Futures data for Bitcoin suggests $22,000 as the probable next target.

A correction in Bitcoin (BTC) price to $22,000 is becoming more probable as BTC derivatives start to show bearish signs.

The Bitcoin price chart indicates a decline in investor sentiment following the highly publicized win by Grayscale Asset Manager against the U.S. Securities and Exchange Commission (SEC) on Aug. 29, along with the SEC’s postponement of several spot BTC exchange-traded fund (ETF) applications.

The key question remains whether the potential for an ETF can outweigh the increasing risks.

Spot Bitcoin ETF enthusiasm is diminishing

By Aug. 18, the entire 19% surge that followed BlackRock’s initial ETF filing had completely reversed as Bitcoin returned to $26,000.

Subsequently, there was an unsuccessful attempt to regain the $28,000 support level as investors increased expectations for ETF approval following favorable news regarding Grayscale Bitcoin Trust (GBTC) request.

Bitcoin/USD price index, 1-day. Source: TradingView

Bitcoin/USD price index, 1-day. Source: TradingView

Investor confidence in cryptocurrency has declined as the S&P 500 index closed at 4,515 on Sept. 1, just 6.3% shy of its all-time high from January 2022. Additionally, gold, which has struggled to surpass the $2,000 mark since mid-May, is 6.5% away from its peak. As a result, the overall sentiment among Bitcoin investors, just seven months before its halving in 2024, is notably less optimistic than anticipated.

Some analysts attribute Bitcoin’s underwhelming performance to ongoing regulatory actions against the two major exchanges, Binance and Coinbase. Furthermore, various sources suggest that the U.S. Department of Justice (DOJ) is likely to bring charges against Binance in a criminal investigation. These claims stem from allegations of money laundering and possible sanctions violations involving Russian entities.

Related: Weekly close risks BTC price ‘double top’ — 5 things to know in Bitcoin this week

Moreover, various sources indicate that the U.S. Department of Justice (DOJ) is likely to indict Binance in a criminal investigation. These claims are based on allegations of money laundering and potential sanctions violations involving Russian entities.

North Code Capital CIO and Bitcoin advocate Pentoshi conveyed the current situation in a social media post:

I think we still will eventually get some bearish Binance news vs DoJ. That should be seen as opportunity!

But overall. We also likely get ETF’s this year or early next year and $btc heading to 401k’s

Said it before but this is a year for accumulation. Don’t lose sight of the…— Pentoshi euroPeng (@Pentosh1) September 1, 2023

Pentoshi believes that the potential benefits from a spot ETF approval outweigh the price effects from the forthcoming regulatory actions against the exchanges. While it is impossible to determine the validity of such an assumption, this analysis overlooks the fact that U.S. inflation, as indicated by CPI, has decreased to 3.2% in July 2023 from 9.1% in June 2022.

Additionally, the total assets of the U.S. Federal Reserve (Fed) have been reduced to $8.12 trillion, down from a recent peak of $8.73 trillion in March 2023. This indicates that the monetary authority has been withdrawing liquidity from the markets, which negatively impacts Bitcoin’s inflation hedging narrative.

Examining a longer time frame, Bitcoin’s price has maintained the $25,000 level since mid-March, but a closer look at derivatives data reveals that the conviction of bulls is being tested.

Bitcoin derivatives indicate declining demand from bulls

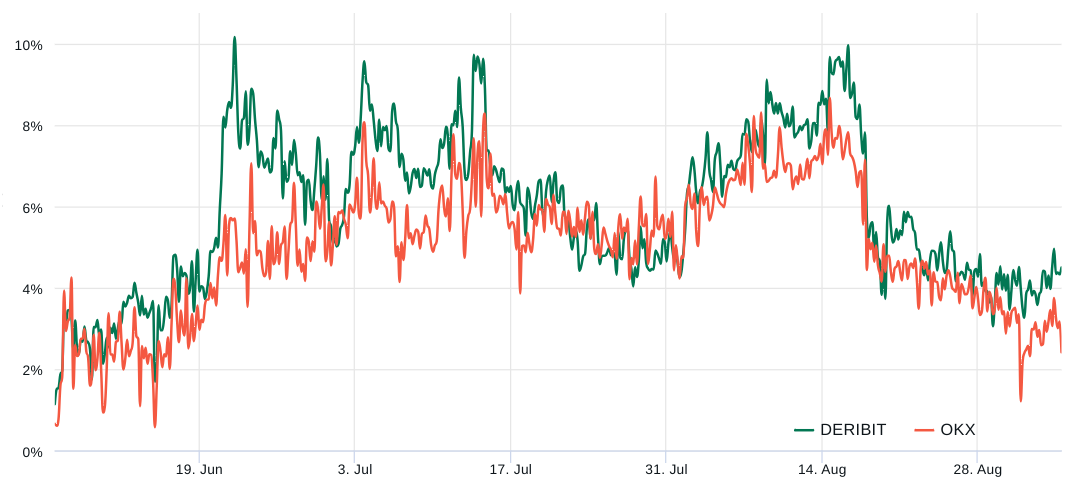

Bitcoin monthly futures generally trade at a slight premium to spot markets, suggesting that sellers are demanding more to postpone settlement. Consequently, BTC futures contracts in healthy markets should trade at a 5 to 10% annualized premium — a situation known as contango, which is not exclusive to crypto markets.

Bitcoin one-month futures annualized premium. Source: Laevitas.ch

Bitcoin one-month futures annualized premium. Source: Laevitas.ch

Bitcoin’s current 3.5% futures premium (basis rate) is at its lowest since mid-June, prior to BlackRock’s filing for a spot ETF. This metric indicates a reduced demand for leveraged buyers using derivative contracts.

Traders should also examine options markets to gauge whether the recent correction has led to diminished optimism among investors. The 25% delta skew serves as a significant indicator when arbitrage desks and market makers charge more for upside or downside protection.

In summary, if traders expect a decline in Bitcoin’s price, the skew metric will rise above 7%, while periods of enthusiasm tend to exhibit a negative 7% skew.

Bitcoin 30-day options 25% delta skew. Source: Laevitas.ch

Bitcoin 30-day options 25% delta skew. Source: Laevitas.ch

As shown above, the options’ 25% delta skew has recently entered bearish territory, with protective put (sell) options trading at a 9% premium on Sep. 4 compared to similar call (buy) options.

BTC futures suggest $22,000 next

Bitcoin derivatives data indicates that bearish momentum is strengthening, particularly as the approval of a spot ETF may be postponed until 2024, due to the SEC’s concerns regarding the absence of measures to prevent a significant portion of trading from occurring on unregulated offshore exchanges using stablecoins.

Meanwhile, the uncertainty in the regulatory environment favors the bears, as the fear, uncertainty, and doubt (FUD) surrounding potential DOJ actions or ongoing lawsuits against the exchanges by the SEC cannot be disregarded.

Related: Bitcoin ETF applications; Who is filing and when the SEC may decide

Ultimately, a retracement to $22,000 — the level last observed when Bitcoin’s futures premium was 3.5% — appears to be the most probable outcome, given the recent failure to maintain positive price momentum despite the increased likelihood of a spot Bitcoin ETF approval.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.