Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

FASB regulations ‘remove negative perceptions’ that deterred companies from cryptocurrency, according to analyst.

The new regulations from the United States Financial Accounting Standards Board regarding cryptocurrency accounting are set to remove the “poor optics” that have affected companies holding digital assets, as noted by analysts from Berenberg Capital.

On September 6, the U.S. Financial Accounting Standards Board (FASB) sanctioned new guidelines for cryptocurrencies concerning how businesses report the fair value of their assets on their balance sheets.

In a subsequent note, Berenberg’s senior equity research analyst Mark Palmer asserted that these modifications would be especially advantageous for firms like MicroStrategy, which will soon have the ability to report their digital asset holdings quarterly without needing to recognize impairment losses.

“The adjustment should assist MicroStrategy and other companies that possess digital assets in removing the negative optics that have arisen from impairment losses under the existing FASB regulations,” Palmer stated.

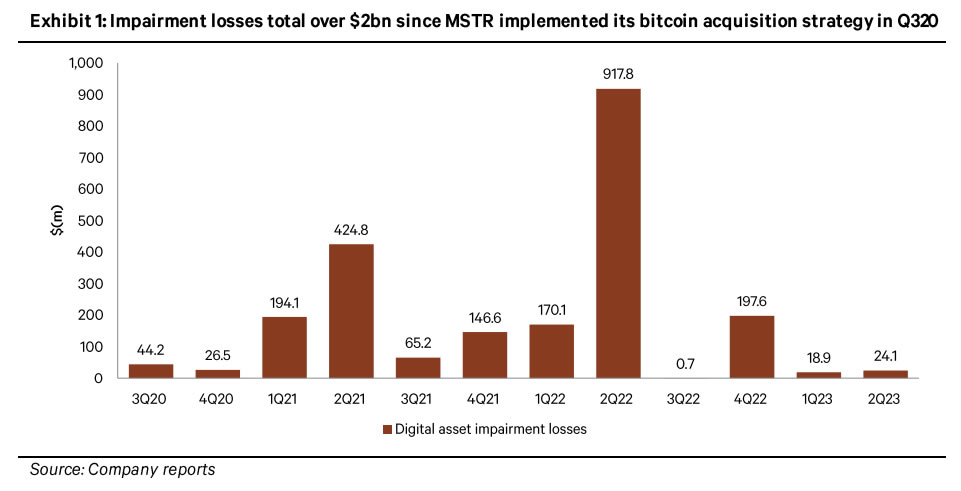

Since it began acquiring Bitcoin in August 2020, MicroStrategy has accumulated $2.23 billion in total impairment losses.

Additionally, several of the quarterly reports the company has issued over the past three years have shown significant impairment losses on its BTC holdings, reflecting declines in the asset’s price.

MicroStrategy impairment losses. Source: Berenberg Capital

MicroStrategy impairment losses. Source: Berenberg Capital

This resulted in unfavorable media coverage of the company and its reports, “creating the impression that the company’s intrinsic value had been adversely affected when that was not the reality,” Palmer remarked.

With the new regulations set to take effect in 2025, companies that hold cryptocurrencies will be permitted to report those assets at fair value. Consequently, their quarterly reports will reflect the current values of the assets, including any price recoveries.

At present, impairment losses must be reported and cannot be adjusted even if the asset price rebounds.

MicroStrategy is the largest corporate holder of BTC globally, with 152,800 coins as of July 31, currently valued at approximately $3.9 billion. The new regulations can be implemented early, and Berenberg anticipates that MicroStrategy will take this step, which would value its BTC holdings at $8.8 billion by April 2024.

Related: MicroStrategy returns to profit and now owns $4.4B worth of Bitcoin

Berenberg’s note mentions that MicroStrategy CEO Michael Saylor previously stated that the main reason more companies have not embraced a BTC investment strategy is due to the FASB’s “hostile” and “punitive” approach to crypto. He further expressed that the change is a favorable development:

“A change in the accounting treatment would be a significant positive catalyst for the price of Bitcoin, as it would spur adoption by tech companies.”

Magazine: How to protect your crypto in a volatile market: Bitcoin OGs and experts weigh in