Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

EU’s crypto investor safeguards set to be implemented by late 2024.

Investors in cryptocurrency within Europe currently lack protection under the European Union’s cryptocurrency asset market regulations, and it will take some time before these protections are implemented.

On October 17, the European Securities and Markets Authority (ESMA), Europe’s securities regulator, released a statement regarding the transition to the European crypto regulations known as the Markets in Crypto-Assets Regulation (MiCA).

The ESMA highlighted that investor protections based on MiCA will not be activated until at least December 2024, indicating that investors should be ready to potentially lose all funds they intend to invest in cryptocurrency. The authority further noted:

“Holders of crypto-assets and clients of crypto-asset service providers will not benefit during that period from any EU-level regulatory and supervisory safeguards […] such as the ability to file formal complaints with their NCAs [National Competent Authorities] against crypto-asset service providers.”

Even post-December 2024, there is no assurance that investors will receive complete protection under MiCA until 2026. Once MiCA is applicable to crypto asset service providers in late 2024, member states may still choose to grant crypto service providers an additional 18-month “transitional period” that allows them to operate without a license, commonly referred to as a “grandfathering clause.”

“This means that holders of crypto-assets and clients of crypto-asset service providers may not benefit from full rights and protections afforded to them under MiCA until as late as July 1, 2026,” the ESMA stated. Most NCAs will have limited authority to oversee those benefiting from the transitional period, depending on local regulations.

“In most instances, these powers are restricted to those available under current anti-money laundering frameworks, which are significantly less comprehensive than MiCA,” the ESMA added.

Retail investors should be cognizant that there will be no guaranteed safe crypto asset even after MiCA is enacted, the authority emphasized, stating:

“ESMA reminds holders of crypto-assets and clients of crypto-asset service providers that MiCA does not address all of the various risks associated with these products. Many crypto-assets are by nature highly speculative.”

The recent alerts from the ESMA follow the regulator’s release of a second consultative paper on MiCA on October 5, after the regulations were enforced in June 2023.

Related: EU considers more stringent regulations for large AI models: Report

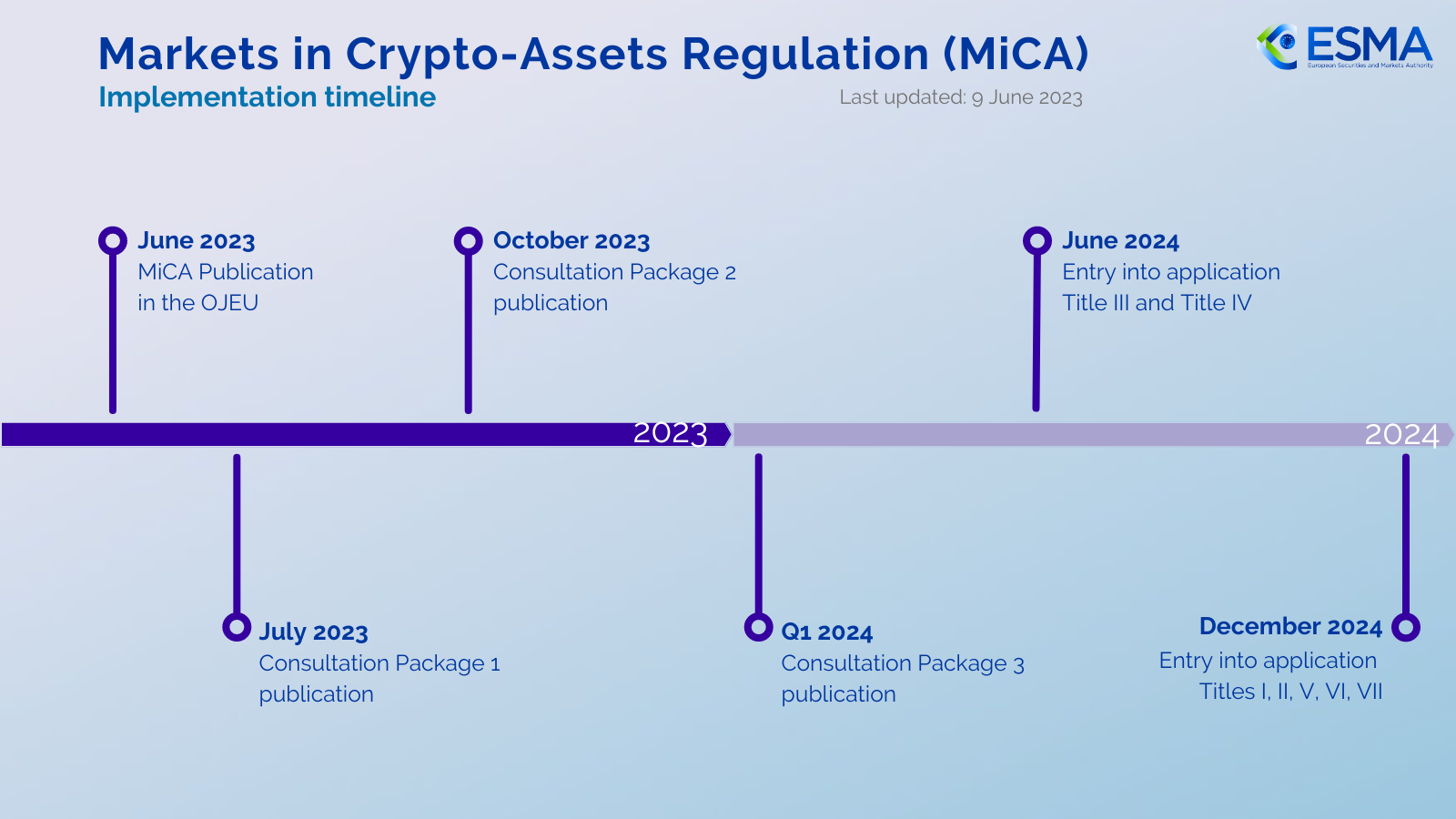

During the MiCA implementation phase, the ESMA and other relevant authorities are tasked with engaging the public on a variety of technical standards that are anticipated to be published in three sequential packages.

MiCA implementation timeline. Source: ESMA

MiCA implementation timeline. Source: ESMA

Officially launched in 2020, MiCA seeks to establish legislation to regulate crypto assets in Europe by modifying existing laws, specifically Directive 2019/1937. The foundation of MiCA was laid in 2018 due to the increasing public interest in cryptocurrency investments.

Collect this article as an NFT to preserve this moment in history and show your support for independent journalism in the crypto space.

Magazine: The Truth Behind Cuba’s Bitcoin Revolution: An on-the-ground report