Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Europe’s involvement in the upcoming phase of tokenization

In this week’s Crypto Long & Short Newsletter, Lukas Enzersdorfer-Konrad discusses how regulatory clarity in the EU may facilitate the scaling of tokenised markets. Following that, Andy Baehr encourages BNB to “suit up.”

(Deep Doshi/ Unsplash)

(Deep Doshi/ Unsplash)

What to know:

You’re reading Crypto Long & Short, our weekly newsletter providing insights, news, and analysis for professional investors. Sign up here to receive it in your inbox every Wednesday.

Welcome to our institutional newsletter, Crypto Long & Short. This week:

- Lukas Enzersdorfer-Konrad discusses how the EU’s regulatory clarity may facilitate the scaling of tokenised markets

- Andy Baehr encourages BNB to “suit up”

- Key headlines institutions should be aware of by Francisco Rodrigues

- “Bitcoin’s drawdowns compress as markets mature” featured in Chart of the Week

-Alexandra Levis

STORY CONTINUES BELOWDon’t miss another story.Subscribe to the Crypto Long & Short Newsletter today. See all newslettersSign me up

Expert Insights

Europe’s role in the next wave of tokenisation

– By Lukas Enzersdorfer-Konrad, chief executive officer, Bitpanda

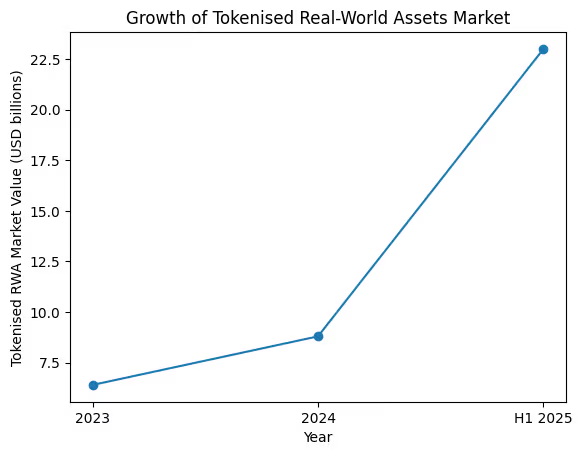

The tokenisation of real-world assets (RWAs) has evolved from a buzzword into a viable business model. It has become foundational for institutional blockchain adoption. In the first half of 2025 alone, the value of tokenised RWAs increased by 260%, reaching $23 billion in on-chain value. Over recent years, the sector has witnessed rapid and sustained growth, sufficient to transition tokenisation from an experimental concept to a core element of digital-asset infrastructure. This indicates a structural transformation in how financial markets are constructed and ultimately expanded.

Tokenisation is becoming a cornerstone of institutional blockchain adoption, with major firms like BlackRock, JPMorgan, and Goldman Sachs publicly investigating or implementing related initiatives, and significant institutions affirming its potential. Despite this progress, growth continues to face limitations. A majority of assets remain within permissioned systems, divided by regulatory ambiguity and restricted interoperability. Scalable public infrastructure is still underdeveloped, hindering the transition from institutional pilot projects to widespread market engagement. In essence, while tokenisation is effective, the necessary market infrastructure for global adoption is still in the process of being established.

What remains absent? Regulation, as a facilitator. Institutions require clarity before they commit resources to their balance sheets and develop long-term strategies. Retail investors need clear guidelines that protect them without excluding them. Markets need standards they can trust. Without these components, liquidity remains limited, systems stay isolated, and innovation struggles to progress beyond early adopters.

Europe has undoubtedly positioned itself as an early frontrunner in this domain. With MiCA now operational and the DLT Pilot Regime fostering structured experimentation in digital securities, the region has advanced beyond disjointed sandboxes. The European market is the first to implement a cohesive, continent-wide regulatory framework for tokenised assets. Rather than viewing compliance as a hindrance, the region has transformed regulatory clarity into a competitive edge. It offers the legal, operational, and technical assurance that institutions need to innovate confidently and at scale.

The continent’s regulatory-first strategy is already yielding substantial momentum. Under MiCA and the EU’s DLT Pilot Regime, banks have started to issue tokenised bonds on regulated platforms, with European issuance surpassing €1.5 billion in 2024 alone. Asset managers are experimenting with on-chain fund structures tailored for retail distribution, while fintech companies are incorporating digital-asset infrastructure directly into licensed platforms. Collectively, these advancements represent a transition from pilot initiatives to active deployment, addressing one of the industry’s longstanding bottlenecks: the capacity to establish compliant infrastructure from the outset.

A new phase: interoperability and market structure

The forthcoming phase of tokenisation will depend on interoperability and shared standards, areas where Europe’s regulatory clarity could once again lead the way. As more institutions introduce tokenised products to the market, fragmented liquidity pools and proprietary frameworks risk re-establishing the silos present in traditional finance within digital contexts.

While traditional finance has dedicated years to optimizing for speed, the next wave of tokenisation will be influenced by trust in who develops and governs the infrastructure, as well as whether both institutions and retail users can rely on it. Europe’s clarity regarding regulations and market frameworks provides it with a credible chance to set global standards rather than merely adhering to them.

The EU can bolster this position by promoting cross-chain interoperability and standardized disclosure practices. Establishing common regulations early would enable tokenised markets to expand without repeating the fragmentation that hindered past financial innovations.

Headlines of the Week

– By Francisco Rodrigues

President Donald Trump’s unexpected nomination of Kevin Warsh to head the Fed introduced new dynamics that unsettled the markets. The rally in precious metals experienced a sharp selloff, while cryptocurrency values faced significant corrections, with major players still moving to seize opportunities.

- Bitcoin is the ‘newest, coolest software’: Inside Kevin Warsh’s complicated crypto history: This week’s significant headline was President Donald Trump’s unexpected nomination of former Fed governor Kevin Warsh, a veteran of the 2008 financial crisis with Wall Street experience, as the next Federal Reserve Chair.

- Australia’s corporate regulator flags risks from rapid innovation in digital assets: The Australian Securities and Investments Commission has identified risks associated with digital assets and AI in its latest annual report.

- The hidden reason bitcoin didn’t rally as gold and silver surged: Analysts indicate that orderbook data showed persistent sell-side pressure beneath $90,000 that consistently dampened upward momentum, even when broader market conditions seemed favorable.

- Hyperliquid’s HYPE emerges as crypto market haven: The token surged as it integrated traditional assets within the cryptocurrency realm. Silver futures volume surged on the platform during the precious metals rally, and HYPE’s ascent continued with the planned inclusion of prediction markets and options.

- Binance transfers 1,315 bitcoin into user protection fund as it prepares to acquire $1 billion BTC: The largest cryptocurrency exchange moved around $100 million in bitcoin from a wallet into its Secure Asset Fund for Users, as it redefines its user protection reserve.

Vibe Check

Suit up, BNB

– By Andy Baehr, head of product and research, CoinDesk Indices

Last week’s CoinDesk 20 (CD20) reconstitution welcomed BNB into the index for the first time. This was not an issue of size — BNB has consistently ranked among the largest digital assets by market capitalization. It was a matter of fulfilling the liquidity and other criteria that govern CD20 inclusion. For the first time, BNB met those requirements.

The outcome? One of the largest changes in composition since the index’s inception in January 2024. BNB enters the CD20 with a weight surpassing 15%, establishing itself as a significant component in the lineup.