Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

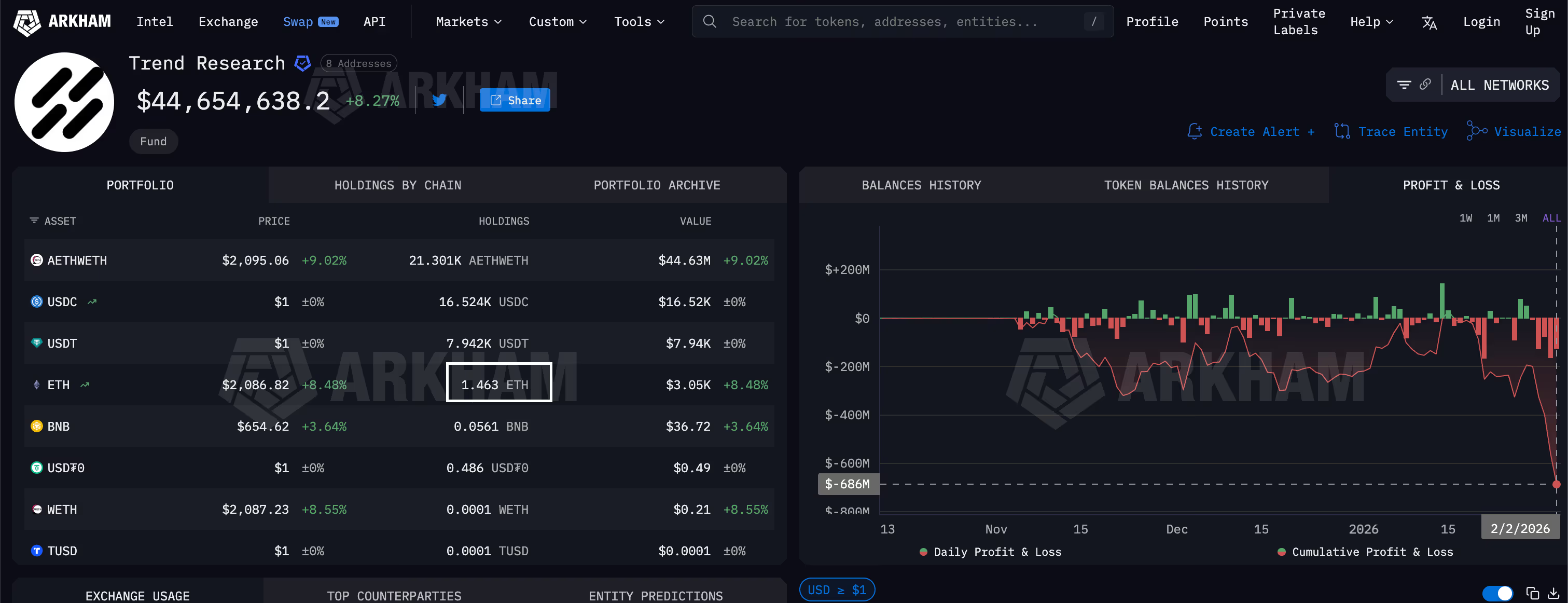

Ether’s recent decline below $2,000 results in a $686 million deficit for trading company.

The trading firm’s leveraged ETH long position collapsed this week as the price of ether plummeted, leading to an estimated loss of $686 million.

Trading firm suffers huge loss due to ether crash. (Getty Images+/Unsplash)

Trading firm suffers huge loss due to ether crash. (Getty Images+/Unsplash)

What to know:

- Trend Research, a trading company led by Liquid Capital founder Jack Yi, established a $2 billion leveraged long position in ether by borrowing stablecoins against ETH collateral.

- As ether’s price decreased to $1,750 this week, the firm’s leveraged ETH position collapsed, leading to an estimated loss of $686 million.

- Yi characterized the significant sell-off as a risk management strategy and stated he continues to have a positive outlook on a “mega” crypto bull market, forecasting ETH above $10,000 and bitcoin surpassing $200,000 despite the setback.

An ether bull was caught heavily positioned for the upside this week as the cryptocurrency dropped, transforming the whale wager into a multi-million dollar setback.

This bull is Trend Research, a trading firm directed by Liquid Capital founder Jack Yi. The firm spent recent months establishing a bullish (long) position valued at $2 billion on ether by borrowing stablecoins from DeFi leader Aave, which were reportedly secured by ether collateral.

STORY CONTINUES BELOWDon’t miss another story.Subscribe to the Crypto Daybook Americas Newsletter today. See all newslettersSign me up

The position collapsed this week, resulting in a $686 million loss for the firm, as reported by Arkham.

This incident highlights the persistent nature of the crypto market: Volatility can significantly impact traders within a single week. It also illustrates how traders continue to pursue high-risk leveraged strategies—borrowing stablecoins against ETH collateral—despite the tendency for these investments to fail dramatically during downturns.

Trend Research’s multi-million dollar loss. (Arkham)

Trend Research’s multi-million dollar loss. (Arkham)

How it went down

The team believed in ether’s long-term value and anticipated a swift recovery from its October decline below $4,000.

However, that rebound did not occur—ether continued its downward trend, jeopardizing their “looped ether” long position. As prices dropped, the stablecoin collateral securing the leveraged position diminished, while the fixed debt remained significant in typical leveraged fashion.

The final blow occurred this month as ether began to decline swiftly alongside bitcoin and on February 4, prices dropped to $1,750, marking the lowest level since April 2025. Trend Research reacted by liquidating over 300,000 ether, according to data from Bubble Maps.

“Trend Research began transferring significant amounts of ETH to Binance to settle debts on AAVE. In total, this cluster moved 332k ETH valued at $700M to Binance over a span of 5 days,” Bubble Maps reported on X. The firm now possesses just 1.463 ETH.

Jack Yi referred to these transactions as a measure for managing risk.

“As multi-heads in this round, we remain optimistic about the prospects of the new bull market: ETH reaching over $10,000, BTC exceeding $200,000 USD. We’re merely making some adjustments to mitigate risk, with no alteration in our expectations for the future mega bull market,” Yi stated in a post on X.

He emphasized that the current moment represents an optimal opportunity to acquire tokens, describing volatility as the most prominent characteristic of the crypto sphere. “Historically, numerous bulls have been shaken out by this volatility, but what often follows is a significant rebound,” he remarked.