Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Digital Assets Exchange-Traded Product Market Overview for Advisors

Digital asset ETPs are quickly becoming integrated into conventional portfolios ($184B AUM), propelled by the adoption of bitcoin ETFs in the U.S.

(Allison Saeng/ Unsplash+)

(Allison Saeng/ Unsplash+)

What to know:

You’re reading Crypto for Advisors, CoinDesk’s weekly newsletter that unpacks digital assets for financial advisors. Subscribe here to get it every Thursday.

In today’s newsletter, Joshua De Vos, head of research at CoinDesk, summarizes their latest crypto ETF report covering U.S. adoption, the speed at which it’s happening and asset concentration.

In Keep Reading, we link to the U.S. and Global ETF reports for those who want to do a deeper dive.

STORY CONTINUES BELOWDon’t miss another story.Subscribe to the Crypto Long & Short Newsletter today. See all newslettersSign me up

– Sarah Morton

Digital assets exchange-traded product landscape: past, present and future

Crypto for Advisors – February – Digital Asset ETPs

Digital asset Exchange-Traded Products (ETPs) are now one of the most telling indicators of how swiftly crypto is being integrated into traditional portfolio frameworks. As detailed in CoinDesk’s most recent research report, the market has advanced beyond the initial stage of fragmented access and is now in a phase where regulated wrappers and exchange-traded fund (ETF) distributions are significantly influencing how capital enters this asset class.

The state of crypto ETP adoption

By the end of 2025, crypto ETP assets under management (AUM) reached $184 billion. The United States remains the focal point, representing roughly $145 billion, or nearly 80% of global assets AUM. ETFs dominate the product landscape, accounting for 84.6% of crypto structured products by assets. The market is also heavily tilted toward straightforward exposure. Approximately 94.1% of crypto ETPs utilize a delta-one strategy, and 96.1% are managed passively.

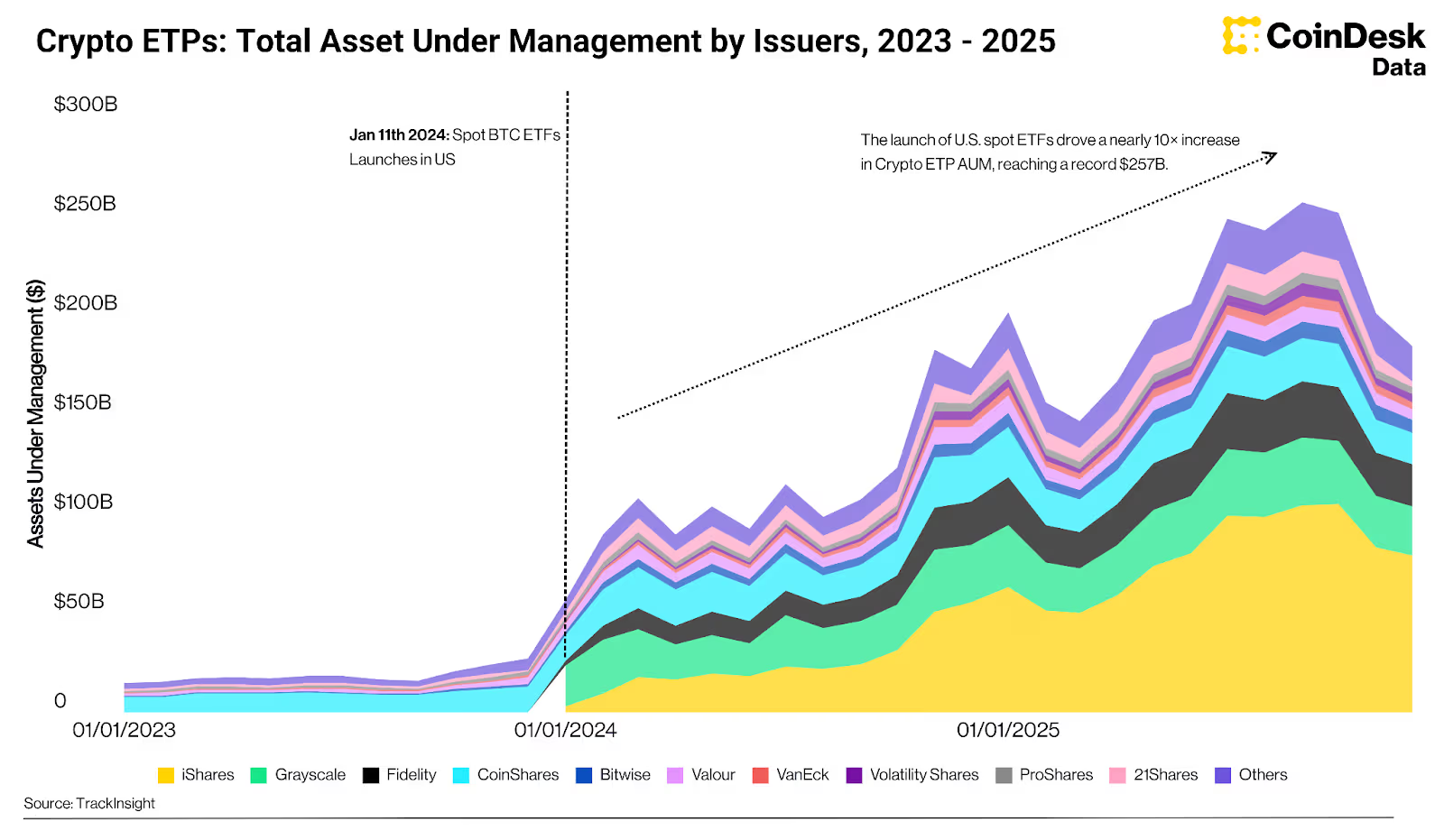

The increase in AUM has primarily been fueled by the introduction of U.S. spot bitcoin ETFs in January 2024. The impact was immediate. This launch cycle propelled crypto ETP assets significantly higher and established a product category that now fits within the same ETF allocation frameworks utilized across equities, fixed income, and commodities.

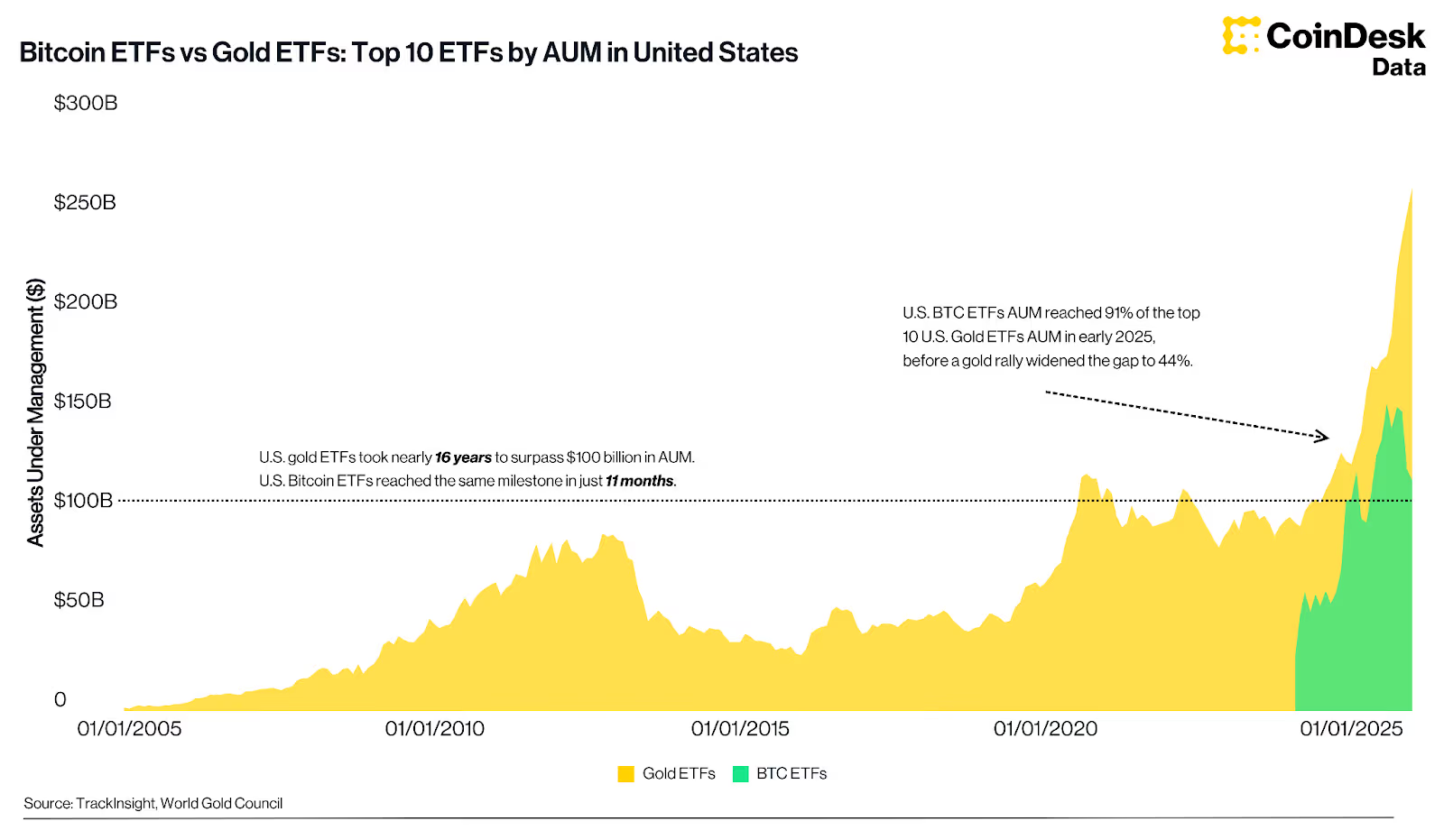

The rate of adoption has been exceptionally rapid when compared to previous ETF cycles. U.S. bitcoin ETFs reached $100 billion in assets within a mere 11 months, while U.S. gold ETFs took nearly 16 years to exceed the same figure. By early 2025, bitcoin ETFs had achieved 91% of the top 10 U.S. gold ETFs by AUM, although gold’s subsequent surge widened the disparity. This reflects less on relative value and more on the speed at which bitcoin has been integrated into institutional distribution channels once the wrapper was introduced.

Scale and concentration

In the crypto ETP market, exposure is still highly concentrated. Bitcoin-based products hold $144 billion in AUM, accounting for 78.2% of total AUM. Ether-based products have reached $26.5 billion, indicating that institutional interest is slowly expanding beyond bitcoin. Exposure to other cryptocurrencies remains limited, with Solana and XRP products managing $3.8 billion and $3.