Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

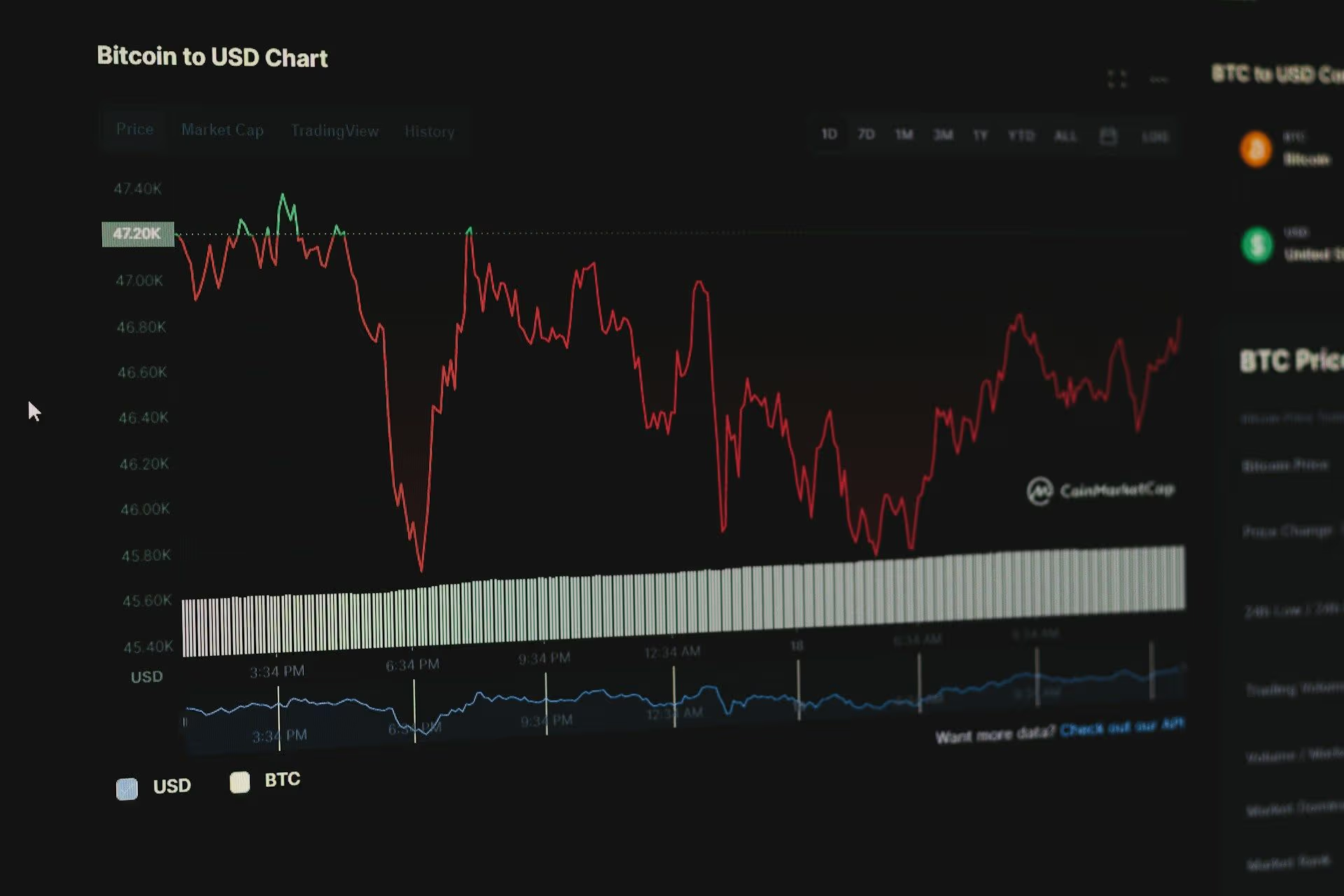

Cryptocurrency declines under $70,000 after losing post-election increases amid widespread selling.

Crypto sentiment has been negatively impacted as Gemini announces plans to cease operations in multiple regions and reduce its workforce, while spot bitcoin ETF inflows have turned negative.

(Behnam Norouzi/Unsplash/Modified by CoinDesk)

(Behnam Norouzi/Unsplash/Modified by CoinDesk)

Key points:

- Bitcoin has increased to approximately $69,000 after a decline to around $60,000, unable to maintain its gains following Trump’s 2024 election amidst a wider market downturn, with the CoinDesk 20 index falling over 17%.

- Other cryptocurrencies experienced greater losses over the week, with ETH declining by 22.4%, BNB by 23.4%, and SOL by 25.2%.

- Crypto sentiment declined as Gemini announced its intention to discontinue operations in various regions and reduce its workforce, while spot bitcoin ETF inflows became negative.

Bitcoin has rebounded from a low of approximately $60,000 to around $69,000, having effectively relinquished the gains made after Donald Trump’s election in November 2024 this week.

The decline of the cryptocurrency coincided with a broader market downturn that resulted in the CoinDesk 20 (CD20) index losing more than 17% of its value within a week.

STORY CONTINUES BELOWDon’t miss another story.Subscribe to the Crypto Daybook Americas Newsletter today. See all newslettersSign me up

While bitcoin declined by around 16.5% in the past week, other cryptocurrencies performed worse. Ether dropped by 22.4%, BNB fell by 23.4%, and Solana decreased by 25.2%. Shares of crypto-related companies experienced significant declines despite a rebound on Friday, as BTC briefly regained $70,000.

This movement followed a sharp decline the previous day, which Wintermute characterized as the most severe single-day decline in bitcoin since the FTX collapse.

The sell-off was fueled by market-wide liquidations and what appeared to be a “sell at any price” mentality, according to Jasper De Maere, desk strategist and OTC trader at Wintermute in an emailed statement.

De Maere mentioned that institutional desks reported “small but manageable liquidation,” which did not fully account for the scale of the move, raising questions about where the stress resided within the system.

De Maere noted that the cascade occurred alongside a broader cross-asset deleveraging. The Nasdaq 100 tracker QQQ decreased by about 500 basis points over three sessions, while silver and gold fell approximately 38% and 12% from their cycle highs, respectively.

In crypto options, implied volatility surged into the 99th percentile, with skew shifting toward unusually costly puts, he stated.

De Maere identified ether as the “epicenter of the pain,” indicating that many traders hurried to purchase protection against further losses through put options, which can yield payouts if prices decline and grant the holder the right to sell at a predetermined price. In bitcoin, he observed that positioning suggested expectations of ongoing volatility, with traders concentrating on a broad range that could span from about $55,000 to $75,000.

Further affecting sentiment, this week crypto exchange Gemini announced its plans to close operations in the U.K., European Union, and Australia, as well as reduce its workforce by approximately 25% as part of a restructuring. The company will transition to withdrawal-only mode for users in the impacted regions and collaborate with brokerage platform eToro for users to transfer their assets.

Meanwhile, Bitfarms (BITF) experienced a rise in its shares after abandoning its “bitcoin company” identity to concentrate on artificial intelligence (AI) infrastructure.

Market structure has contributed to the volatility. Bitcoin’s average 1% market depth, which measures how much can be traded near the current price without influencing the market, has decreased to around $5 million from over $8 million in 2025, as reported by Kaiko research analyst Thomas Probst to Reuters. Diminished depth can lead to more abrupt price movements.

Flows in spot bitcoin ETFs have also turned negative. Data from SoSoValue indicates around $1.25 billion of net outflows over the last three days. Jim Bianco of Bianco Research estimated on social media that the average ETF cost basis is near $90,000, leaving holders with roughly $15 billion in unrealized losses.

“It has been stated that crypto is ‘programmable money.’ If that is the case, BTC should trade like a software stock,” Bianco remarked in an X post, adding that the recent decline demonstrates it is moving in tandem with software stocks.

Software stocks fell this week after Anthropic introduced a new automation tool for its AI models aimed at legal and other knowledge-focused workflows. Shares of Salesforce (CRM), Adobe (ADBE), and ServiceNow (NOW) declined by 8%, 9%, and 13% respectively over the week, among others.

BTIG chief market technician Jonathan Krinsky also noted that bitcoin has recently been correlated with software stocks. “There’s compelling evidence that both of these [bitcoin and software stocks] have reached tactical lows,” Krinsky stated during an interview with CNBC. “[Bitcoin] bottomed last night right around $60,000, so I think that’s a solid level to trade against.”

“On the upside, it is essential to see it return above $73,000; that was the key breakdown level, which would confirm a tradable low is certainly established,” he added.

The Trump administration has upheld a pro-crypto position, which contributed to bitcoin reaching a new all-time high exceeding $125,000 last year, prior to a subsequent correction.