Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Cryptocurrency advocates overlook ‘intense fear’ as they drive bitcoin upward.

Your day-ahead look for Feb. 12, 2026

(Midjourney/Modified by CoinDesk)

(Midjourney/Modified by CoinDesk)

What to know:

You are currently reading Crypto Daybook Americas, your morning update on the developments in the cryptocurrency markets overnight and what to anticipate in the coming day. Crypto Daybook Americas will commence your morning with detailed insights. If you have not subscribed to the email yet, click here. You will want to start your day with it.

By Francisco Rodrigues (All times ET unless stated otherwise)

Bitcoin and the broader cryptocurrency market experienced gains over the past 24 hours after the U.S. jobs report for January indicated that growth in various sectors of the economy was limited, despite the overall figures exceeding expectations and undermining anticipations for imminent interest rate reductions.

STORY CONTINUES BELOWDon’t miss another story.Subscribe to the Crypto Daybook Americas Newsletter today. See all newslettersSign me up

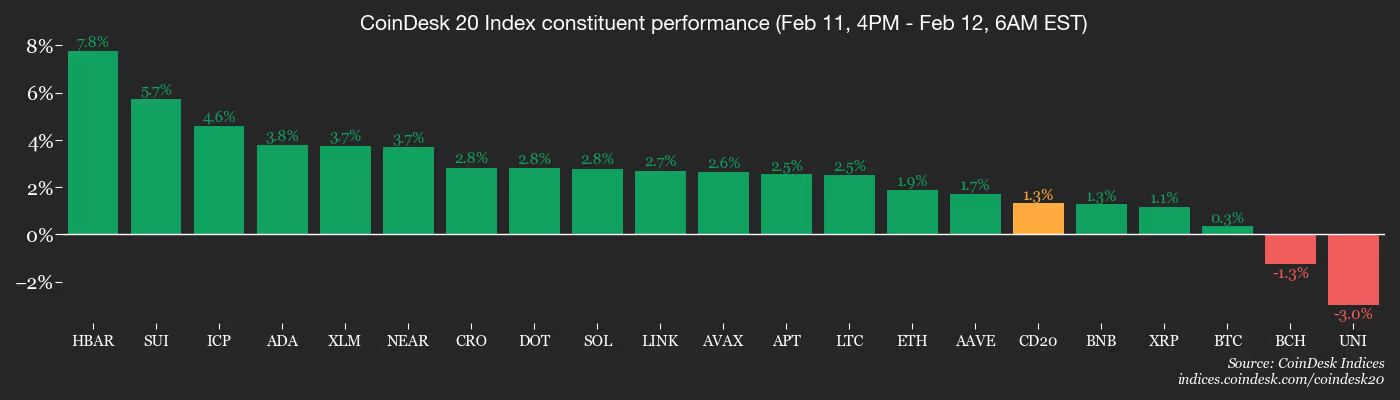

BTC rose by 1.25% during this timeframe, while the CoinDesk 20 (CD20) index increased by 1.18%. This resilience follows a significant decline last week that saw bitcoin’s price drop close to $60,000.

This selloff resulted in $3.2 billion in realized losses, marking the most significant in bitcoin’s history, surpassing even the 2022 Terra collapse, based on data from Glassnode. The data platform Checkonchain described it as a “textbook capitulation event,” where low-conviction holders quickly sold off their assets. Open interest also saw a decrease, as per CoinGlass.

The remaining traders seem hesitant to sell, even though interest rate cuts appear to be further away. Rate reductions generally decrease yields on fixed-income products, thus making riskier investments more appealing.

The likelihood of the Federal Reserve reducing rates by 25 basis points next month has dropped to 7% from 18% on prediction market Polymarket and from 20% on rival Kalshi.

Bitcoin’s favorable response indicates that sellers may be losing momentum. This, along with a Crypto Fear & Greed Index signaling the lowest levels since the collapse of FTX in 2022, suggests that the market’s bottom may have already occurred.

However, the upcoming U.S. CPI report will offer the market clearer guidance on potential actions from the Federal Reserve moving forward. Remain attentive!

Read more: For an analysis of today’s movements in altcoins and derivatives, see Crypto Markets Today

What to Watch

For a more extensive list of events this week, refer to CoinDesk’s "Crypto Week Ahead".

- Crypto

- No events scheduled.

- Macro

- Feb. 12, 8:30 a.m.: U.S. initial jobless claims for the week ending Feb. 7 (Prev. 231K)

- Feb. 12, 10 a.m.: U.S. existing home sales for January Est. 4.25M (Prev. 4.35M)

- Earnings (Estimates based on FactSet data)

- Feb. 12: Coinbase (COIN), post-market, $1.04

- Feb. 12: Coincheck Group (CNCK), post-market, $0.01

- Feb. 12: Bitdeer Technologies Group (BTDR), pre-market, -$0.06

Token Events

For a more comprehensive list of events this week, see CoinDesk’s "Crypto Week Ahead".

- Governance votes & calls

- Feb. 12: Bittensor will host a livestream on X regarding governance.

- Unlocks

- No significant unlocks.

- Token Launches

- Feb. 12: BlockDAG Network (BDAG) will be listed on MEXC, Coinstore, LBank, BitMart, Xt, and others.

Conferences

For a more comprehensive list of events this week, see CoinDesk’s "Crypto Week Ahead".

- Day 3 of 3: Consensus Hong Kong

- Day 3 of 3: Solana Breakout (Online)

Market Movements

- BTC is down 0.56% from 4 p.m. ET Wednesday at $67,385.45 (24hrs: +1.72%)

- ETH is up 0.32% at $1,975.60 (24hrs: +2.26%)

- CoinDesk 20 is up 0.48% at 1,939.73 (24hrs: +2.48%)

- Ether CESR Composite Staking Rate is up 13 bps at 3%

- BTC funding rate is at 0.0032% (3.4514% annualized) on Binance

- DXY remains steady at 96.81

- Gold futures have declined by 0.22% to $5,087.40

- Silver futures are down 0.78% at $83.26

- Nikkei 225 finished unchanged at 57,639.84

- Hang Seng closed down 0.86% at 27,032.54

- FTSE increased by 0.20% to 10,492.86

- Euro Stoxx 50 rose by 0.58% to 6,070.81

- DJIA closed down 0.13% at 50,121.40 on Wednesday

- S&P 500 remained unchanged at 6,941.47

- Nasdaq Composite closed down 0.16% at 23,066.47>