Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Crypto markets experience a downturn as Base and ether.fi reshape the layer-2 environment.

Your day-ahead look for Feb. 19, 2026

Crypto markets are experiencing a downturn. ((NickyPe/Pixabay modified by CoinDesk)

Crypto markets are experiencing a downturn. ((NickyPe/Pixabay modified by CoinDesk)

What to know:

You are reading Crypto Daybook Americas, your morning summary of developments in the crypto markets overnight and what is anticipated for the upcoming day. Crypto Daybook Americas will provide you with essential insights to start your morning. If you haven’t subscribed to the email yet, click here. You won’t want to miss it.

By Jacob Joseph (All times ET unless stated otherwise)

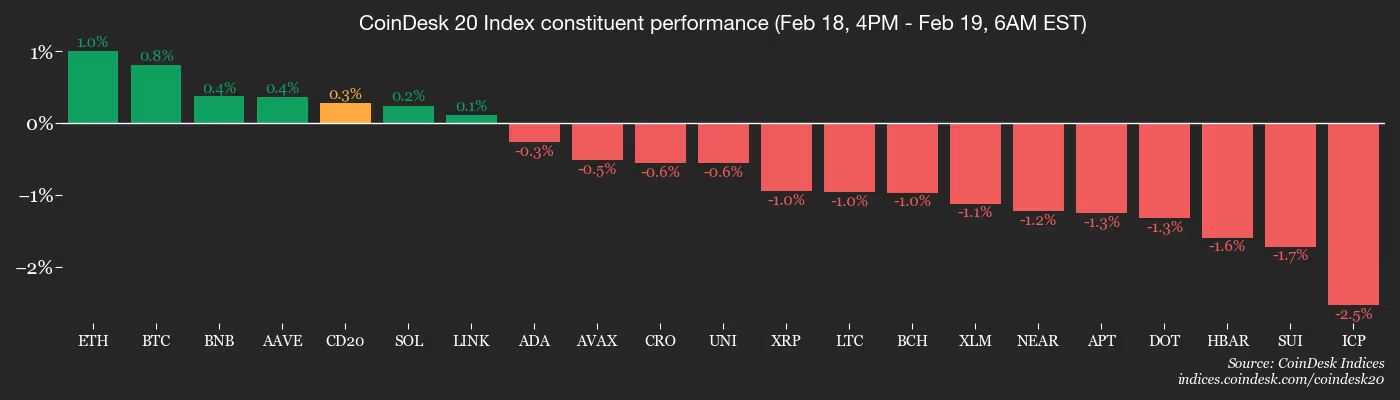

Despite the CoinDesk 20 index (CD20) remaining relatively stable since midnight UTC, crypto markets are still facing challenges. Almost all members have decreased, with the exception of bitcoin , which is slightly up by less than 0.1%.

STORY CONTINUES BELOWDon’t miss another story.Subscribe to the Crypto Daybook Americas Newsletter today. See all newslettersSign me up

The index has decreased by 2% over the past 24 hours, and spot bitcoin exchange-traded funds have experienced negative flows for the second consecutive session, with $133 million in net outflows recorded on Wednesday. Spot ether (ETH) ETFs also saw net outflows. The second-largest cryptocurrency has declined by an additional 0.2% since midnight.

A significant event overnight was Coinbase’s (COIN) announcement that its layer-2 network, Base, will transition away from the OP Stack, the open-source, modular rollup framework developed by Optimism that currently supports it. The OP Stack allows chains like Base and Unichain to function as low-cost, Ethereum-secured layer 2s, fully compatible with the Ethereum Virtual Machine (EVM) and aligned with Optimism’s broader Superchain strategy.

Instead of depending on various external contributors for core upgrades and protocol modifications, Base plans to centralize development within a self-managed codebase, providing the team with more authority over infrastructure, roadmap, and technical advancements.

This shift has significant ramifications for Optimism. Historically, Base has represented the majority of Superchain-generated revenue — often surpassing 90% — which benefits the Optimism Collective. This announcement poses a considerable potential challenge to Optimism’s revenue projections, with the OP token falling by 24% since Wednesday following the news.

On a more favorable note, ether.fi announced it will transition its Cash product to Optimism’s OP Mainnet. This migration will introduce approximately 70,000 active cards, 300,000 accounts, and millions of dollars in total value locked. The non-custodial payment card enables users to spend ETH, BTC, and stablecoins at over 100 million Visa merchants, offering 3% crypto cashback and handling around $2 million in daily transaction volume.

In another significant layer-2 update, Robinhood’s testnet recorded 4 million transactions in its initial week, according to CEO Vlad Tenev. The Arbitrum-based Robinhood Chain aims to facilitate tokenized real-world assets and a wider array of on-chain financial services, indicating the firm’s ongoing commitment to blockchain infrastructure.

While these ecosystem advancements are positive, larger markets continue to operate within a broader downtrend. The latest minutes from the Federal Reserve meeting, released yesterday, reveal increasing differences among policymakers regarding the direction of interest rates.

Several officials suggested that further rate reductions should be paused for now, with the possibility of resuming easing later in the year only if inflation continues to decrease. Stay vigilant!

Read more: For analysis of today’s activity in altcoins and derivatives, see Crypto Markets Today

What to Watch

For a more detailed list of events this week, see CoinDesk’s "Crypto Week Ahead".

- Crypto

- Feb. 19, 8 a.m.: Zama to host a live presentation of its 2026 roadmap.

- Macro

- Feb. 19: U.S. Fed’s Raphael Bostic, Michelle Bowman, and Neel Kashkari will give speeches throughout the day.

- Feb. 19, 8:30 a.m.: U.S. initial jobless claims for Feb. 14 estimated at 225K (Prev. 227K)

- Earnings (Estimates based on FactSet data)

- Feb. 19: Riot Platforms (RIOT), post-market, -$0.32

Token Events

For a more detailed list of events this week, see CoinDesk’s "Crypto Week Ahead".

- Governance votes & calls

- ENS DAO is voting to register the on.eth name and establish it as an on-chain registry for blockchain metadata. Voting ends Feb. 19.

- Unlocks

- No significant unlocks.

- Token Launches

- Feb. 19: Resolv to complete rollout of updated USR/RLP yield distribution parameters

- Feb. 19: Injective to commence INJ Community Buyback Round #226

Conferences

For a more detailed list of events this week, see CoinDesk’s "Crypto Week Ahead".

- Day 3 of 4: ETHDenver

Market Movements

- BTC has increased by 0.87% from 4 p.m. ET Wednesday, priced at $66,896.68 (24hrs: -1.31%)

- ETH has risen 1.29% to $1,966.13 (24hrs: -1.49%)

- CoinDesk 20 is up 0.39% at 1,932.97 (24hrs: -2.57%)

- Ether CESR Composite Staking Rate remains stable at 2.81%

- BTC funding rate is at 0.0056% (6.1747% annualized) on Binance

- DXY is steady at 97.67

- Gold futures are unchanged at $5,009.90

- Silver futures have risen 1.13% to $78.47

- Nikkei 225 closed up 0.57% at 57,467.83

- Hang Seng closed up 0.52% at 26,705.94

- FTSE is down 0.63% at 10,618.95

- Euro Stoxx 50 is down 0.81% at 6,054.02

- DJIA closed on Wednesday up 0.26% at 49,662.66

- S&P 500 closed up 0.56% at 6,881.31

- Nasdaq Composite closed up 0.78% at 22,753.63

- S&P/TSX Composite closed up 1.5% at 33,389.73

- S&P 40 Latin America closed up 0.37% at 3,707.85

- U.S. 10-Year Treasury rate has increased by 1.3 bps to 4.094%

- E-mini S&P 500 futures are down 0.3% at 6,873.25

- E-mini Nasdaq-100 futures are down 0.39% at 24,857.50

- E-mini Dow Jones Industrial Average Index futures are down 0.35% at 49