Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Crypto Long & Short: The Illusion of Liquidity in Cryptocurrency

In this week’s Crypto Long & Short Newsletter, Leo Mindyuk of ML Tech states that although the crypto markets may appear liquid in theory, the availability of executable liquidity at scale is more dispersed and fragile than many institutions realize.

(A Chosen Soul/ Unsplash+)

(A Chosen Soul/ Unsplash+)

What to know:

You are reading Crypto Long & Short, our weekly newsletter that provides insights, news, and analysis for professional investors. Subscribe here to receive it in your inbox every Wednesday.

Welcome to our institutional newsletter, Crypto Long & Short. In this week’s edition:

- Leo Mindyuk discusses how executable liquidity at scale is more fragmented and fragile than many institutions recognize

- Key headlines that institutions should monitor by Francisco Rodrigues

- Helium’s deflationary shift in Chart of the Week

-Alexandra Levis

STORY CONTINUES BELOWDon’t miss another story.Subscribe to the Crypto Long & Short Newsletter today. See all newslettersSign me up

Expert Insights

Crypto’s liquidity illusion: why displayed volume does not equate to tradable depth

– By Leo Mindyuk, co-founder and CEO, ML Tech

Crypto may appear liquid, until one attempts to trade significant volumes. This is particularly true during market stress and even more so for assets beyond the top 10-20 cryptocurrencies.

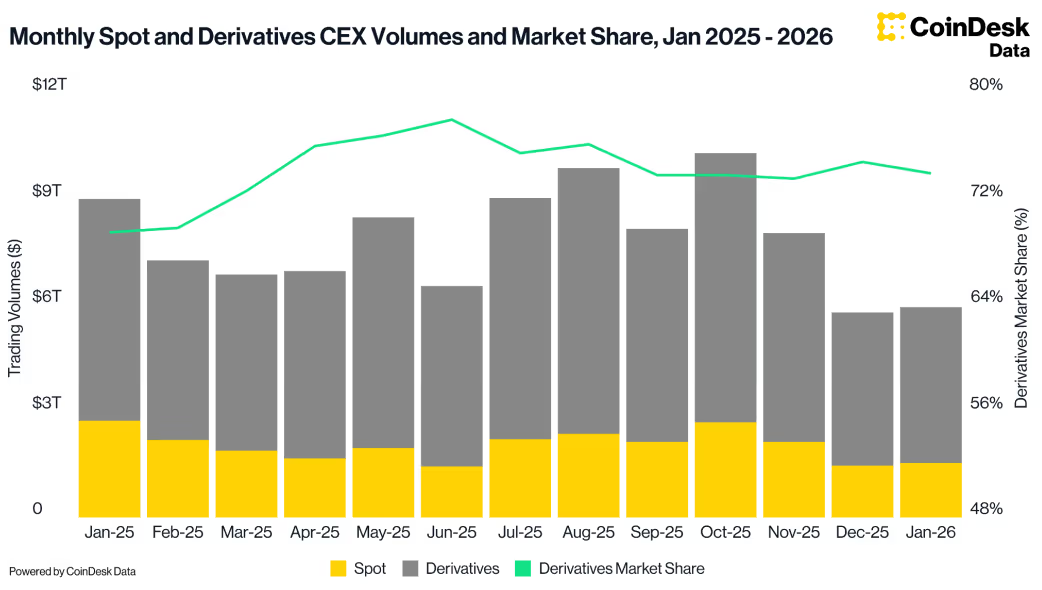

On the surface, the statistics are striking. Billions traded in daily volume and trillions in monthly volume. Narrow spreads on bitcoin and ether (ETH). Numerous exchanges vie for trade flow. It resembles a well-established, highly efficient market. At the start of the year, monthly spot and derivatives volumes were about $9 trillion, then around October 2025, monthly volume reached approximately $10 trillion (including considerable activity surrounding the market downturn on October 10th). However, in November, derivatives trading volumes fell by 26% to $5.61 trillion, marking the lowest monthly activity since June, followed by even steeper declines in December and January, according to CoinDesk Data. While those figures remain impressive, let’s delve deeper.

At first glance, numerous crypto exchanges appear to be competing for trade flow; however, in reality, a limited number of exchanges dominate (refer to the graph below). If these exchanges experience thinning liquidity or connectivity challenges that hinder volume execution, the entire crypto market is affected.