Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Crypto Long & Short: Generation Z places faith in code rather than bank assurances

In this week’s Crypto Long & Short Newsletter, Haider Rafique from OKX presents a comprehensive analysis on the generational viewpoints regarding crypto investments. Meanwhile, Sky demonstrates resilience against the anticipated downturn in 2026 in this week’s Chart of the Week.

(Natalia Blauth/ Unsplash+)

(Natalia Blauth/ Unsplash+)

What to know:

You are reading Crypto Long & Short, our weekly newsletter offering insights, news, and analysis tailored for the professional investor. Subscribe here to receive it directly to your inbox every Wednesday.

Welcome to our institutional newsletter, Crypto Long & Short. This week:

- Haider Rafique from OKX presents a thorough analysis on the generational viewpoints concerning crypto investments

- Key headlines that institutions should note by Francisco Rodrigues

- Sky shows resilience against the 2026 downturn in this week’s Chart of the Week

-Alexandra Levis

STORY CONTINUES BELOWDon’t miss another story.Subscribe to the Crypto Long & Short Newsletter today. See all newslettersSign me up

Expert Insights

Gen Z Trusts Code Over Bank Promises

By Haider Rafique, global managing partner, OKX

The banking sector is evidently concerned about potential disruptions from crypto.

After several months of intensive lobbying, the Senate Banking Committee has delayed its markup of market structure legislation, partially due to the position taken by banks regarding stablecoin yields.

However, this may be inconsequential, as banks face a far more significant crisis: they are failing to connect with younger consumers based on fundamental trust principles.

Based on the behaviors observed on the OKX app globally, we undertook a study to gain insights into generational perspectives within our transforming industry.

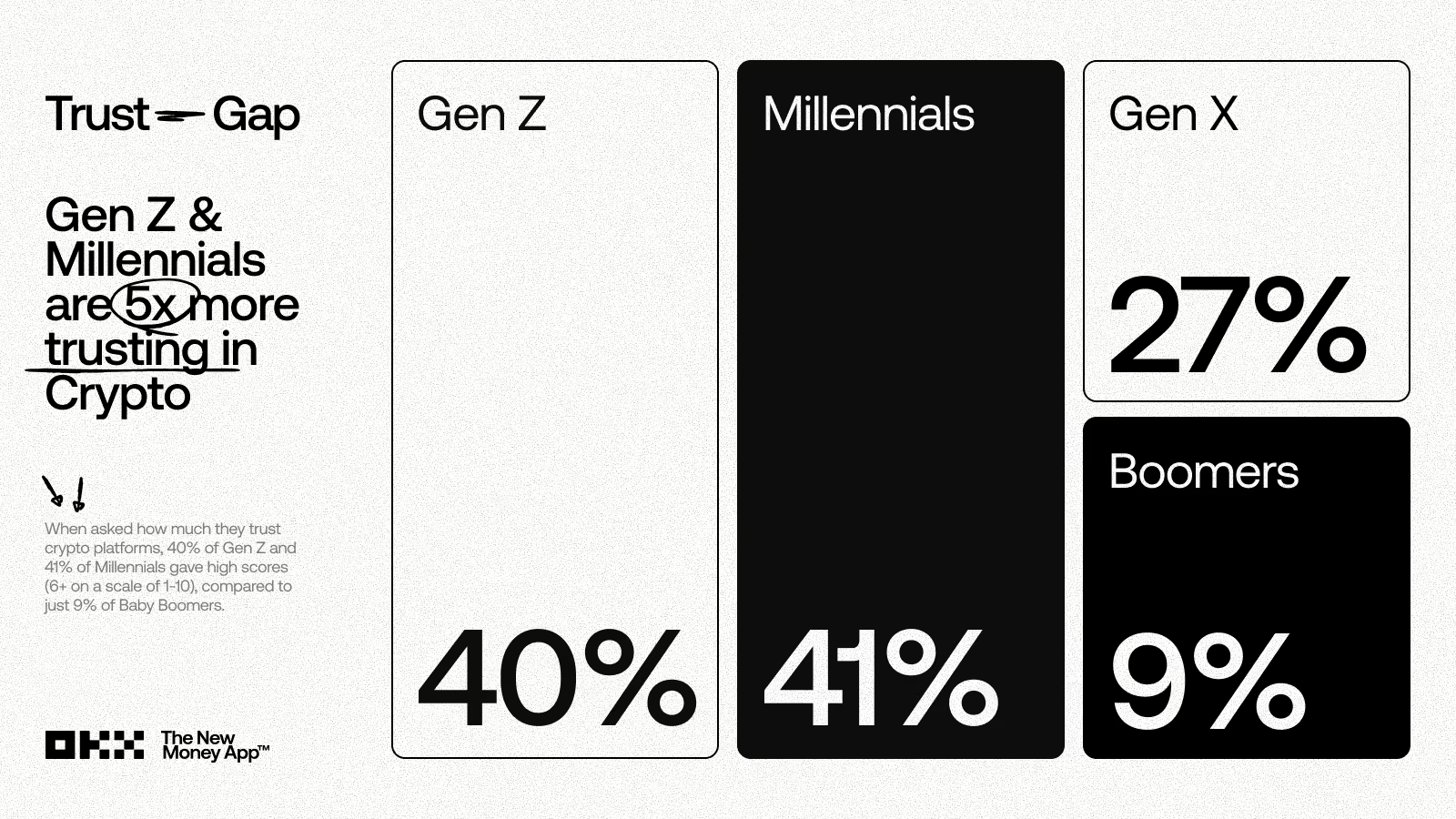

The findings clearly indicate: Gen Z and millennial consumers exhibit nearly five times more trust in crypto compared to their boomer counterparts. Furthermore, one in five Gen Z and millennial consumers express low trust in traditional financial institutions, while almost three-quarters (74%) of baby boomers maintain high levels of trust in the conventional system.

The underlying reasons for this phenomenon are deeper than just viral trends and memecoins. This generation has grown up with open-source code and real-time dashboards, leading them to anticipate similar transparency from traditional finance.

As the world shifts on-chain and everything becomes tokenized, it is evident that younger individuals perceive the digital economy as their equivalent of the stock market.

Traditional finance is not their domain; it belongs to their parents and grandparents.

A generation shaped by institutional failure

A recent report from FINRA and the CFA Institute indicates that a significant portion of Gen Z investors are increasingly leaning towards crypto in comparison to other assets — a behavioral indicator showing that younger Americans are inclined to explore alternatives to traditional avenues when they feel they are not receiving transparency or competitive returns. The study reveals that nearly 20% of Gen Z investors exclusively hold crypto.

This should serve as a wake-up call for banks, emphasizing that trust is no longer something institutions can merely assert; it must be proven.

Baby boomers established their financial paths during a time when institutions were considered the most secure option available. Regulations provided a sense of protection, and trust was something extended initially and questioned afterward.

In contrast, Gen Z has experienced the opposite. They matured in the aftermath of the 2008 financial crisis, entered adulthood burdened with substantial student debt, and now confront a housing market with a significant shortage of units alongside persistent inflation.

Moreover, they have witnessed years of fluctuating policies regarding student loans, changes in repayment guidelines, and diminished borrower protections. These inconsistencies have reinforced a vital lesson: institutional promises can shift overnight. When trust is continuously challenged, skepticism becomes a logical response.

It is not that banks are losing Gen Z to crypto; they are losing them to the concept of trust.