Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Costo depletes its supply of gold bars, but is it a superior investment compared to Bitcoin?

Costco has garnered attention this week after quickly depleting its stock of gold bars. Amid economic instability and increasing inflation, it is expected that investors are gravitating towards traditional safe-haven assets such as gold. The pertinent question is whether gold’s performance will ultimately drive its price above $2,050, a threshold last reached in early May.

Over the past year, gold prices have risen significantly by 12%. This increase has been partly driven by the Federal Reserve’s actions to tackle inflation through sustained higher interest rates, a strategy that favors limited assets like gold. While gold’s performance is noteworthy, it is crucial to contextualize it.

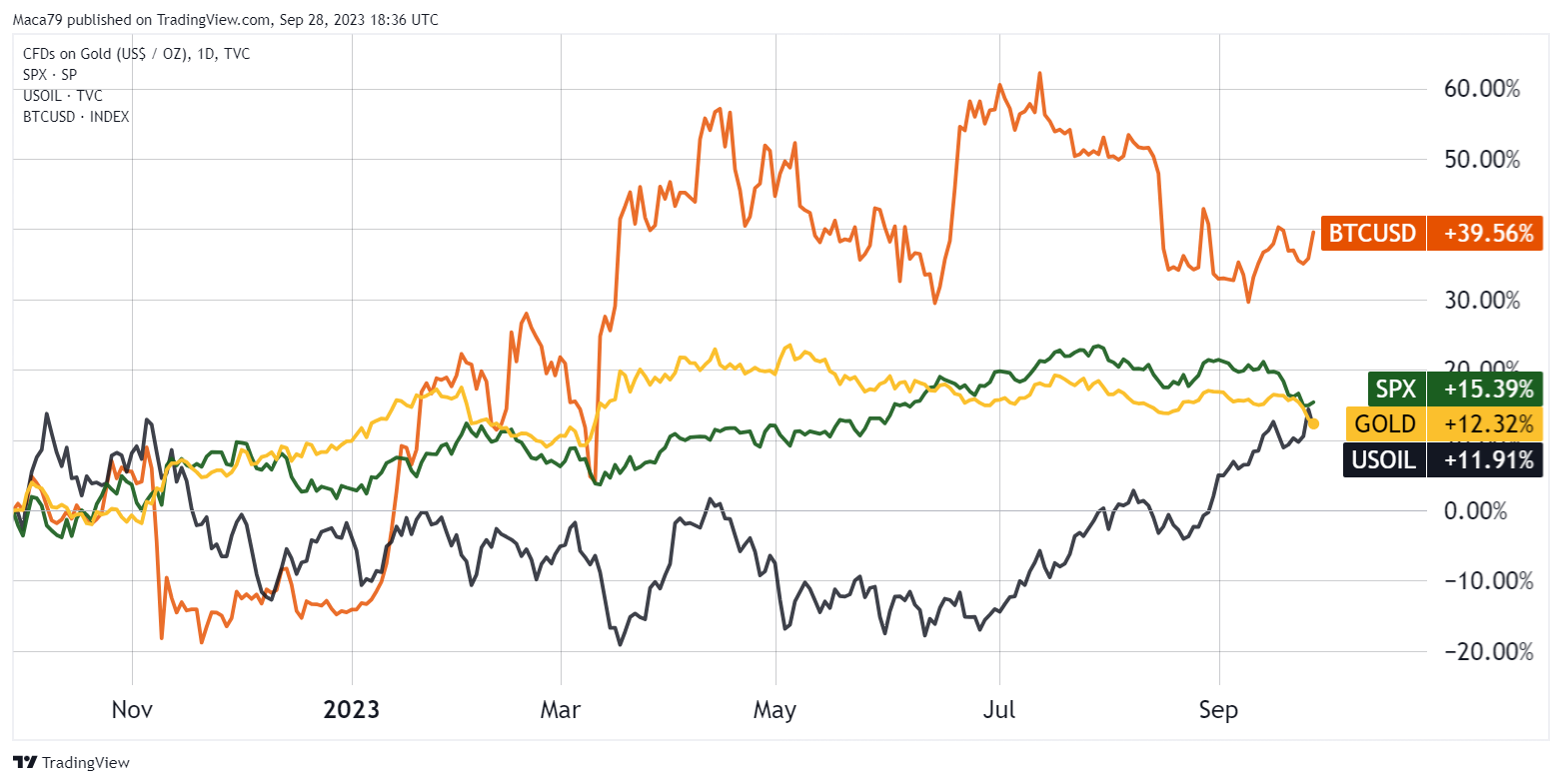

Gold (yellow) vs. Bitcoin (orange), S&P 500 (green) and WTI oil (black), last 12 months. Source: TradingView

Gold (yellow) vs. Bitcoin (orange), S&P 500 (green) and WTI oil (black), last 12 months. Source: TradingView

During the same timeframe, gold’s returns have been comparable to those of the S&P 500, which experienced a 15.4% increase, and WTI oil, which rose by 12%. However, these gains are modest when contrasted with Bitcoin’s (BTC) remarkable 39.5% surge. Nevertheless, it is important to highlight that gold’s lower volatility at 12% renders it an appealing option for investors aiming to mitigate risk.

Risk-reward scenarios favor gold

One of gold’s most compelling attributes is its dependability as a store of value during periods of crisis and uncertainty. Gold’s position as the world’s largest tradable asset, valued at over $12 trillion, makes it a primary candidate to benefit from capital inflows whenever investors withdraw from traditional markets such as stocks and real estate.

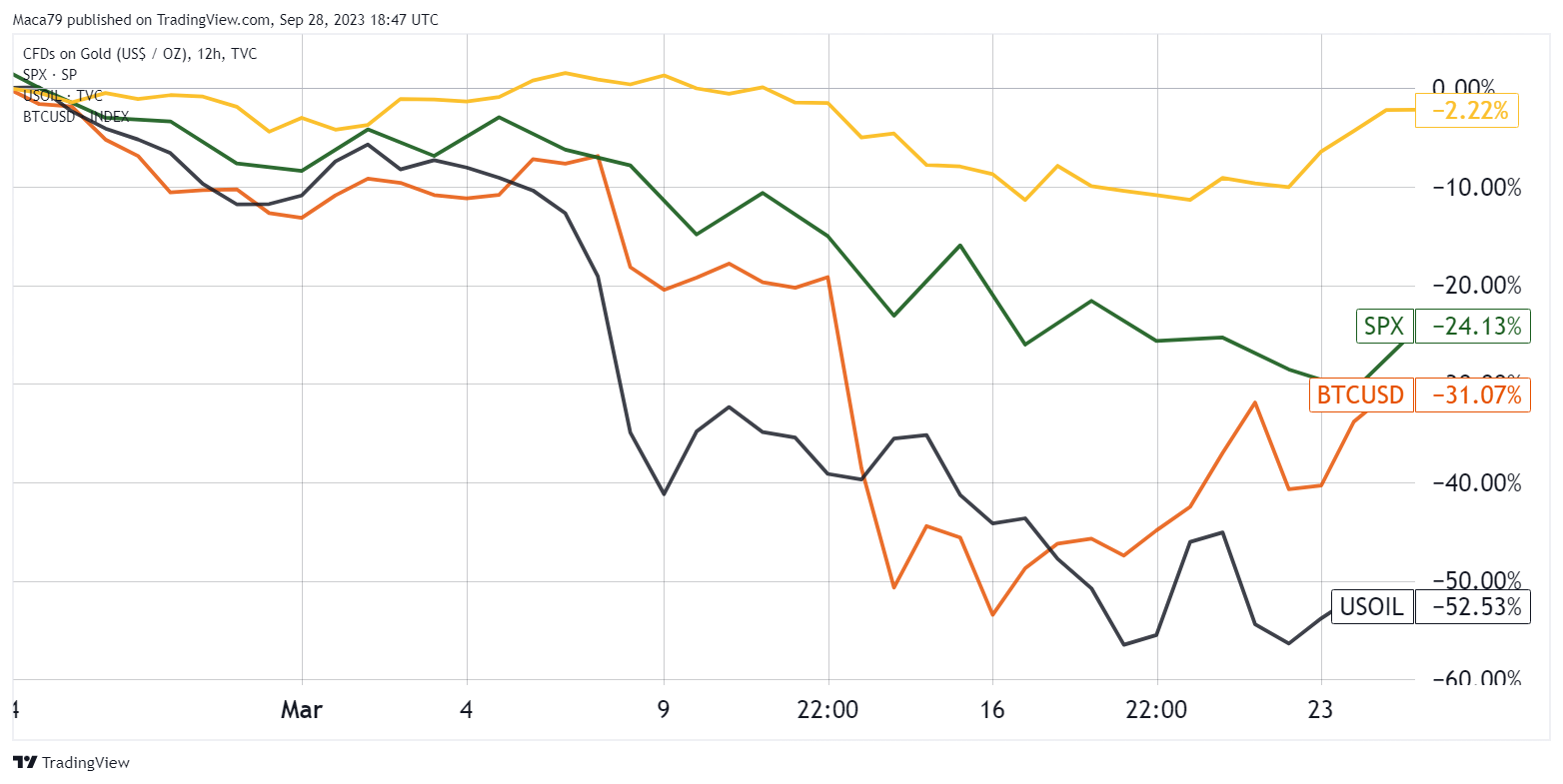

Gold (yellow) vs. Bitcoin (orange), S&P 500 (green) and WTI oil (black), Feb/Mar 2020. Source: TradingView

Gold (yellow) vs. Bitcoin (orange), S&P 500 (green) and WTI oil (black), Feb/Mar 2020. Source: TradingView

For instance, during the peak of the COVID-19 pandemic, gold only fell by 2.2% in the 30 days leading up to March 24, 2020.

As per data from the World Gold Council, central banks have been net purchasers of gold for the second month in a row, adding 55 tons to their reserves, with significant acquisitions by China, Poland, and Turkey.

Bloomberg reported that Russia intends to enhance its gold reserves by an additional $433 million to protect its economy from the fluctuations of commodity markets, particularly in the oil and gas sectors.

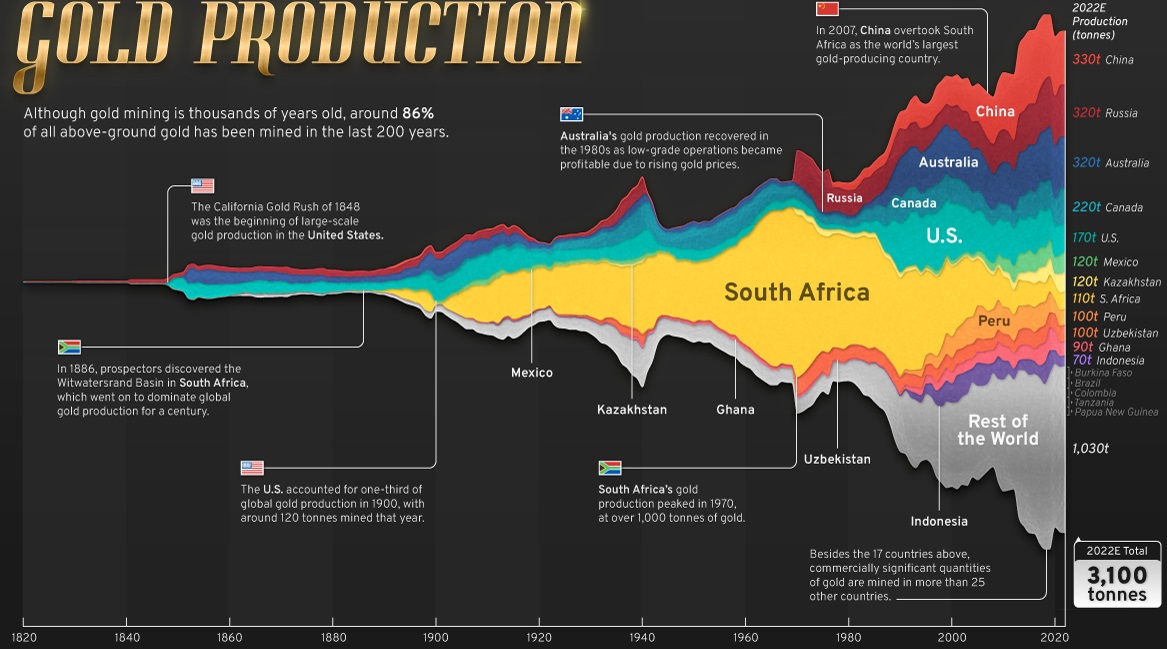

200 years of gold production. Source: Visual Capitalist

200 years of gold production. Source: Visual Capitalist

Examining production statistics, Visual Capitalist estimates that around 3,100 tonnes of gold were mined in 2022, with Russia and China contributing 650 tonnes of this total. The World Gold Council also forecasted that if gold prices continue to rise, total production could hit a record high of 3,300 tonnes in 2023.

A key metric to consider when assessing gold’s investment viability is its stock-to-flow ratio, which gauges the production of a commodity in relation to the total amount available.

Related: Bitcoin price holds steady as S&P 500 plunges to 110-day low

Gold’s stock-to-flow has remained consistent at approximately 67 for the past 12 years. In contrast, Bitcoin has undergone three scheduled halvings, effectively decreasing its issuance, and currently has a stock-to-flow ratio of 59. This indicates that Bitcoin has a lower equivalent inflation rate compared to the precious metal.

Bitcoin can outperform gold even with lower inflows

Bitcoin’s performance may exceed that of gold as the U.S. government nears a shutdown due to hitting the debt ceiling, prompting investors to look for alternative scarce assets. Bitcoin’s $500 billion market capitalization allows for significant price increases even with smaller inflows. Additionally, central banks might be forced to liquidate their gold holdings to meet expenses, further enhancing Bitcoin’s attractiveness.

There is also the potential for new gold discoveries. While gold continues to be a mainstay in the realm of safe-haven assets, Bitcoin’s notable gains and lower equivalent inflation rate position it as a strong alternative for investors seeking different stores of value. Nonetheless, the prevailing economic uncertainty and the Federal Reserve’s monetary policies will continue to support both assets.

This article is for informational purposes only and is not intended to be and should not be construed as legal or investment advice. The views, thoughts, and opinions expressed herein are solely those of the author and do not necessarily reflect or represent the views and opinions of Cointelegraph.