Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Copper, gold, and bitcoin: An essential macro indicator to observe.

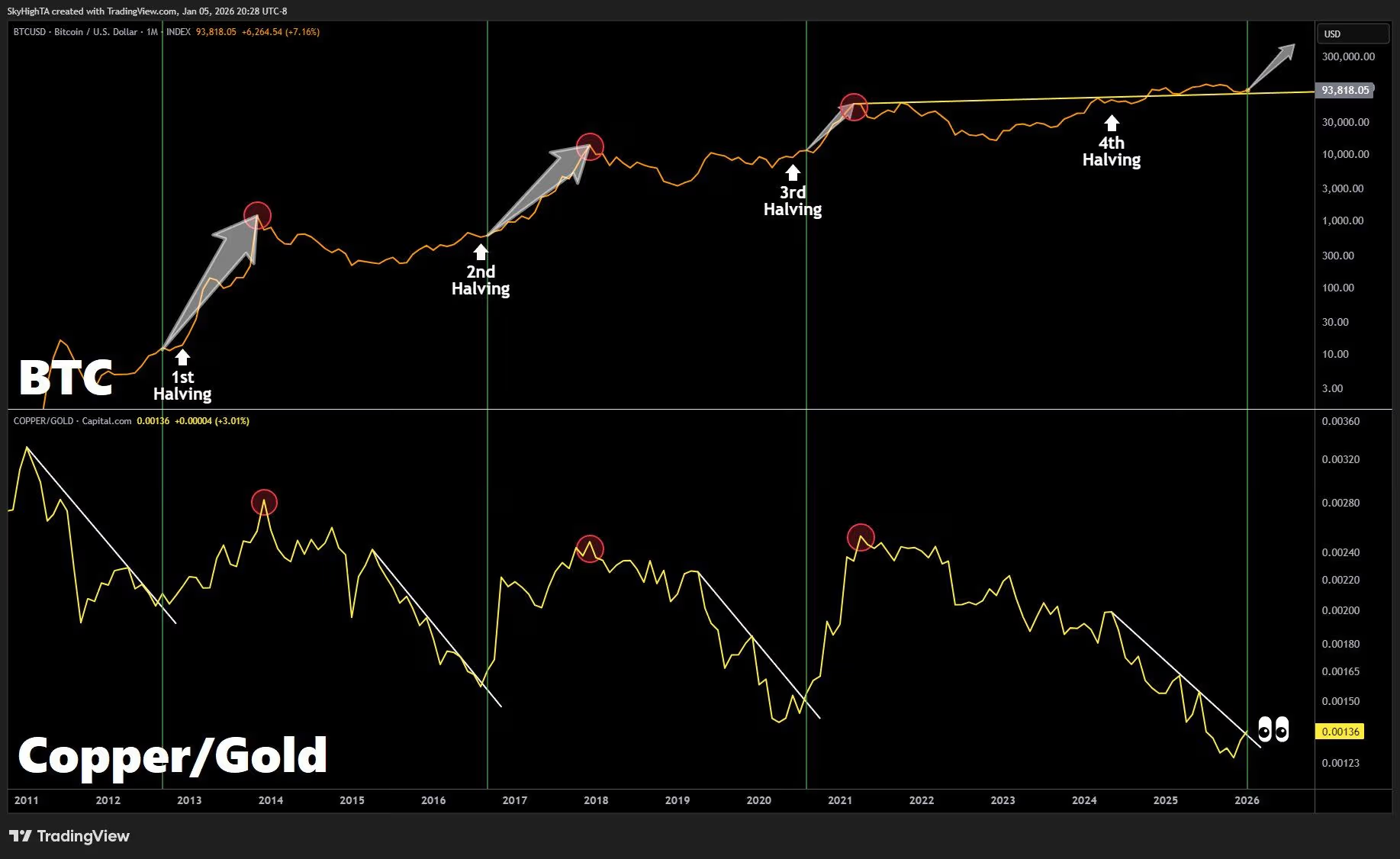

The copper-to-gold ratio is rising, a trend that has historically coincided with significant turning points in bitcoin cycles.

The copper price is approaching historical highs, indicating economic growth. (stux/Pixabay modified by CoinDesk)

The copper price is approaching historical highs, indicating economic growth. (stux/Pixabay modified by CoinDesk)

What to know:

- An increasing copper-to-gold ratio indicates a transition toward risk-on conditions and has typically been seen before significant bitcoin surges following extended downtrends.

- The ratio has now surged from a prolonged decline. Copper’s recent strength relative to gold may bolster a bitcoin increase through 2026.

The copper-to-gold ratio is commonly monitored as a macroeconomic indicator of momentum and investor risk tolerance. Traditionally, it has demonstrated a significant correlation with bitcoin , according to SuperBitcoinBro.

Copper is closely linked to industrial demand and tends to excel during economic upturns. Conversely, gold is considered a defensive asset that usually performs better during times of heightened uncertainty and sluggish growth.

STORY CONTINUES BELOWDon’t miss another story.Subscribe to the Crypto Daybook Americas Newsletter today. See all newslettersSign me up

When the ratio between copper and gold increases, it suggests a risk-on market, whereas a decreasing ratio indicates risk aversion.

Copper/Gold Ratio (@SuperBitcoinBro)

Copper/Gold Ratio (@SuperBitcoinBro)

More crucially for bitcoin, however, is the trend of the ratio following extended decreases. An uptick in the ratio has frequently foreshadowed substantial bitcoin rallies, especially when they coincide with bitcoin halving cycles.

Bitcoin halvings, which cut the rewards for miners by half, take place approximately every four years and restrict supply. Historically, these events have served as a catalyst for prolonged bull markets.

During the fourth bitcoin halving, in April 2024, the copper-to-gold ratio was still on a decline. This trend has now changed. The ratio currently rests near 0.00136 after reaching a low of about 0.00116 in October.

Simultaneously, copper prices are exceeding $6 per pound at record levels, while gold is trading around $4,455 per ounce, also near its peak. Over the last three months, copper has appreciated by 18% and gold by 14%.

If copper’s robustness indicates improving growth prospects rather than mere supply issues, the resulting risk-on signal could facilitate a bitcoin rally in 2026.