Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Chances of Jesus Christ’s return in 2026 increase, surpassing bitcoin’s returns.

The Polymarket wager serves as a reminder that the most unusual areas of crypto can occasionally be the sole ones experiencing growth.

(Christian Dubovan/Unsplash, modified by CoinDesk)

(Christian Dubovan/Unsplash, modified by CoinDesk)

Key points:

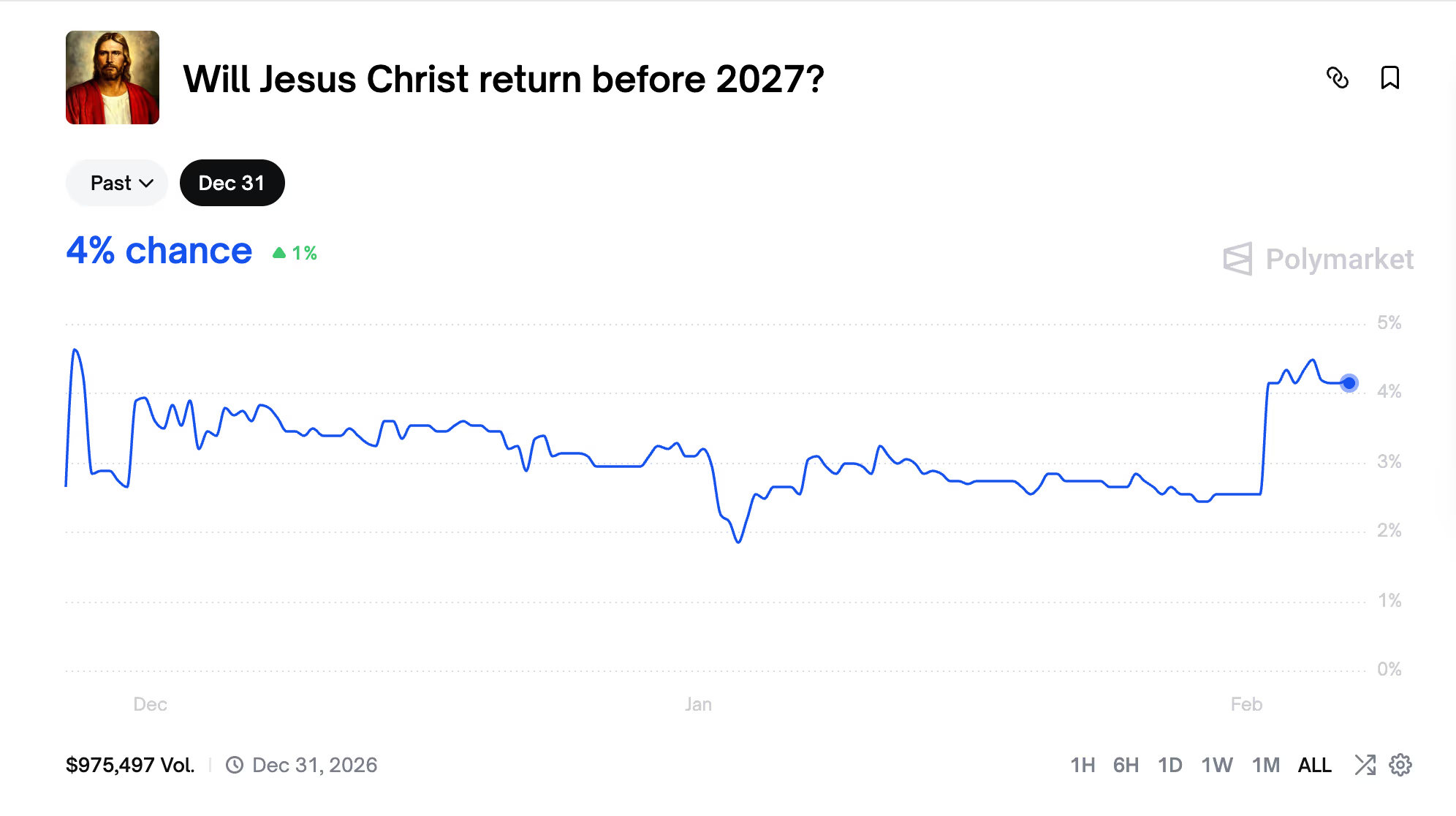

- Traders on the prediction platform Polymarket have increased the implied odds of Jesus Christ’s return by the end of 2026 to approximately 4%, more than doubling since the beginning of January.

- This contract, primarily viewed as a novelty, has outperformed bitcoin this year as the cryptocurrency has declined amid concerns ranging from potential quantum-computing threats to speculation regarding hedge-fund issues.

- The movement underscores how lightly traded prediction markets can fluctuate like microcap tokens and how Polymarket increasingly reflects shifting online focus across politics, entertainment, and religion.

Traders on the prediction market Polymarket have increased the implied odds of the Second Coming of Jesus Christ by year-end, transforming one of the platform’s more unusual contracts into a superior performer compared to bitcoin.

The market, titled “Will Jesus return in 2026,” traded around 4 cents on Friday, indicating roughly a 4% probability. This marks an increase from a low of about 1.8% on January 3, representing a gain of over 120% for the “Yes” side in just over a month.

STORY CONTINUES BELOWDon’t miss another article.Subscribe to the Crypto Daybook Americas Newsletter today. See all newslettersSign me up

In contrast, bitcoin has been trending downward. The leading cryptocurrency has decreased by 18% this year due to reasons such as fears that quantum computing may undermine its encryption, speculation about potential hedge fund collapses, and broader risk-averse behavior across global markets.

This price movement has resulted in even novelty-like prediction contracts appearing resilient in comparison.

Polymarket operates similarly to binary options. A “Yes” share pays $1 if the event occurs and $0 if it does not, with the trading price reflecting the collective implied probability.

A trader purchasing “Yes” at 4 cents is essentially investing that amount for a chance to win $1. Conversely, someone buying “No” at 96 cents is wagering that the event will not take place and stands to gain 4 cents if the contract concludes “No.”

If “No” trades remain in the mid-to-high 90s for extended periods, it creates the appearance of a gradual, consistent gain for anyone willing to allocate funds there, despite the trade ultimately being binary and still subject to sharp fluctuations.

The contract will resolve to “Yes” if the Second Coming occurs by December 31, 2026, at 11:59 p.m. ET, and to “No” otherwise. Polymarket indicates that the resolution will rely on a consensus from credible sources, a clause that emphasizes why traders regard the market more as a novelty than a serious prediction.

The price dynamics provide a glimpse into how prediction markets can behave like microcap tokens. With relatively low liquidity, even minor surges in buying can drive probabilities significantly higher, resulting in attention-grabbing percentage increases.

The increase also signifies Polymarket’s expanding role as a real-time indicator for online interest, where various topics from elections to celebrity news to religious forecasts can be traded on the same platform.

Therefore, the “Jesus trade” remains a minor spectacle. However, in a year where bitcoin has faced challenges in achieving stability, it serves as a reminder that the most eccentric sectors of crypto can occasionally be the only ones progressing.