Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Cash App’s Bitcoin earnings exceed $2 billion in the initial quarter.

Fintech company Block, founded by Twitter’s Jack Dorsey, has disclosed an impressive $2.16 billion in Bitcoin (BTC) revenue from its flagship product Cash App for the first quarter.

In a shareholder letter detailing its Q1 2023 earnings, Block (NYSE:SQ) indicated that its Bitcoin revenue — which includes BTC sales to customers as total revenue — increased by 18% from $1.83 billion in Q4 and 25% compared to Q1 2022.

Our Q1 earnings are now available. $SQ https://t.co/oGcnRuzFb3

— Block Investor Relations (@BlockIR) May 4, 2023

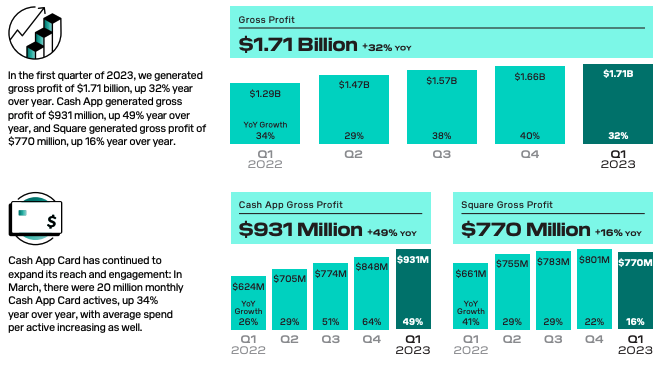

Cash App’s overall profits exceeded $931 million in the first quarter of 2023, reflecting a 49% year-over-year growth. However, Cash App’s profit was modest in comparison to the company’s gross profit, which totaled $1.71 billion. Block also operates the widely-used business payment platform Square, which experienced a slight decline of 3.8% in profits from the fourth quarter of 2022.

The shareholder letter stated that the multi-billion-dollar Bitcoin revenues were fueled by “an increase in the volume of Bitcoin sold to customers,” and were “partially offset” by a drop in Bitcoin’s market price relative to the same period in 2022.

The fintech company also reported earnings per share of 40 cents, surpassing analyst predictions of 35 cents per share by 14%, with first-quarter revenue rising 26% year-over-year.

Block’s gross profits have risen 32% year-over-year. Source: Block shareholder letter

Block’s gross profits have risen 32% year-over-year. Source: Block shareholder letter

During the earnings conference call with investors, Block CEO Jack Dorsey highlighted both artificial intelligence and “open protocols” as technologies that would assist the company in effectively addressing the “significant shifts” occurring in the global financial landscape. He pointed to ongoing bank failures in the United States and de-dollarization as key factors.

The equities market reacted positively to Block’s earnings report. The fintech firm’s stock price briefly rose by 5% to $63.50 in after-hours trading, before stabilizing to a 2.5% increase at the time of publication.

Related: Jack Dorsey’s nano Bitcoin mining chip heads to prototype

This increase represented the first sign of recovery from a prolonged decline in Block’s stock price, which had suffered a notable 25% drop following the publication of a critical report by prominent short sellers Hindenburg Research.

On March 23, Hindenburg criticized Block for “systematically taking advantage of the demographics it claims to be helping,” asserting that Block’s success with Cash App relied on a “willingness to facilitate fraud against consumers and the government.”

“Hindenburg is known for these types of attacks, which are designed solely to allow short sellers to profit from a declined stock price,” Block stated in response to Hindenburg’s claims. “We have reviewed the full report in the context of our own data and believe it’s designed to deceive and confuse investors.”

Magazine: Joe Lubin — The truth about ETH founders split and ‘Crypto Google’