Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

BTC price projections suggest a $130K goal following the 2024 Bitcoin halving event.

Bitcoin (BTC) is projected to reach $128,000 or higher by the conclusion of 2025, according to various analytical models.

On Oct. 17, popular trader and analyst CryptoCon shared his latest BTC price predictions on X (formerly Twitter), estimating a two-year target of approximately $130,000.

Various BTC price predictions align at $130,000 for 2025

Participants in the Bitcoin market are divided regarding how BTC price movements will react to the upcoming block subsidy halving next year; however, CryptoCon maintains a strongly optimistic long-term outlook.

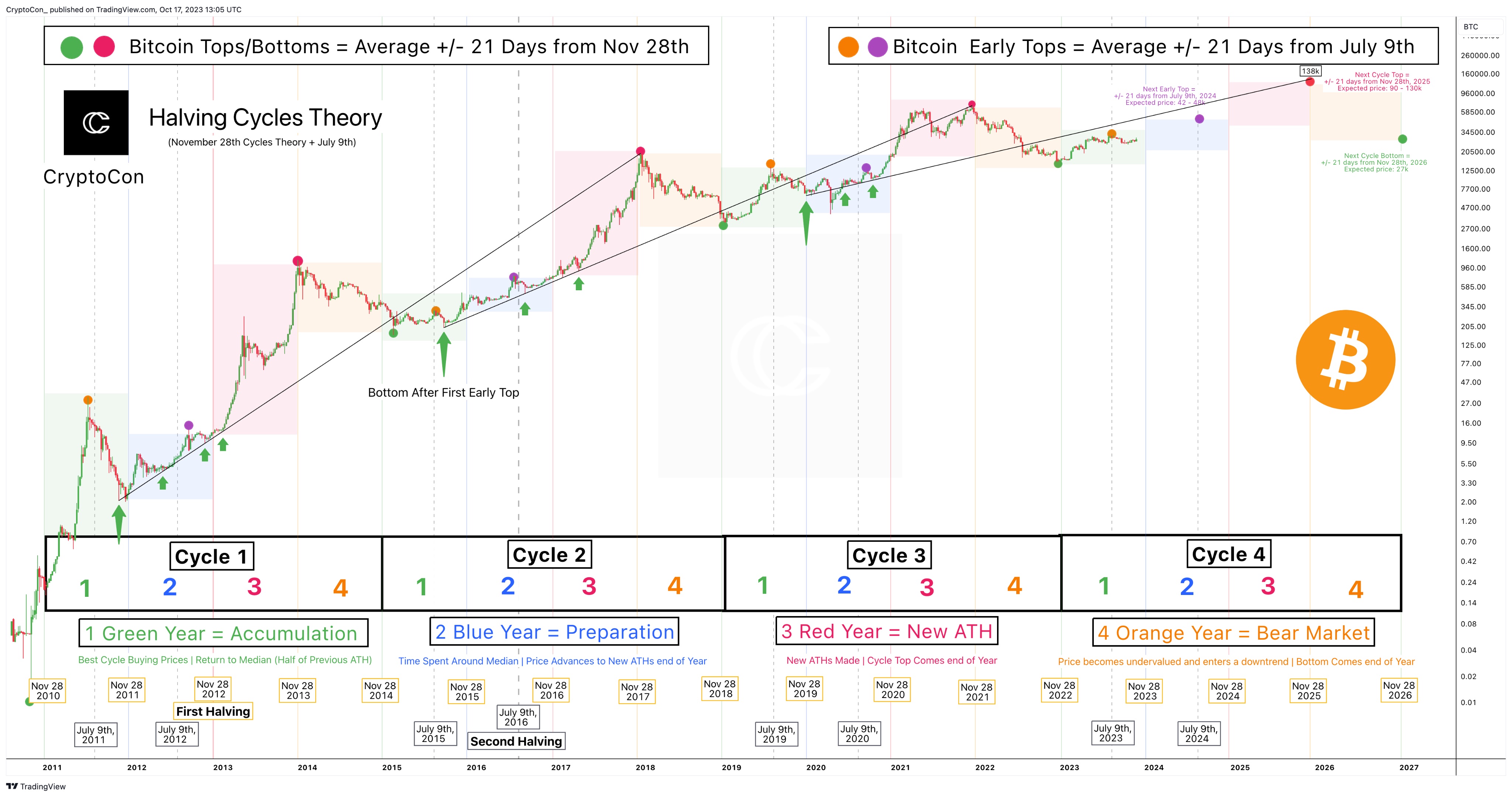

In an update concerning several models that track Bitcoin price cycles along with their peaks and troughs, the analyst emphasized that the vicinity of $130,000 is rapidly becoming a focal point.

“I’ve been conducting numerous Bitcoin cycle top experiments recently, and I consistently observe the same price point… 130k,” he summarized.

An accompanying chart illustrated the so-called “early” peaks in each price cycle, alongside the actual cycle peak representing a new all-time high.

The early peaks, on average, occur three weeks before or after July 9, CryptoCon clarified. The new all-time highs arise three weeks before or after Nov. 28 — a phenomenon that Cointelegraph reported on last month.

The timing of these occurrences is derived from plotting straightforward diagonal trendlines from the initial early peak.

“This method has accurately identified the price of the last two cycle peaks, and based on our trend from the previous cycle, suggests a price of around 138k,” the X post continued.

“I am ready for lower prices, but the conditions are aligning at 130k for Bitcoin this cycle!”

BTC price model data. Source: CryptoCon/X

BTC price model data. Source: CryptoCon/X

According to model timing, 2025 is anticipated to be the year when the next cycle peak occurs, nearly double the current record established in 2021.

“History favors the bears”

Four-year halving cycles serve as a reference for many prominent Bitcoin market analysts.

Related: Mining BTC is harder than ever — 5 things to know in Bitcoin this week

Among these analysts is the well-known trader Rekt Capital, who continues to emphasize that the pre-halving year of 2023 may lead to some new local lows before the bull market fully materializes.

#BTC

5 Phases of The Bitcoin Halving

1. Pre-Halving period

If a deeper retracement is going to happen, it will likely occur over the next 140 days or so (orange)

In fact, $BTC retraced -24% in 2015 and -38% in 2019 at this same stage in the cycle (i.e. ~200 days before the Halving)… pic.twitter.com/r1dAWBJXyw— Rekt Capital (@rektcapital) October 6, 2023

He previously cautioned that the $32,000 highs observed earlier this year could potentially create a double-top pattern, contributing to a prolonged downturn in BTC prices thereafter.

“At this same point in the cycle (~180 days before the Halving)… BTC retraced -25% in 2015/2016 and -38% in 2019,” one of his recent X posts states.

“The only question is: does history repeat? Or does 2023 produce something entirely different? I’m a Macro Bull, but history favors Bears.”

Rekt Capital noted that any new lows “should be viewed as an opportunity for re-accumulation.”

This article does not provide investment advice or recommendations. Every investment and trading decision carries risk, and readers should perform their own research before making any decisions.