Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

BTC holders surpassed cryptocurrency funds by 69% in the first half of the year, according to 21e6 Capital.

The traditional buy and hold, or hodl, strategy for Bitcoin (BTC) surpassed the performance of most crypto funds by 68.8% during the first half (H1) of 2023.

As per information from Switzerland-based investment advisor 21e6 Capital AG, crypto funds, on average, yielded returns of 15.2% in H1 2023, while BTC experienced gains of approximately 84%.

Crypto funds on average generated 15.2% return in the first half of 2023 lol pic.twitter.com/vb8pwYfiX9

— Alex Krüger (@krugermacro) August 5, 2023

In the report, Maximilian Bruckner, the head of marketing at 21e6 Capital AG, noted that crypto funds have “often been able to significantly outperform Bitcoin in prior bull markets.”

Bruckner attributed a large part of the lackluster performance of crypto funds in 2023 to the difficult market environment and the substantial cash reserves they maintained at the end of 2022.

Following the collapse of FTX and other crypto entities in 2022, the report indicated that many crypto funds chose to reduce risk and build cash reserves, consequently missing out on a notable BTC price surge in H1 2023.

“Funds with large cash positions will underperform Bitcoin in a bull market, unless the funds’ assets perform significantly better than Bitcoin.”

“Due to the prevailing sentiment at the end of 2022, many funds held larger-than-usual cash positions. Additionally, most major altcoins also lagged behind Bitcoin – creating a challenging environment for funds,” the report states.

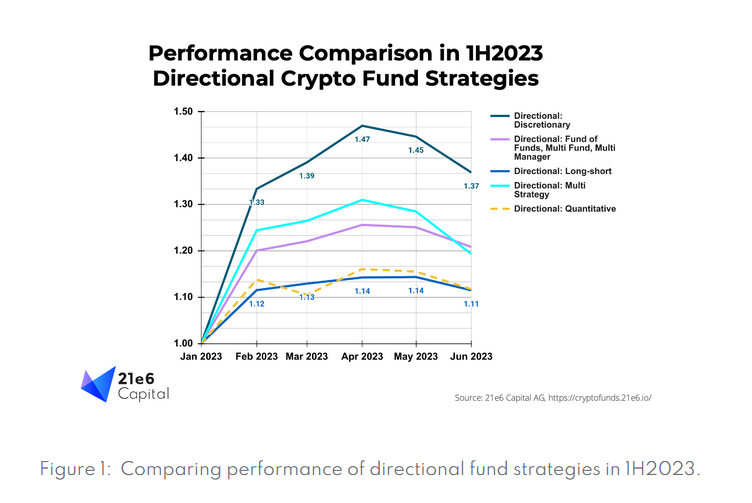

Directional fund strategy comparison H1 2023. Source: 21e6 Capital AG

Directional fund strategy comparison H1 2023. Source: 21e6 Capital AG

As of this writing, BTC is valued at approximately $29,000 and continues to face difficulties in maintaining a position above the $30,000 mark, which has only been briefly exceeded on a few occasions in 2023.

Related: Price analysis 8/4: BTC, ETH, BNB, XRP, DOGE, ADA, SOL, MATIC, LTC, DOT

Nonetheless, current prices represent a 75% increase for the asset since January 1, according to CoinGecko data.

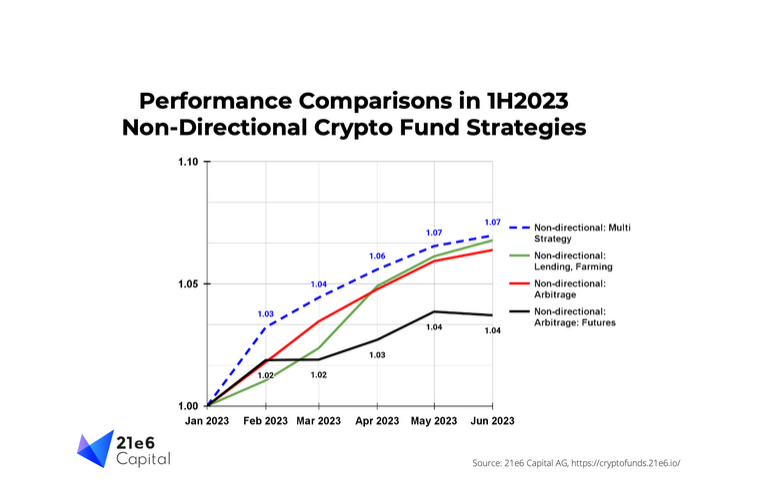

“All crypto fund strategies achieved positive results this year. But relative to Bitcoin, they underperformed, especially those with significant exposure to altcoins, to futures, or those strongly dependent on momentum signals.”

“Looking ahead, we are closely monitoring which exchanges will emerge as leading futures providers. Additionally, the level of funding rates in crypto futures markets and the capability of quantitative funds to capture trends will be key areas of focus as we observe the markets,” the report adds.

Ultimately, the report emphasized that investor sentiment has shown slight improvement over H1 2023, indicating that some funds may soon begin to allocate more cash into the crypto sector.

However, it also pointed out that current data regarding inflows and outflows suggests that a “full recovery of sentiment” has not yet occurred.

Non-direction crypto fund strategy comparison H1 2023. Source: 21e6 Capital AG

Non-direction crypto fund strategy comparison H1 2023. Source: 21e6 Capital AG

Magazine: ‘Elegant and ass-backward’: Jameson Lopp’s first impression of Bitcoin