Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

BlackRock insiders indicate that a Bitcoin ETF could be available in approximately six months, according to Novogratz.

The first spot Bitcoin (BTC) exchange-traded fund (ETF) in the United States may receive approval as early as before February 2024, as stated by Galaxy Digital CEO Mike Novogratz, referencing information from sources at BlackRock and Invesco.

“This is a significant development. It’s significant because both our contacts from Invesco and BlackRock suggest that it’s a matter of when, not if — indicating that the timeframe is likely around six months,” Novogratz informed shareholders during Galaxy’s Q2 earnings call on August 8, which disclosed a net loss of $46 million.

“If you had to estimate, it’s probably […] four to six months until the SEC approves a Bitcoin ETF.”

Galaxy Digital, led by Novogratz, is among the numerous applicants for a spot Bitcoin ETF, having reapplied in June alongside $1.5 trillion asset manager Invesco, which ranks as the fourth-largest ETF issuer in the U.S.

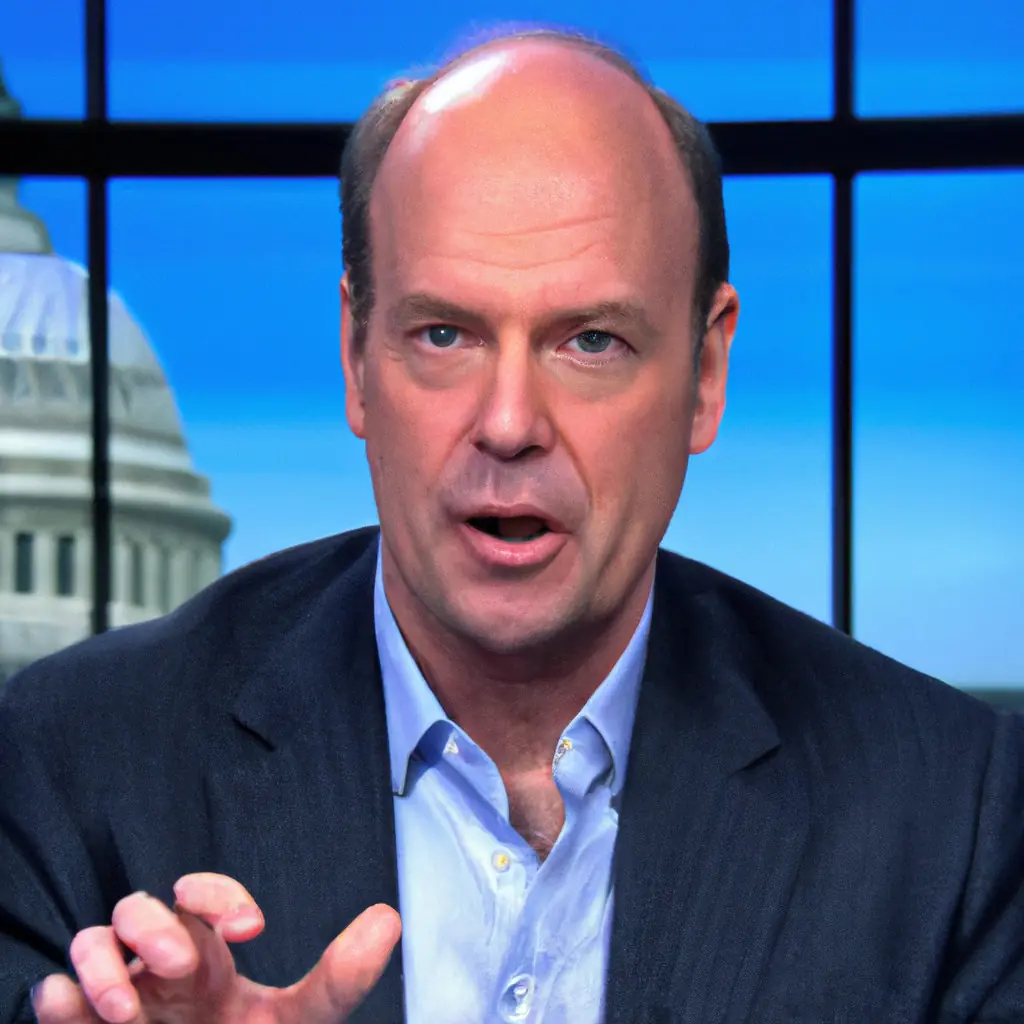

According to “contacts” from within BlackRock and Invesco, the approval of a spot Bitcoin ETF is a matter of “when, not if,” likely occurring in “four to six months” — Galaxy CEO Mike Novogratz during the earnings call this morning pic.twitter.com/TIhHC7xnHI

— Eric Balchunas (@EricBalchunas) August 8, 2023

While addressing shareholders, Novogratz refrained from commenting on the anticipated timing of the ETF’s approval, which remains uncertain as it is currently with the Securities and Exchange Commission.

Nonetheless, Novogratz is of the opinion that once approved, issuers of spot Bitcoin ETFs like BlackRock and Invesco will fiercely compete for market share.

“The news regarding both BlackRock’s ETF filing and, frankly, Invesco along with Galaxy, we’re going to compete vigorously to capture market share once it receives approval.”

In response to an inquiry, Galaxy Digital president Chris Ferraro expressed that he would not be surprised if the SEC ultimately approves a potential Bitcoin ETF to avoid being perceived as “obstructionist.”

“I believe that’s where the potential ETF approval comes into play, indicating that, hey, you can’t label us as anti-crypto; we just approved an ETF. So we’re optimistic that this will also apply to our filing,” Ferraro stated.

Or, even earlier

Meanwhile, some analysts suggest that the influx of spot Bitcoin ETFs could occur even sooner, contingent on the ruling of a judge in Grayscale’s lawsuit against the SEC.

Related: ETF analyst raises spot Bitcoin ETF approval chances in the US to 65%

Last year, Grayscale filed a lawsuit against the SEC for denying its request to convert its Grayscale Bitcoin Trust into a spot ETF.

“If the SEC loses its case against @Grayscale, as we anticipate, the path of least resistance would likely be a wave of simultaneous approvals for all spot #Bitcoin ETF applicants — including Grayscale and the other eight active filings.” @NYCStein in @Bloomberg today. Cc @EricBalchunas… pic.twitter.com/k72W6Ek7RK

— Craig Salm (@CraigSalm) August 2, 2023

Analysts contend that if the SEC were to lose its case against Grayscale, the “path of least resistance” would lead to simultaneous approvals for multiple or all spot Bitcoin ETF applicants.

Journeys: Hervé Larren on Bitcoin, Apes and the psychology of ‘blue-chip’ NFTs