Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

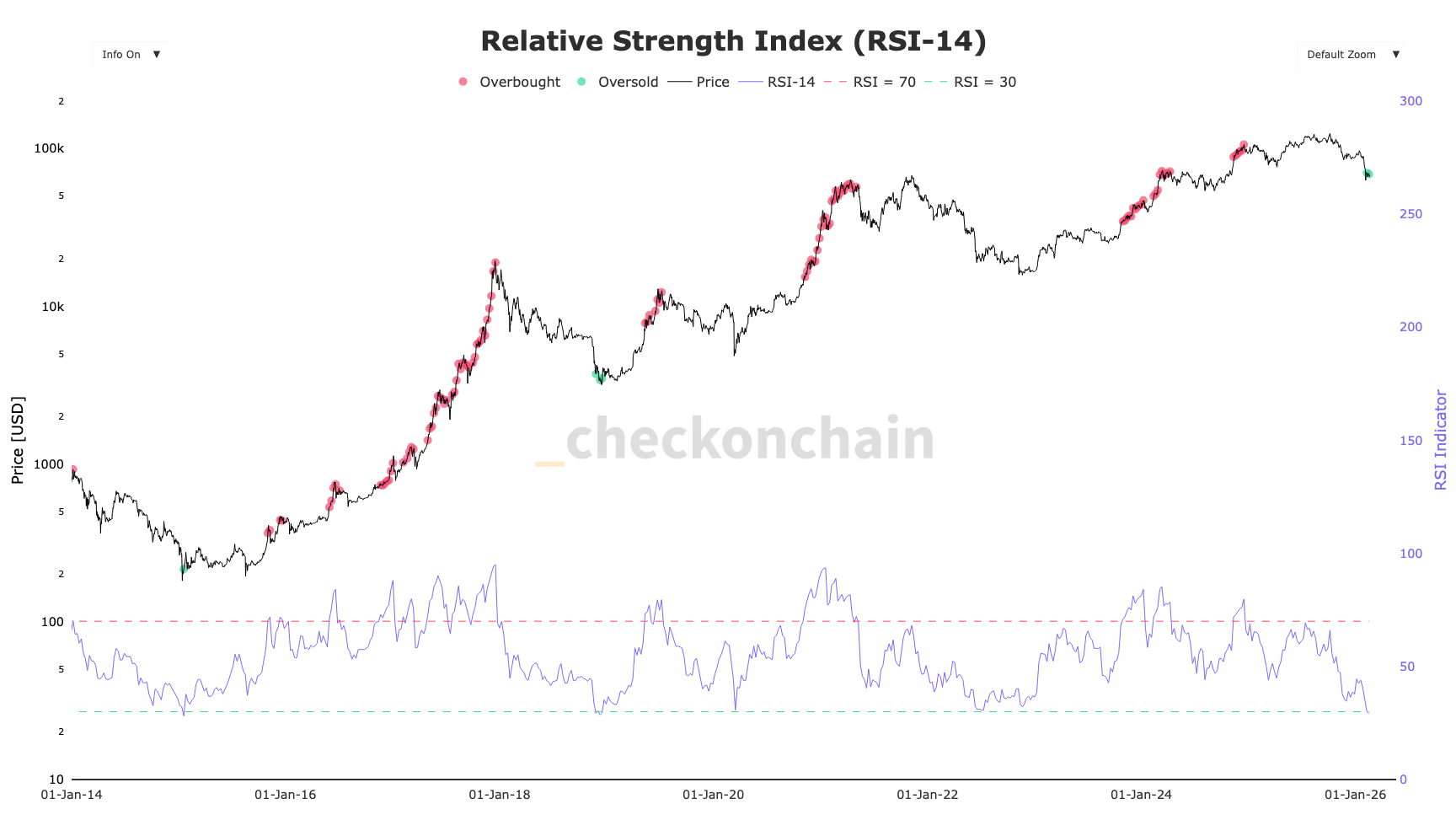

Bitcoin’s unusual oversold RSI decline indicates a prolonged, gradual recovery period ahead.

Historical patterns indicate that the present movement may result in a consolidation phase around the $60,000 area in the upcoming months prior to the next upward surge.

BTC RSI 14 (Checkonchain)

BTC RSI 14 (Checkonchain)

Key points:

- This month, Bitcoin’s 14-day Relative Strength Index (RSI) has fallen below 30 for the third time in its history, according to checkonchain.

- The RSI functions as a momentum indicator that evaluates the pace and scale of recent price shifts by comparing average gains and losses over a span of 14 days.

- Similar RSI levels observed in 2015 and 2018 were succeeded by extended consolidation periods prior to significant breakouts.

Bitcoin’s 14-day Relative Strength Index (RSI) has declined below 30 for the third time in its history this month, according to checkonchain.

The RSI is widely utilized for assessing an asset’s momentum by analyzing the speed and extent of recent price changes and comparing average gains and losses over a defined period of 14 days.

STORY CONTINUES BELOWDon’t overlook another update.Subscribe to the Crypto Daybook Americas Newsletter today. See all newslettersSign me up

The index generates a value ranging from 0 to 100, with readings exceeding 70 typically viewed as overbought, while values below 30 suggest oversold conditions, implying that selling pressure may be excessive. Bitcoin’s 14-day RSI has not reached 100 since December 2024, when Bitcoin first exceeded $100,000.

Past instances of readings below 30 have indicated prior cycle bottoms. In January 2015, Bitcoin’s RSI dropped to about 28 while prices lingered near $200. Subsequently, the market underwent approximately eight months of consolidation before a significant recovery commenced. A similar trend was noted in December 2018 when the RSI fell below 30 around $3,500, followed by about three months of sideways accumulation before Bitcoin surged higher.

BTC is currently trading near $66,000, with market sentiment remaining in “fear” or “extreme fear” on the Crypto Fear & Greed Index for a substantial portion of the past 30 days. Since reaching a peak in October, Bitcoin has lost over 50%, briefly dipping towards $60,000.

Historical data indicates that the current movement may result in consolidation around the $60,000 mark in the coming months before the next upward movement.